Zoopla HPI: 12% more buyers in the housing market over the past month

Zoopla HPI: 12% more buyers in the housing market over the past month – however buyers’ market remains with an average discount of £12,125 to achieve a sale.

Key points from publication:

-

- Demand for homes improves for the first time since the Spring – there are 12% more buyers in the market over the last 4 weeks, although demand still remains a third lower than a year ago

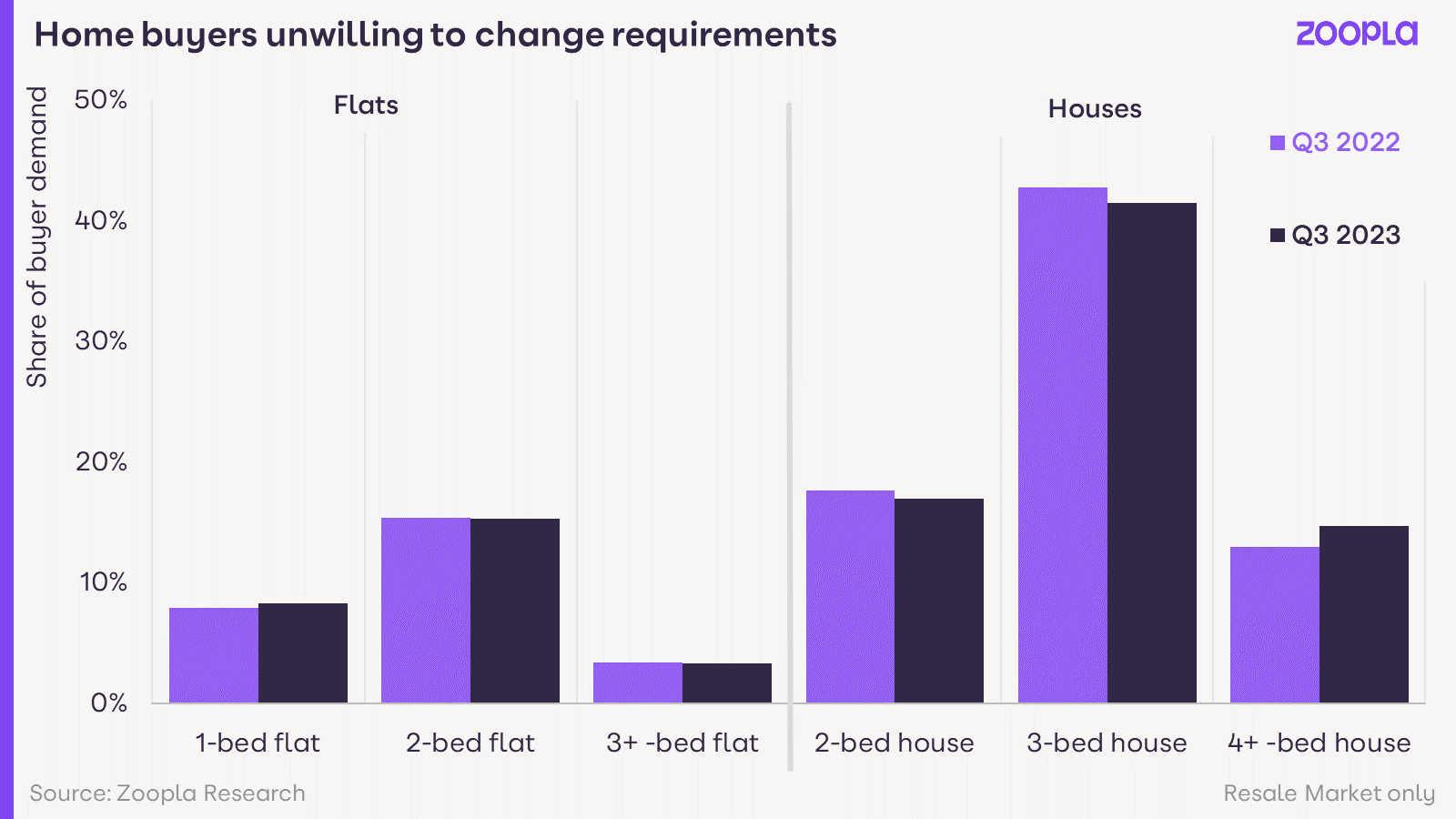

- Buyers appear unwilling to compromise on the size of the property they’re looking for despite having 20% less buying power due to higher mortgage rates.

- Would-be buyers are waiting for a fall in house prices or mortgage rates to get back into the market

- UK house prices have fallen by 0.5% over the last 12 months.

- Prices are on track to be 2-3% lower by the year end but they are still 17% higher than pre-pandemic levels.

- A buyers’ market continues, with the discount to the asking price for newly agreed sales averaging 4.2% or £12,125 below the asking price. Discounts to the asking price to achieve a sale are highest in London and the South East at 4.8%

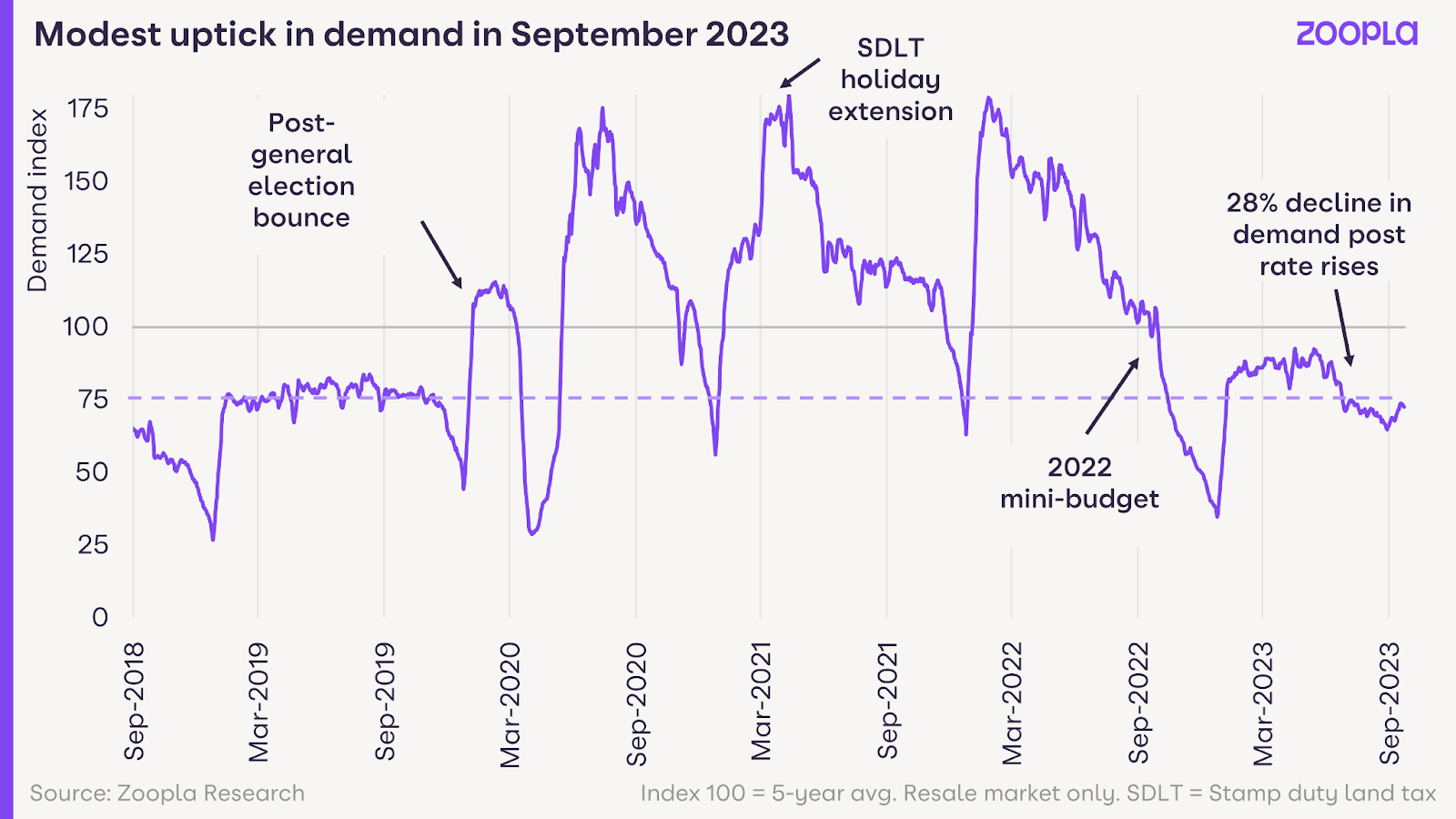

London, 28 September 2023: Zoopla’s latest House Price Index has revealed an uptick in both buyer demand and the number of sales agreed over September. Demand* has improved in all regions of the UK and risen by 12% in September, while sales agreed are also up.

Improvements to buyer demand and sales agreed

The decline in buyer demand over the summer months as mortgage rates increased has started to reverse, while enquiries to estate agents are up 12% since the August bank-holiday weekend.

This uptick in enquiries is partly seasonal but also reflects improved consumer confidence, which is at a two-year high, and homeowner expectations of lower mortgage rates which are currently on track to fall below 5%. The closer rates get to 4%, the more buyers will come back into the market – further supporting demand and sales agreed.

Demand has improved across all regions in the UK, noticeably in southern England where enquiries for homes have been weakest throughout 2023. Demand is up 19% in the South East over the past three weeks and 16% in London. The number of new sales agreed has also increased and is closely tracking 2019 levels.

Buyers remain unwilling to compromise despite lower buying power

Despite mortgage rates over 5% delivering a significant 20% reduction to household buying power compared to early 2022, home hunters remain unwilling to make compromises on the size of home they are looking for.

This is highlighted by the share of buyer demand by property type and size which is virtually the same as a year ago with many buyers holding out for either a fall in house prices or mortgage rates.

This unwillingness to compromise is also explained by the fact that buying a home is a big expensive life event and younger buyers are taking longer mortgages to boost their buying power in comparison to previous generations.

Buyers’ market remains, with the highest discounts to achieve a sale found in London

The buyers’ market continues to prevail with 80% more homes available for sale in comparison to September 2021. The average discount to asking price for a newly agreed sale now stands at 4.2% or £12,125. This number is being skewed by London and the South East where discounts are greater at 4.8%. This figure stands at 2.8% for the rest of the UK.

Commenting on the market outlook, Richard Donnell, Executive Director at Zoopla, says:

“The housing market continues to adjust to a higher mortgage rate environment.

“Better news on inflation and the end of base rate increases has provided scope for lenders to start reducing mortgage rates which has supported a modest uptick in demand for homes this September.

“Buyers continue to remain cautious, and many are waiting for better value for money and improved affordability from lower house prices or further falls in mortgage rates before returning to the market.

“House price falls have been modest with the average house still 17% more expensive than before the start of the pandemic.

“Forbearance by lenders, tougher mortgage regulations over recent years and a strong labour market appear to have moderated the stress in the market compared to previous cycles that would have driven larger price reductions.

“House prices will continue to drift lower, especially in southern England, ending the year 2-3% lower meaning falling mortgage rates are required to boost activity and attract buyers back into the market.”

Kindly shared by Zoopla