Stress of house buying process is key reason for improving not moving

Millions of homeowners are choosing to improve rather than move – and for many it’s because they cannot stand the stress of buying.

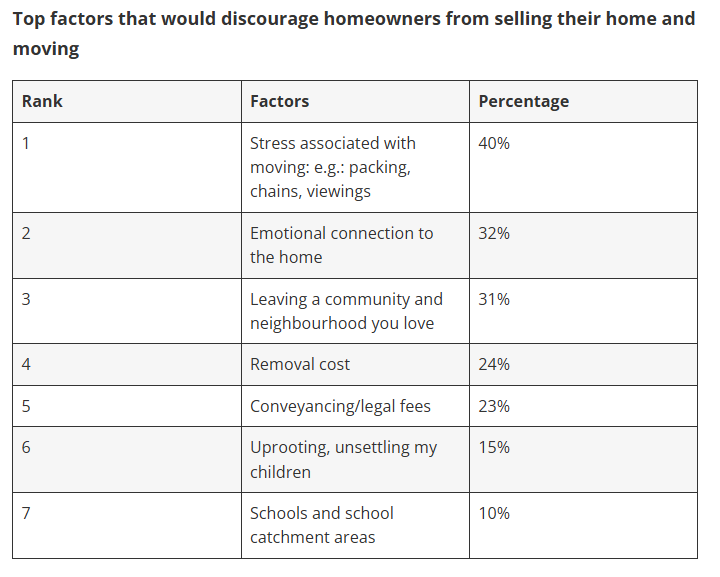

New research from Churchill home insurance reveals that one in 15 homes in England and Wales (1,740,402 homes) now carry official Improvement Indicators, following substantial home improvements, such as loft conversions and extensions. For 40%, the sheer stress of moving – including dealing with property chains and hosting viewings – is a major deterrent.

A strong emotional connection to their home (32%) and a deep attachment to their community and neighbourhood (31%) also play significant roles in discouraging people seeking out a new home.

Financial factors such as removal costs (24%), and legal fees including conveyancing (23%), rank lower than an emotional connection to a home. These pressures combined however, often make staying put and improving a home a more appealing and less disruptive option than moving.

In 2023/24 alone (the last full year data available), 103,043 homes were added to the Valuation Office Agency’s register following significant improvement work.

Increasingly, some home improvements such as small extensions, loft conversions, and garage conversions, may be allowed under permitted development, meaning that planning permission is not required if it is under a certain size and meets certain conditions.

Sarah Khan, head of Churchill Home Insurance, says:

“Moving house can be one of life’s biggest decisions and upheavals, especially when your home holds years of memories. How many people have their children’s height as they grow marked on a doorframe, a cherished reminder they can’t pack with them? When you factor in the stress, fees, moving expenses, and leaving a neighbourhood and community you love, it’s no wonder so many homeowners choose to improve, rather than move.”

Kindly shared by EstateAgentTODAY Image courtesy of Adobe