Shawbrook Bank: Money myths, anxieties and financial jargon

Shawbrook Bank have written an article that looks at some of the common myths about money, the financial anxieties and the jargon that’s used.

During the COVID-19 pandemic, many lost jobs and livelihoods. The state of people’s personal finances was uncertain and money worries were rife as we grappled with the ‘new normal’.

With this in mind, it comes as no surprise that the UK is now feeling anxious about managing their money and getting back on track if they had some financial difficulties over this time.

But, what exactly are the UK’s biggest anxieties when it comes to personal loans and understanding ‘financial jargon’?

We asked more than 2,000 UK residents their current concerns and anxieties about lending and borrowing money in 2021.

From how off-putting confusing language is in loan agreements to what money myths are believed to be true and false, our new report shows the level of financial anxiety felt throughout the UK.

The most popular reasons for taking out a personal loan in 2021:

- To purchase a car

- To pay off other debts

- To complete other home renovations or DIY projects

The most popular causes of anxiety when taking out a personal loan in 2021:

- Accruing more debt

- If my income fell due to unforeseen circumstances and I could not make any repayments

- I’d be locked into making fixed repayments every month

Our study found that 30% of the British public admit to feeling some level of anxiety when it comes to managing their own finances.

Financial anxiety map of the UK

Shawbrook Bank are able to reveal which residents in the UK feel the most anxiety around managing their money.

The study found that having a clear repayment plan is the most important part of applying for a personal loan. 53% selected this as the biggest factor for easing money worries. Having a fixed interest rate for the duration of their personal loan was the next important factor (52%).

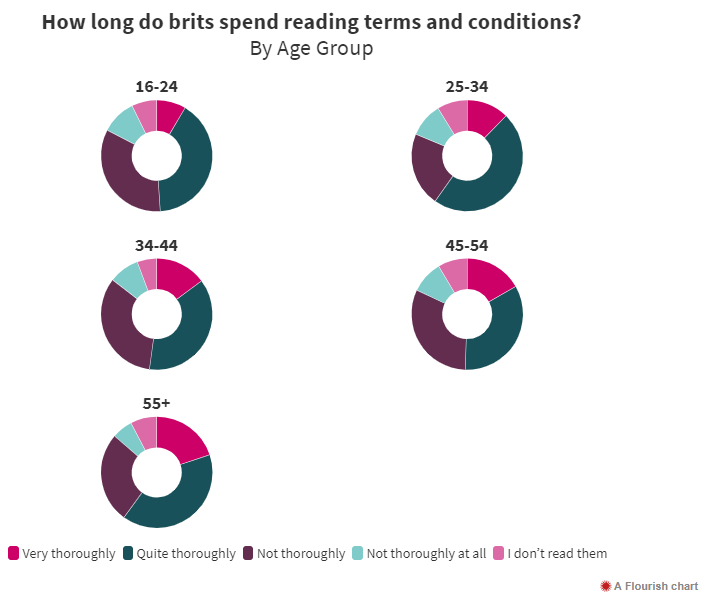

Reading important T&Cs & confusing financial jargon

When it comes to managing finances, including personal loans, the survey reveals how many Brits are unconfident in their knowledge of common financial terminology.

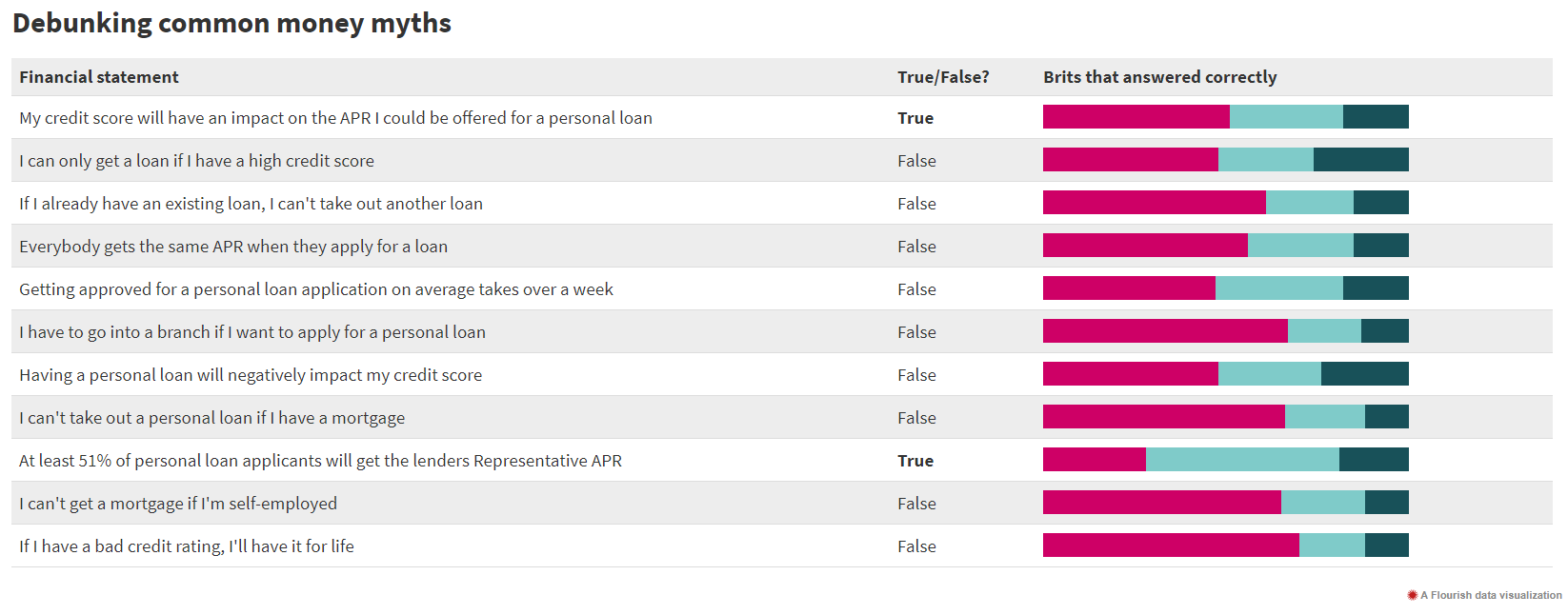

Our report found that only 30% agree that they are ‘very confident’ in their understanding of what a credit score is, and just 25% admit to knowing their current credit score. Further still, a quarter of Brits believe that having a personal loan will negatively impact their credit score – which is false if you manage it properly and make all your repayments on time.

How long do you spend reading Terms & Conditions (T&Cs) on a document before agreeing to it? Our study reveals that around 8% don’t read them at all.

Debunking common money myths

Here’s how the UK scores against common money myths:

5 tips for reducing financial anxiety

To help Brits manage their money better Sally Conway, Head of Consumer Communications at Shawbrook Bank provides money management advice:

- Make a budget and stick to it

Knowing how much money you have coming in versus your expenses is the best place to start. It’s important to include everything, from the odd takeaway coffee to your regular bills like rent or mortgage payments. If you are spending more than you earn, look at where you can cut back. Remember to be realistic. There is no point making a budget that you know you will not be able to stick to.

- Educate yourself

- Ask for help or speak to your friends and family

- Start building an emergency fund or a buffer

- Shop around and do your research

Kindly shared by Shawbrook Bank

Main photo courtesy of Pixabay