Search Acumen Conveyancing Market Tracker – Q3 2020 edition

19 November 2020 – Search Acumen Conveyancing Market Tracker – Q3 2020 edition – active firms leap 56% and transactions double from Q2 – but can the recovery last?

Highlights:

- The number of active firms jumped 56% in Q3 2020, rising to 3,751, up from 2,411 in Q2 2020

- Conveyancing volumes increased sharply by 105% over the last quarter, climbing to 169,143 in Q3, up from 82,385 in the previous quarter

- First registrations experienced the biggest jump of transaction types over the last quarter, rising more than ninefold to 993, up from 100 in Q2

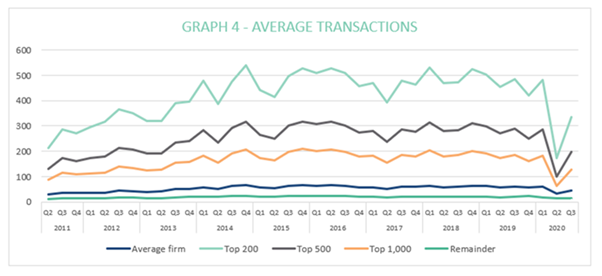

- Transaction volumes for the average firm jumped 32% over the last quarter, increasing to 45 in Q3, up from 34 in Q2 but still falling short of the 60 transactions seen in Q1

- The top 1,000 firms saw average business levels double from 64 transactions in Q2 to 128 in Q3 – but this remains the second lowest figure seen since Q1 2013

The conveyancing market regained its footing in Q3 2020 as demand returned to the property market following a turbulent Q2, according to the Q3 2020 edition of the Conveyancing Market Tracker from Search Acumen, the property data insight and technology provider.

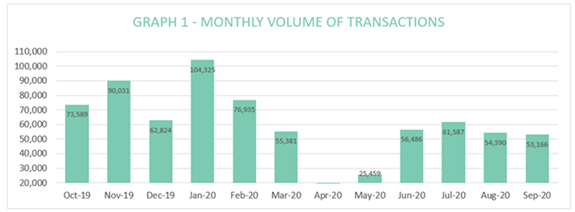

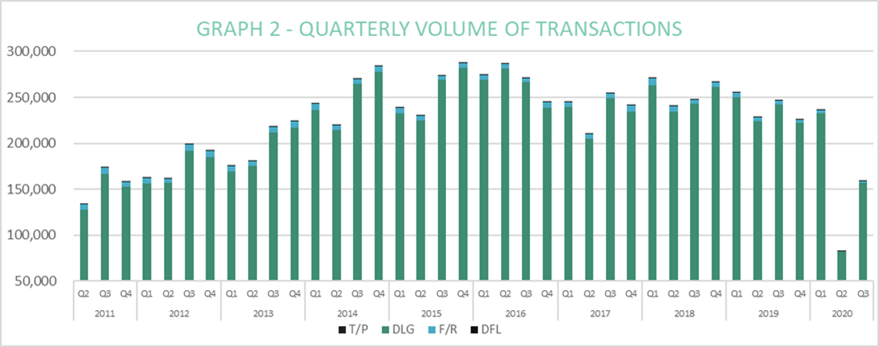

The tracker shows conveyancing volumes rose sharply by 105% over the last quarter, climbing to 169,143 registered transactions in Q3 2020, up from 82,385 in Q2 2020.

July was the busiest month, with 61,587 transactions completed. The surge can be largely attributed to the re-opening of the housing market following the spring lockdown, with the Government’s stamp duty announcement likely to drive higher transaction volumes during the remainder of the year as consumers looked to take advantage of tax savings.

Government support breathes life into the market

Q3 saw a return of consumer confidence as lockdown measures eased, which in turn helped to unlock latent demand that was put on hold in Q2. Demand was further boosted by some homebuyers looking to move out of cramped spaces following months spent inside. Comparing transaction types, first registrations (F/R) experienced the biggest jump in activity over the last quarter as the recovery got underway, rising almost tenfold to 993 in Q3 from 100 in Q2.

In response to the spike in business volumes, the number of active conveyancing firms in the market jumped 56% over the last quarter in response to high demand, rising to 3,751 in Q3 2020, up from 2,411 in Q2. However, this remained the second-lowest number on record with 177 fewer firms active than in Q1 2020 (3,928).

Similarly, the peak of transactions in July still did not see levels return to those seen in the early pre-Covid months of the year, with numbers in February at 76,935. In addition, total transactions in Q3 were still down by almost a third (-31%) compared to the same period in 2019 where 246,816 transactions took place.

The number of active firms in Q3 represents a 7% annual decline from 4,024 in Q3 2019. Longer term trends reveal the number of active firms has now fallen by 10% over the last three years from 4,191 in Q3 2017.

Market share reverts to pre-Covid levels

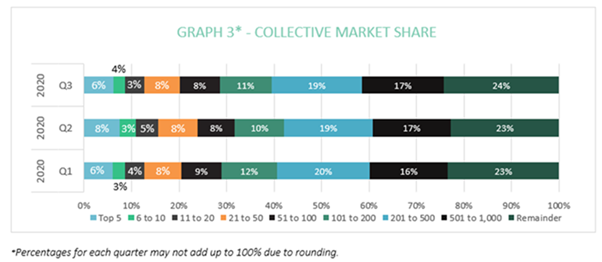

For the conveyancing market as a whole, the breakdown of market shares rebalanced in Q3 2020 to levels seen before the pandemic hit. The top five ranking firms saw their combined market share contract from the heights of Q2, where they achieved an 8% share when the market was at its slowest point, to 6% in Q3 – consistent with the level seen for most of the last five years.

The top 200 firms experienced the same trend as their collective market share fell back from 42% in Q2 2020 to 39% in Q3. However, they registered a total of 66,687 transactions between July and September, a 92% increase from the 34,747 seen in the previous three months.

Average transactions rebound but fail to reach solid ground

For the average conveyancing firm, transactions jumped 32% quarterly, increasing to 45 in Q3, up from 34 in Q2 but not quite regaining the total of 60 transactions seen in Q1. Despite being an improvement on the lockdown period, this Q3 figure still represents the lowest number of average transactions since Q2 2013 where 40 transactions took place per firm.

The top five firms enjoyed a 66% uptick in their average transaction levels for the quarter, rising to 2,068 in Q3 compared to 1,244 in Q2. The biggest leap in average transactions was across the top 1,000 firms, who saw business levels more than double (101%) from 64 in Q2 to 128 in Q3. However, this also remained the lowest figure seen since Q1 2013 in the early days of recovery from the post-2008/9 credit crunch.

Andy Sommerville, Director of Search Acumen, comments:

“These third-quarter figures demonstrate a recovery from the full force of the pandemic’s impact in Q2, but it is no time for the market to drop its defences quite yet. While the Government’s Stamp Duty holiday is helping to propel activity into Q4, it has not relieved conveyancers of the pressures they faced in Q2 but has instead presented a different set of challenges for them to navigate.

“After clearing the initial backlog of transactions, raising the stamp duty threshold has swamped public bodies with search requests, and meant that organisations including HM Land Registry and Local Authorities have struggled to keep up. Further, an overreliance on outdated processes has meant that age-old search delays are rearing their ugly head – slowing down the transaction process and threatening to hamper the benefits of the Stamp Duty scheme. To capitalise on the property tax incentive ahead of the deadline next Spring, transactions must progress as soon as possible as delays rumble on.

“It is time the Government acted decisively by tackling recurring delays in the property market through proper investment and an acceleration of its digitisation programme. While this won’t be resolved by 31stMarch 2021, an industry wide change in mindset is required now – not to mention a new approach to leveraging the available technology to harness the data at our fingertips.

“We saw evidence of an increase in firms adopting digital practices as a result of the pandemic. What’s needed now is firm commitment by all parties to collaborate, adopt the right technologies and build a more efficient property market. Only then will we be able to identify risks upfront, reduce uncertainty and progress transactions more effectively in the long term.”

Kindly shared by Search Acumen

Main article photo courtesy of Pixabay