Savoy Stewart: Global Hotspots for London Office Investment

In the aftermath of the vote to leave the EU two-and-a-half years ago, plenty has been written about the future global standing of the UK, with many naysayers suggesting London will be particularly hard-hit by the economic fallout.

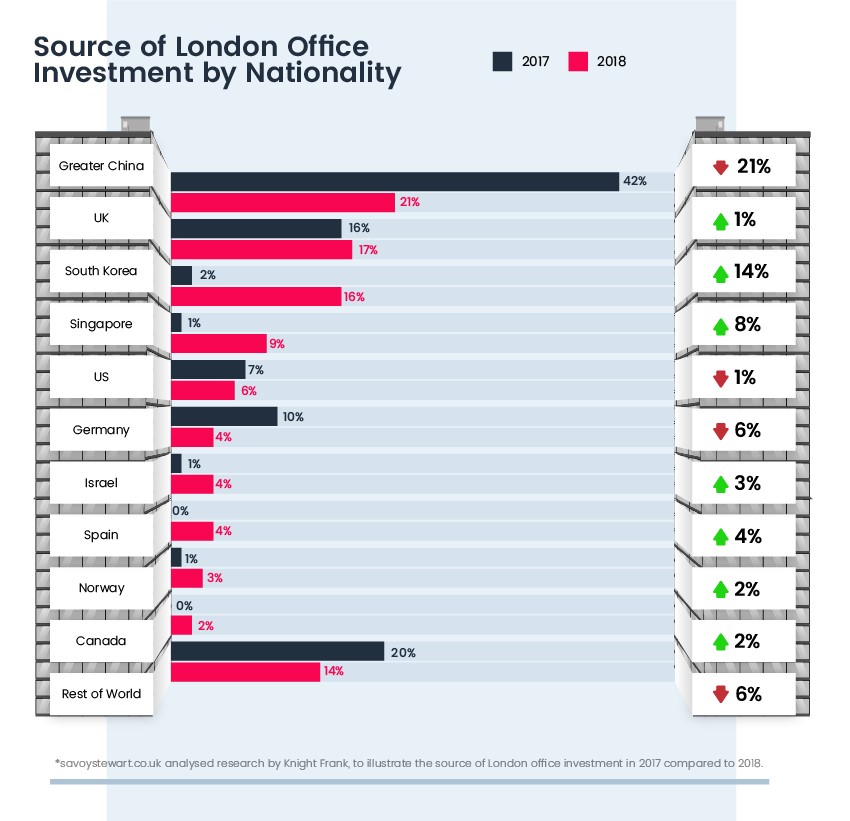

- London office investment is falling in Greater China and Germany.

- London office investment is rising in South Korea, Singapore and Israel.

- The London office market saw more investment than any other global city in 2018.

- Since the EU referendum, London’s workforce has grown by 278,000 jobs on a net basis.

- In 2018, 8 million sq. ft. was let in the London office market, the highest level since 2014.

Naturally, like with any change, there will be an adjustment period. But new research proposes London will continue to attract the interest of occupiers and investors alike.

Commercial property specialists, savoystewart.co.uk explored Knight Frank’s The London Report 2019 to prove London is prospering and to consider the global powerhouses choosing to invest in the capital. Giving good indication that, past the impending result on Brexit, our nation will continue to thrive.

Per Knight Frank’s report, Savoy Stewart found London saw greater volumes of commercial real estate investment than any other global city in 2018 – with over £16 billion of transactions. Likewise, in 2018, 14.8 million sq. ft. was let in the London office market; the highest level since 2014 and 15% above the long-term average.

Work in London has remained buoyant too. According to the Office for National Statistics (ONS), in the two years following the referendum, the capital’s workforce grew by 278,000 jobs on a net basis. The information and communication sector accounted for 26% of these new roles, while the financial sector has seen close to 6,000 jobs created since the vote, disproving some concern over job loss and relocation.

Centring on investment, it’s reasonable to say foreign capital remains key. Over 80% of acquisitions were driven by overseas purchasers in 2018.

But who is investing?

Savoy Stewart took time to analyse the source of London office investment in 2017 compared to 2018, to signify where interest lies and to forecast what global partners the UK should nurture moving forward in 2019.

In 2017, Greater China held the highest source of London office investment, at 42%. Followed by homegrown investment (UK; 16%) and healthy acquisition from Germany (10%) and the US (7%.)

In 2018, London office investment in Greater China dropped by half, bringing the total to 21%. This is perhaps to be expected following capital controls imposed on outbound investment in this region. Homegrown investment grew by 1% (UK; 17%) amid a drop in investment from Germany (4%) and the US (6%.)

Encouragingly, despite a fall in investment in certain areas, we can see a great rise in emerging markets. Notably, London office investment in South Korea grew from 2% in 2017 to a prosperous 16% in 2018. While investment in Singapore grew from 1% in 2017 to 9% in 2018.

Slight yet impactful rises in London office investment can also be seen in Israel (1% in 2017; 4% in 2018), Spain (0% in 2017; 4% in 2018) and Norway (1% in 2017; 3% in 2018.)

Darren Best, managing director of savoystewart.co.uk, comments:

“London is the hub of debate amid Brexit. There is a lot of expectation regarding its future power as our capital and, in turn, our future power as a country. But we shouldn’t get caught up in what we don’t know; the what ifs and the maybes.

“We should focus on what we do know; the facts and figures. In the two-and-a-half years since the vote, we have maintained healthy investment and a healthy workforce.

“It is really encouraging to see that, despite some pitfalls and perhaps a slowed pace, interest in London office investment is burning through, with notable interest from South Korea, Singapore and Israel. A real melting pot of possibility.

“The way we do business is changing, and it is certain to change further, but it is not ending. We will continue to thrive, but in a different way.”

Kindly shared by Savoy Stewart