Reallymoving: House price falls forecast for February and March could signal end of market frenzy

In the latest Reallymoving House Price Forecast, house price falls look likely for February and March could signal end of market frenzy.

Headlines from publication:

- Average property prices in England and Wales are set to decline by 1.6% over next three months

- A rise of 0.2% in February will be followed by falls of -0.9% in March and -0.8% in April

- Strong New Year buyer demand reported on the portals has not yet translated through to transactions

- Annual growth will remain positive, but will slow to +1.4% in April – the lowest rate in 20 months

- Rising borrowing costs and inflation could already be impacting buyer decision-making

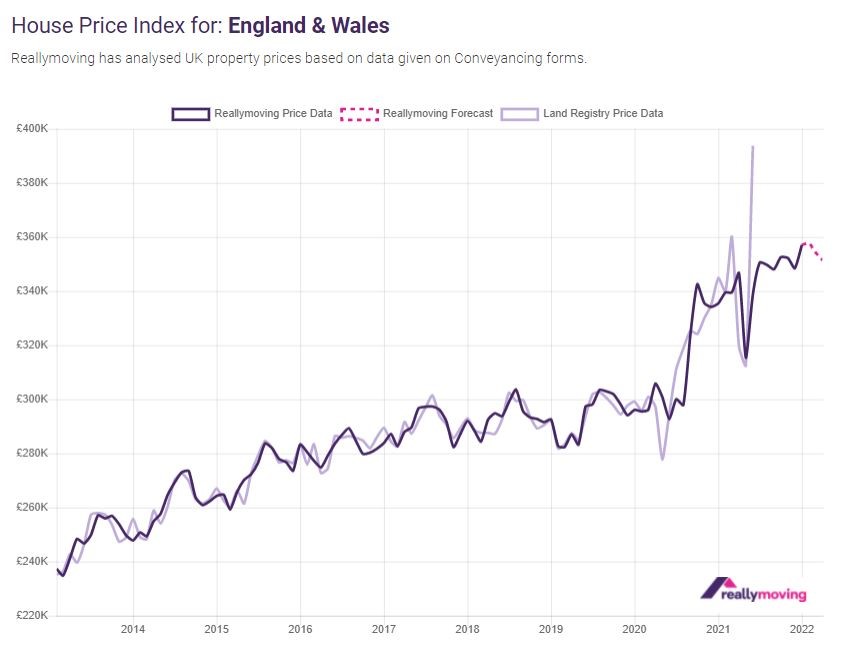

House prices in England and Wales are set to fall in March and April based on deals already agreed between buyers and sellers, indicating that the post-lockdown property market boom may finally be running out of steam, reports the reallymoving House Price Forecast January 2022, released today.

Based on deals agreed between buyers and sellers in the run up to Christmas and over the new year period, house prices will rise by 0.2% in February before falling 0.9% in March and a further 0.8% in April.

Homebuyer activity at the start of the year has been strong, according to Rightmove and Zoopla, with record numbers of valuation requests and property searches suggesting the pandemic-driven ‘race for space’ continues to play out, yet it remains to be seen how much of this early home mover activity translates through to sales.

Rising interest rates and concerns about inflation and the growing cost of living may already be having an impact on consumer sentiment, resulting in buyers agreeing to pay less for properties.

Reallymoving captures the purchase price that buyers have agreed to pay when they search for conveyancing quotes through the comparison site, typically 12 weeks before they complete. This enables reallymoving to provide a three-month house price forecast that historically has closely tracked the Land Registry’s Price Paid data, published retrospectively.

Annually, price growth has remained positive since August 2020, a run of twenty months, with year on year increases of +5.4%, +4.4% and +1.4% forecast for February, March and April. Yet it’s clear that the rate of growth is slowing, indicating the post-pandemic housing market rush could be coming to an end as the market enters a calmer period.

What does this mean for First-Time Buyers?

Raising a deposit is as challenging as ever and any readjustment of the market this spring is unlikely to make affordability much less of a barrier in real terms.

First-Time Buyers numbers have been increasing recently, but they will be concerned about rising interest rates and the cost of living crisis on already stretched finances and the threat of tightening borrowing criteria by lenders. At the same time, rents are rising again, making it harder to save.

On the plus side, most First-Time Buyers still benefit from paying no stamp duty and have exclusive access to the Help to Buy scheme, which has a further year to run. Those who have managed to save throughout the pandemic will be in a good position to move and lock in a cheap fixed-rate deal while they still can.

Rob Houghton, CEO of reallymoving, comments:

“Falls in the average house price in March and April could indicate the beginning of a slowdown in the property market, but the rate of growth we’ve seen since the summer of 2020 couldn’t continue indefinitely and a return to a more stable footing would be good news for First Time Buyers in particular.

“While growth in earnings fails to keep pace with the cost of living, worries about the inevitable squeeze on household finances will make some people think twice about moving and reluctant to take on more debt, which is why the shortage of homes for sale across the board could be an ongoing problem in 2022 – especially considering many of the people who would have sold this year brought their move forward to benefit from the stamp duty saving.

“Much will depend on the volume of new listings we see hitting the market this spring and the speed at which lenders push up the cost of fixed rate deals.”

Kindly shared by Reallymoving

Main photo courtesy of Pixabay