Reallymoving Cost of Moving Report 2024: Moving home now costs almost £14,000, or £2,186 for First-Time Buyers

Moving home now costs almost £14,000, or £2,186 for First-Time Buyers, according to the Reallymoving Cost of Moving Report 2024.

Average moving costs have more than doubled in the last decade, and there’s only a brief window to move before Stamp Duty bills rise next April

Key points from publication:

-

- Homeowners buying and selling a property in 2024 need to pay £13,978 in upfront expenses

- Movers in London pay £30,048 to move home – more than twice the national average

- First-Time Buyers pay £2,186 in upfront costs to buy their first home

- The cost of moving has more than doubled (+114%) in the last decade from £6,533 in 2014

- Lowering of Stamp Duty thresholds on 1st April 2025 will see the cost of moving jump to £16,478

The process of buying and selling a home in 2024 costs almost £14,000 in upfront expenses – and there’s only a brief window before that cost rises even further when lower Stamp Duty thresholds are reinstated on 1st April 2025 – pushing the cost of moving up another £2,500 to a record high of £16,478.

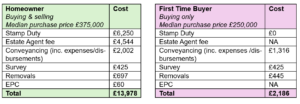

Taking into account Stamp Duty, conveyancing, estate agent fees, a Level 2 Homebuyer survey, an EPC and removals costs, comparison site reallymoving has analysed data from almost 140,000 quotes to determine the typical cost of moving home in 2024.

Table 1: The Cost of Moving in 2024

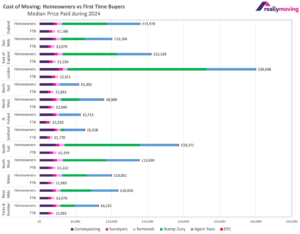

Movers in London face most prohibitive costs:

There is a clear north-south divide in the cost of moving home, driven largely by the gulf between median house prices across the country. Movers in the North-East of England pay the least, with a home move costing £5,492 – less than one fifth of the cost of moving home in London.

In comparison, movers in the capital must fork out £30,048 on average, due to higher house prices which drive up stamp duty bills and estate agent fees.

London is the only location where, based on their average purchase price, First Time Buyers will be forced to pay stamp duty again from next April, meaning they need to find an additional £6,250 on top of their current £2,552 bill for buying a home.

Moving costs are about to go up significantly:

On the 1st April 2025, the temporary higher threshold at which Stamp Duty is payable, currently £250,00 for someone buying and selling a property at the same time, will be reduced back to £125,000. Based on the median purchase price in England, the average stamp duty bill will jump by £2,500 from £6,250 to £8,750, pushing the total cost of moving to a new record high of £16,478.

Movers in the North-East and Northern Ireland, who currently benefit from paying no Stamp Duty at all based on the median purchase price, will be forced to pay £2,400 and £2,500 respectively when the lower threshold is restored.

Proportion of FTBs paying Stamp Duty set to double:

The proportion of First-Time Buyers (FTBs) paying Stamp Duty will more than double from 17% currently to 39% when the government reinstates the £300,000 threshold on 1st April 2025.

This presents a significant additional upfront cost at a time when FTBs are already grappling with high house prices and mortgage rates – as well as extortionate rents which make it harder than ever to save a deposit.

Reallymoving’s research shows it takes nearly 6.5 years to save to buy a first home, assuming FTBs can afford to put aside 10% of their salary each month. Based on the UK average FTB purchase price, they need to raise £25,554 to cover a 10% deposit and additional moving costs such as conveyancing, a survey and removals.

A home move costs 3% less than in 2023:

With the cost of many home mover services tied to house prices, a 3% fall in the median sale price and a 1.3% fall in the median purchase price in 2024 means estate agent fees, conveyancing fees, a survey and stamp duty bills are all lower than last year, when the total cost of moving home was £14,458.

As providers have competed for business in a slow market, moving costs have also failed to rise with inflation, meaning in real terms a home move this year costs £1,087 less than in 2023.

The busiest and quietest times to move:

Around 2.3 million moves take place every year, but there are particular days and months that are favoured by movers, creating greater competition for removals and conveyancing services.

August has been the most popular month to move home for the last 12 years, with January and February the quietest. Friday is by far the busiest day of the week, with 29% of home moves taking place on a Friday, leaving movers with the weekend to unpack and get organised before the start of the new week. Tuesday is the quietest weekday to move home, meaning there is likely to be less competition for services.

Top tips for saving money on a home move:

-

- Use a comparison site to compare quotes from vetted and accredited firms, checking reviews as well as prices

- Plan ahead if possible, to try and move during quieter periods such as the new year, and avoiding peak times like the end of the summer holidays. Most people want to move on a Friday, so some removals firms may offer a mid-week deal, to help keep costs down.

- People often leave removals until the last minute, but booking well in advance will make it easier to budget costs, before firming up arrangements at the point of exchange. Some removals firms will offer discounts for OAPs, students, key workers or members of the armed forces.

- Declutter first, so you’re only paying to move what you really need and want to take with you. The less you have, the less you pay.

- Don’t cut corners when it comes to insuring your move. First, check your existing home insurance policy as some will cover your possessions in transit. Most removal companies have insurance as part of their contract with you, but always check the excess and the level of cover, and consider upgrading if you’re moving very valuable items.

Reallymoving founder and CEO, Rob Houghton, commented:

“Raising almost £14,000 to finance a home move is a major challenge for many people, especially with the cost of living so high making it even harder to save.

“We’ve seen an increase in the proportion of First-Time Buyer activity in the last few weeks as people accelerate plans to move to take advantage of lower stamp duty bills before they rise next spring, but the window will be too tight for many, so it’s wise to budget for higher stamp duty costs just in case.

“Our data shows that the fewest home moves take place during January and February, but bear in mind that the New Year and early spring may well be busier in 2025 as people rush to beat the stamp duty deadline.

“Always shop around to secure the best deals for conveyancing, surveying and removals, paying close attention to reviews as well as price.

“Over the next few months, it will be even more important to have a reliable and responsive conveyancer who will progress your transaction quickly and efficiently.”

Kindly shared by Reallymoving