Reallymoving March 2020 House Price Forecast

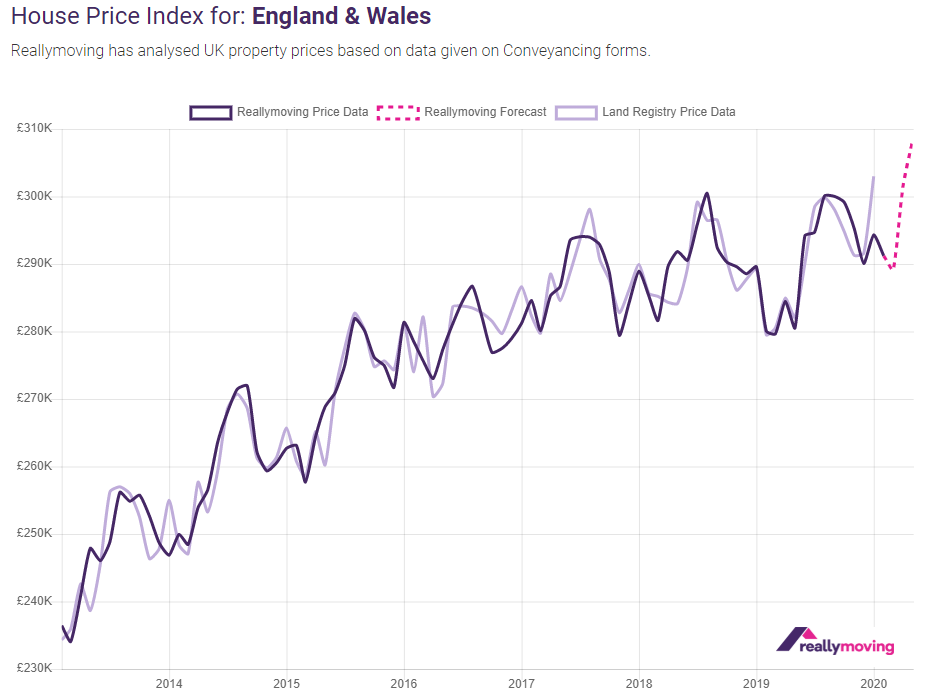

The Reallymoving March 2020 House Price Forecast suggests there is a strong annual growth forecast for this spring, despite Coronavirus.

Headlines:

- The housing market in England and Wales is currently on course for a spring price surge

- Annual growth in house prices will average 6.4% between March and May

- Strong monthly growth to deliver a 5.9% rise in average prices over the next quarter

- Forecasts are based on deals agreed between December 2019 and February 2020, but Coronavirus crisis could derail growth if those deals collapse

| Month | Average price agreed | Monthly change % | Annual change % |

| January 2020 (actual) | £294,317 | 1.5% | 1.6% |

| February 2020 (actual) | £291,214 | -1.1% | 4.0% |

| March 2020 (forecast) | £289,137 | -0.7% | 3.4% |

| April 2020 (forecast) | £301,524 | 4.3% | 6.0% |

| May 2020 (forecast) | £308,396 | 2.3% | 9.9% |

The housing market in England and Wales is currently on track to see strong growth this spring with average prices rising by 5.9% over the next three months, as increased sales activity in the new year translates into deals agreed, according to the reallymoving House Price Forecast March 2020, released today. However, the impact of the Coronavirus crisis could see nervous buyers withdrawing from those deals leading to a collapse in sales over the next few months, which would impact anticipated growth.

Monthly price changes

Average house prices in England and Wales will rise by 5.9% over the next three months, from £291,214 in February to £308,396 in May 2020. A minor 0.7% dip in March, based on deals agreed in December, will be wiped out by growth of 4.3% in April and 2.3% in May following a strong market performance in the New Year when agents reported a notable increase in activity and sales agreed.

Growing consumer confidence as a result of certainty over Brexit and a decisive General Election result could be hit by concern over the Coronavirus and its impact on jobs and the value of pensions and investments, but this will not be evident in the data until June.

Annual price changes

The market continues to perform consistently more strongly than a year ago, as evidenced by nine consecutive months of positive year on year growth between August 2019 and May 2020 This suggests that some of the pent up demand built up in the housing market over the last three years is now being released, but the impact of Coronavirus could mean this upturn in consumer confidence is short lived. Annual growth is currently forecast to reach 3.4% in March, 6.0% in April and a remarkable 9.9% in May, but the latter figure is distorted by a notably weak performance in May 2019 when prices dipped substantially below the long term trend.

Analysis and commentary

Rob Houghton, CEO of reallymoving, comments:

“Buyers returned to the market in their droves in the New Year and this activity has clearly translated through to higher house prices across the country between March and May, but now we are facing another potentially prolonged period of uncertainty due to the deepening Coronavirus crisis.

“The current situation is unprecedented but we know from past events such as the global financial crisis in 2008 that when people were worried about their jobs and their pensions, they tend to withdraw from making big financial decisions and avoid taking on new debt. It’s too early to say the extent to which the property market will be affected, and the Bank of England’s emergency 0.5% interest rate cut should help mitigate the impact, but consumer confidence is fragile and I expect we will see a proportion of deals collapsing and a short-term drop in prices by late spring or early summer.”

Kindly shared by Reallymoving.com