New Council Standards provide higher level of consumer protection

The Equity Release Council has launched its updated industry standards to provide higher level of consumer protection, in the largest evolution since the organisation was established in 2012 as the representative trade body for the UK equity release sector.

Headlines:

- The Council’s Standards set best practice benchmark by providing a higher level of consumer protection than any other form of property-based loan

- Update provides protection for consumers who face complex decisions in a growing later life lending market to support their quality of life in retirement

- Milestone builds on nearly thirty years of work to safeguard and protect consumers

The update introduces an approach based on principles and consumer outcomes, which reflects the latest thinking in financial services regulation and complements the existing rules, safeguards and protections. It sets the benchmark for best practice by providing a higher level of consumer protection than any other form of property-based loan. Its purpose is to ensure that equity release products and services continue to deliver good outcomes for customers, who face increasingly complex decisions in an evolving later life market and regulatory landscape.

An extensive consultation took place earlier this year among the Council’s membership, including providers, advisers, solicitors and surveyors. It also drew on external input from the Financial Conduct Authority (FCA), HM Treasury and the Money and Pensions Service (MaPS). The process was overseen by the Council’s Standards Board, made up of industry professionals and independent regulatory experts*.

The resulting update will be effective from 1st January 2020 and builds on the work which began when clear consumer-focused equity release product standards were first introduced in 1991. The standards have continually evolved since then and have been fundamental to establishing trust in the market, which has supported nearly 500,000 customers to meet their retirement needs during that time.

The standards framework

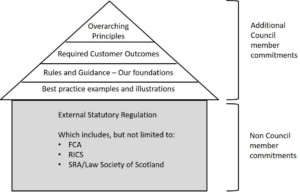

The Council’s standards go above and beyond statutory regulation and legislation to ensure that members’ products and services conform to best practice when helping customers to make financial decisions in later life. In the past year, membership of the Council has increased to more than 300 firms and 1,000 individuals who commit to this benchmark.

Diagram one: Equity Release Council Standards framework

As well as refreshing and simplifying many rules, the latest standards’ update reinforces the existing focus on providing appropriate support to customers who may be exposed to physical, mental and financial vulnerability at any point of contact. Customers of Council member firms receive three levels of protection, encompassing a structured financial advice process; clear product safeguards; and independent face-to-face legal advice. The latter is particularly important in keeping with the Mental Capacity Act, which identifies solicitors among those professionals who can assess whether someone has the capacity to enter into a contract and is not under duress from any third party.

Chris Pond, Chair of the Equity Release Council’s Standards Board, comments:

“The standards are fundamental to the Council’s work to lead a customer-focused market, and today’s launch is an important milestone in nearly thirty years of protecting consumers’ interests. The aim of the review was to ensure that the standards reflect emerging trends in regulation and are future proofed for a world where retirements needs are constantly changing.

“The renewed focus on principles and outcomes alongside existing rules and guidance will help to ensure that equity release products and services continue to meet customer needs. The standards which Council members commit to, above and beyond their regulatory duties, provide the ultimate reassurance to consumers that equity release products are safe and reliable.”

David Burrowes, Chairman of the Equity Release Council, concludes:

“The UK population is ageing rapidly, and people are having to make increasingly complex decisions over longer lives in retirement. Elderly consumers face a wide range of products and services to meet different and often competing needs – from providing additional retirement income and meeting the costs of care to providing early inheritance to family and friends.

“Today’s landscape demands a joined-up approach to later life financial planning that considers all wealth and assets. Longstanding provisions for equity release customers, such as the guarantee of independent legal counsel, have set a high benchmark for delivering advice in the later life arena. Our updated standards build on these guarantees to ensure they are fit for modern day purposes. They recognise that the best outcomes can often be achieved in different ways, by combining clear rules with overarching principles which all members sign up to. These will continue to evolve in future to meet the ever-more complex challenges facing consumers.”

Kindly shared by Equity Release Council