Million-pound house sales on the rise: Popular prime property locations

Million-pound house sales are on the rise, with the East and West Midlands enjoying the biggest increases amid London’s slowdown.

Nearly 7,000 homes were bought for a million pounds or more in the first half of 2019, as the British prime property market sprung back into life.

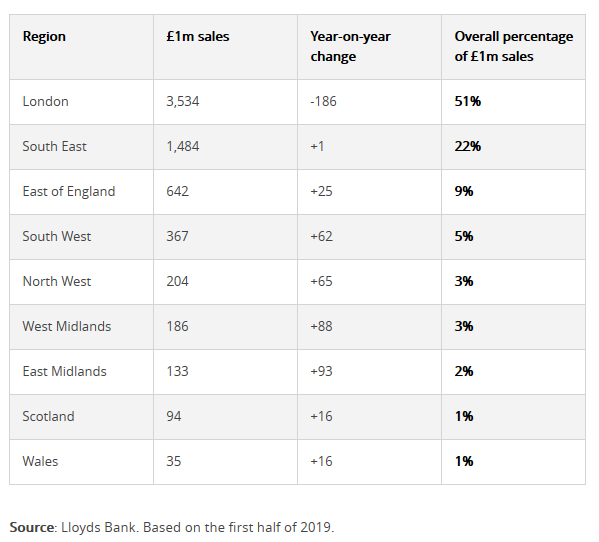

A new report from Lloyds Bank shows the number of house sales for £1m or over has increased by 5% in the space of a year.

This comes despite a drop-off in the number of prime properties being sold in London and the South East.

Here, you can find out where people are buying the most expensive homes and get advice on whether mortgages for £1m or more are really a thing.

Where are people buying million-pound homes?

More than half of Britain’s 6,891 million-pound purchases took place in London, but the English capital’s figure of 3,534 represents a drop of 186 sales compared with last year.

At the other end of the scale, the East and West Midlands saw their number of million-pound sales increase substantially in the space of 12 months.

Elmbridge breaks the London dominance

Nine of the top 10 local authorities for million-pound house sales were in London, with Kensington and Chelsea (477), Westminster (431) and Wandsworth (300) the three most popular places for prime purchases.

Elmbridge in the South East of England was the sole non-London entry in the top 10, with its 178 sales enough to secure eighth place.

What can you buy for a million pounds?

A million pounds is a lot of money, but it gets you considerably more in some parts of Britain than it does in others.

In London, a million pounds won’t go a particularly long way, although more value can be found in suburban areas.

For exactly £1m, you’ll be able to get a one-bedroom flat in the suave South Bank Tower in Central London, a two-bedroom flat in Maida Vale, or a three-bedroom terraced house in leafy north London suburbs of Crouch End.

As you might imagine, there’s greater value to be had in the East and West Midlands, which both saw their numbers of million-pound sales boom.

In the West Midlands, for example, you can get your hands on a nine-bedroom detached home in the rural outskirts of Birmingham or a stunning farmhouse with acres of land in Hampton-in-Arden.

In the East Midlands, you might be tempted by a five-bedroom barn conversion in Swadlincote or a luxury six-bedroom new-build in Nottingham.

Where are the most expensive homes?

You might not be surprised to hear that the top 10 expensive homes currently on the market are all in London.

For £55m you can buy an eight-bedroom townhouse in St James’s Park, while for £40m you can get your hands on a contemporary mansion in Highgate, North London.

The most expensive home outside of London is listed in the Isle of Man. The six-bedroom detached home in Santon stretches to 23,000 square feet and comes with a guide price of £30m.

Can you get a mortgage on a prime property?

While many prime properties go to ultra-wealthy cash buyers, a surprising number are purchased with a traditional mortgage.

UK Finance data shows that 3,791 million-pound mortgages were granted in 2018, up 9% on 2017’s figure of 3,477.

These figures don’t include mortgages granted by private banks, which offer bespoke loans to high-net-worth individuals.

When we crunched the numbers earlier this year, we found that nearly a quarter of mortgage deals on the open market came with maximum loan sizes of at least £1m.

The biggest loans are generally only available with larger deposits, with 29 lenders offering limits of at least £1m at 75% loan-to-value, but only 16 offering deals at 85%.

Our research showed that four lenders offered the biggest mortgages up to a maximum of £10m.

How to find a prime property

The prime property market is much smaller – and therefore more volatile – than the normal resale market.

In some cases, overpriced prime homes can languish on the market for months unsold, while in other instances they disappear before ever hitting the window of an estate agent.

If you’re looking to buy a prime property in a sought-after area, you could consider appointing a buying agent to find the home and negotiate on price for you.

Buying agents will already have the best links with local agents in the area, and they may be able to spy out a great home before it’s listed publicly.

Kindly shared by Which?