Larger homes are driving house price growth – Halifax

Demand for larger homes has driven growth in UK property prices over the past year, according to new research by Halifax.

The analysis – based on data from the Halifax House Price Index – reveals significant variations in price growth across different property types and regions.

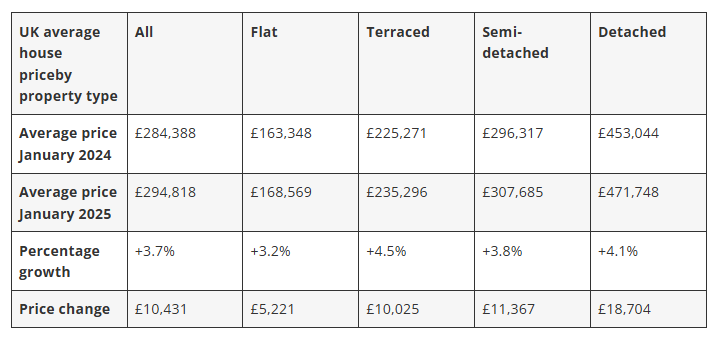

Terraced houses lead the way with annual growth of +4.5%, reaching £235,296, while detached properties increased by +4.1% to £471,748.

In contrast, flats saw the slowest growth at +3.2%, with an average price of £168,569. Semi-detached houses rose by +3.8%, averaging £307,685.

Overall, as easing interest rates improved mortgage affordability last year, annual property price growth reached 3.7% in January 2025, up from just 1% at the start of 2024, Halifax said.

In cash terms, prices increased by £10,431, with the average cost now at £294,818, surpassing the previous peak in August 2022 during the pandemic-era property boom.

Halifax said a fifth more first-time buyers stepped onto the ladder last year, with prices for of terraced homes rising by 3.5% for this cohort, by 2.9% for semi-detached houses and 2.8% for detached properties. Flats lagged behind at 1.8%.

Regionally, the North East saw the strongest growth in flat prices, rising by +15.1% to £100,123, while the East Midlands experienced a slight decrease of 0.6%.

The North East saw the biggest annual increase for terraced houses at 8.4%, while Yorkshire and Humberside had the slowest growth at 2.7%.

Northern Ireland saw the biggest increase for semi-detached houses at 7.0%, while Scotland had the slowest growth at 0.7%.

At the top end of the size scale, Northern Ireland also recorded the strongest annual growth for detached homes, rising 15.2%, while London had the weakest at 0.9%, though it still has the most expensive detached properties in the UK at £944,526. This is around five times more than the cheapest in the North East for £190,757.

Amanda Bryden, head of Halifax Mortgages, said:

“The fortunes of different property types tend to ebb and flow depending on broader market conditions. This time last year, the average price of a flat had risen more quickly than a detached house, as buyers adjusted to higher borrowing costs and sought to compensate by targeting smaller properties.

“Now, as interest rates have started to ease, it’s once again those homes offering more space which are fuelling demand. And that’s not just a short-term trend; over the last decade, bigger properties have tended to outperform smaller homes when it comes to price growth.

“This has caused the gap between the rungs on the housing ladder to widen further, presenting a bigger challenge to those looking to make the step up. However, that only tells part of the story. Slower growth among smaller homes is helpful for first-time buyers, and we saw a big rebound in that market last year, with a fifth more stepping onto the ladder.

“If you look beyond the UK picture to the individual nations and regions, there’s huge variance in average price performance for different property types, with many areas offering more value for money.”

Commenting on the research, Tom Bill, head of UK residential research at Knight Frank said:

“As mortgage rates have remained stubbornly high, UK price growth has primarily been driven by equity-rich, needs-driven buyers over the last year, which explains why demand for houses has been stronger than flats.

“Flat buyers tend to be younger and renting is a more common alternative on the initial rungs of the property ladder. Stretched affordability has also been a concern for those with less equity, with flats often located in higher-value urban centres, which have also been less in-demand as people continue to recalibrate their work/life balance since the pandemic.”

Buying agency Recoco Property Search has linked the demand for bigger homes to the tax levy on private school fees.

Nigel Bishop, founder of Recoco Property Search, said:

“Since Labour has announced a tax levy on private school fees, we have encountered numerous parents who decided to register their children with a state school and, as a result, are looking to move. We are currently registering even more parents contacting us for exactly this reason but they are up against a much tighter deadline to find a suitable home.

“This has created an increased feeling of urgency with many parents willing to offer sellers above asking price. We therefore expect to see a particularly competitive property market for larger family homes in the UK which could see house prices increase further.”

Toby Leek, president of NAEA Propertymark, added:

“Not only are buyers looking to take advantage of easing interest rates to secure a bigger home, but other trends, such as a continued increase in people looking for parking spaces and electric vehicle charging, as well as the surge in desire for outside space post-pandemic are pushing more buyers to pursue larger properties with driveways and gardens, moving away from apartments and flats.

“Terraced homes are likely proving popular amongst buyers as they often offer a home with a larger garden and parking at a more affordable price allowing many to maintain a sustainable financial balance.

“As different areas across the country offer more value for money, it’s likely we will continue to see buyers adjusting their criteria and broadening their search areas.”

Kindly shared by EstateAgentToday

Picture courtesy of Adobe