July 2021: Housing market brushes off Stamp Duty holiday deadline

July 2021: Housing market brushes off Stamp Duty holiday deadline, with strong growth forecast for October, based on deals agreed in July, according to analysis from reallymoving in its House Price Forecast.

Key points from the forecast:

- House price growth to slow through August and September before rising sharply to +1.7% in October

- Autumn increase indicates Stamp Duty holiday was not main driver of recent home mover activity

- Rate of annual growth will decline from 14.3% in August to 5% in September to 1% in October 2021

The housing market in England and Wales appears to have shaken off the end of the most generous part of the Stamp Duty holiday, with prices set to increase by +1.7% month on month in October based on deals agreed in July, according to the Reallymoving House Price Forecast released today. Such a rise in the values of new deals agreed in the month following the tax holiday deadline of 30th June indicates that the tax saving was not the main driver of recent home mover activity, with lifestyle changes, new flexible working arrangements and low mortgage rates more important factors.

Conveyancing quote volumes on reallymoving’s website peaked this spring at more than double the usual level but dropped by 18% in June and a further 21% in July to reach more normal levels for the time of year, indicating it is likely to be activity at the higher end of the market that is fuelling a rise in the average house price.

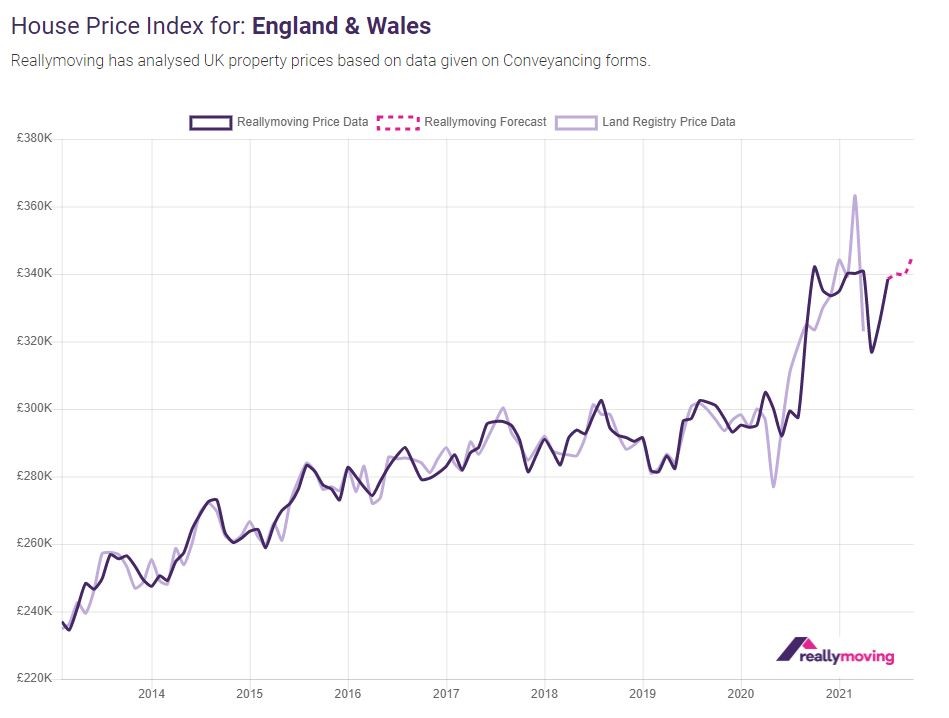

Reallymoving captures the purchase price buyers have agreed to pay when they search for conveyancing quotes through the comparison site, typically 12 weeks before they complete, enabling them to provide a three- month house price forecast that historically has closely tracked the Land Registry’s Price Paid data, published retrospectively (see graph below).

Following an exceptionally busy spring market which saw values rise strongly month on month, the prices agreed between buyers and sellers fell marginally in June which will be reflected in Land Registry data this September (-0.1%). This is likely to be little more than the froth coming off the market as the Stamp Duty holiday deadline approached, with buyers agreeing to pay less as they factored in the tax cost. But this dip appears to be short-lived, with deals done between buyers and sellers in July resulting in a 1.7% increase in the average house price when they complete in October, as once again demand bounces back and the housing market proves its underlying strength and resilience.

Rob Houghton, CEO of reallymoving, comments:

“This latest data allows us to see further into the autumn and once again the housing market is proving itself to be pretty resilient. It’s becoming evident that the phasing out of the Stamp Duty holiday is not having a significant impact on prices, with buyer demand arising from new working arrangements, a reassessment of housing needs and low mortgage rates likely to be a much larger driver of continued activity. Low new supply of homes coming onto the market is also putting upwards pressure on prices.

“Our inaugural Property Market Intelligence Report which launched this month showing that house price inflation is much lower for First Time Buyers at 2.5% than upsizers at 10%. Home movers with more equity are in the best position to move to their dream home now they are less tied to the office and the daily commute. Yet First Time Buyers shouldn’t despair at the sight of climbing prices. They are increasing far more slowly at the lower end of the market, and I’d urge anyone wondering if they can afford to buy their first home to look at the specific data for their area and their buyer group, which may be more favourable than they think.”

Kindly shared by reallymoving.com

Main photo courtesy of Pixabay