Increased activity in the mortgage market anticipated in 2025

Increased activity in the mortgage market anticipated in 2025, according to housing and mortgage markets forecasts published by UK Finance.

UK Finance has today published its housing and mortgage market forecasts for 2025 and 2026 together with projections for 2024 full year numbers.

2025 forecast figures

With rate and cost pressures continuing to ease, the outlook for 2025 is for a gradual improvement in mortgage affordability, feeding into market growth. As interest rates tick down, we expect arrears to continue to fall, with tailored forbearance helping those who need it.

We are forecasting the following for 2025:

|

2025 |

Year on year change compared to 2024 |

|

|

Gross Lending |

£260 billion |

+11 per cent |

|

Lending for house purchase |

£148 billion |

+10 per cent |

|

External remortgaging |

£76 billion |

+ 30 per cent |

|

New buy to let purchase lending |

£9 billion |

-7 per cent |

|

Internal product transfer |

£254 billion |

+13 per cent |

|

Arrears |

99,000 |

-5 per cent |

Key figures for 2024

Throughout 2024, lower inflation, rising real wages and gradual cuts in mortgage offer rates began to ease the affordability constraints which held back the market in 2023. This led to modest annual growth in lending for house purchases, although refinancing markets remained subdued. Arrears levels have been helped by prudent lending standards, extensive lender forbearance and low unemployment.

The number of customers falling behind on their mortgages looks to have peaked early in 2024 before falling back. While the number of properties taken into possession has risen, this is largely due to historic arrears cases now working through the court system and the numbers are very low compared to historic norms.

|

2024 |

Year on year change compared to 2023 |

|

|

Gross Lending |

£235 billion |

+4 per cent |

|

Lending for house purchase |

£135 billion |

+11 per cent |

|

External remortgaging |

£59 billion |

-10 per cent |

|

New buy to let purchase lending |

£10 billion |

+13 per cent |

|

Internal product transfer |

£224 billion |

-7 per cent |

|

Arrears |

104,200 |

-3 per cent |

James Tatch, Head of Analytics at UK Finance, said:

“The mortgage market showed greater than previously expected resilience in 2024 as cost and rate pressures began to recede.

“Affordability constraints did impact external remortgage activity, but strong competition to retain customers meant those coming off fixed rates could find a new internal product transfer deal without needing a new affordability test.

“In 2025 we are forecasting continued steady growth in both house purchase and remortgage lending as affordability improves further.

“We are however forecasting a slight fall in buy-to-let lending in 2025.

“The prudent underwriting standards in place for the past decade have helped most customers who might have fallen into difficultly.

“Arrears look to have peaked early in 2024 before falling back, and we expect them to fall again in 2025.

“Any customer who finds themselves in financial difficulty should speak to their lender at an early stage, as the industry continues to provide a range of tailored support options to anyone who needs help.”

Market overview: a gradual recovery after a tough year

In 2023 higher interest rates and cost-of-living pressures constrained affordability and drove a significant contraction in mortgage lending. This continued into the early months of 2024 but, from early summer, we saw the effect of real wage growth and falling mortgage offer rates translate into an increase in lending for house purchase.

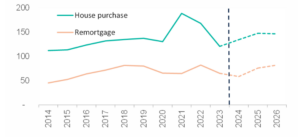

Residential house purchase lending in 2024 totalled £135 billion, an increase of eleven per cent compared with 2023. Although the number of purchase loans in the year grew by four per cent, activity was still well below the average levels seen in the decade before 2023. In 2025, we expect further gradual improvements in affordability to drive another ten per cent increase in purchase lending, to £148 billion.

Remortgaging activity was relatively subdued in 2024. This was, in part, due to slightly lower numbers of customers with fixed rate mortgages reaching the end of their deal periods and looking to refinance. However, despite some cuts in offer rates and rising real wages, affordability constraints limited the options for customers looking to refinance on the open market.

Remortgaging fell by ten per cent to £59 billion in 2024, whilst internal Product Transfer (PT) transactions, which are not subject to affordability tests, fell by a more modest seven per cent to £224 billion. Next year, with more fixed rate deals coming to an end, we forecast growth in refinancing. As affordability continues to ease gradually, remortgaging is expected to grow by 30 per cent to £76 billion, with PT business seeing lower growth of 13 per cent to reach £254 billion.

Chart 1: Residential lending, £ billions

Source: UK Finance forecasts Notes: Dotted lines denote forecast figures

Beyond next year, we expect affordability to become more constrained again in 2026 and, consequently, for house purchase activity to stabilise. Meanwhile continuing stronger numbers of maturing fixed rate deals will drive continued growth in remortgaging.

Buy-to-let activity showed modest growth, but faces headwinds

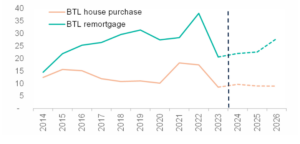

Cost and rate pressures also drove a sharp contraction in the buy-to-let (BTL) market through 2023, but this too saw a modest recovery in 2024. House purchase lending to landlords grew by thirteen per cent to £10 billion. As with the residential sector, this growth was in response to the lowering of new mortgage rates through the year. Next year, however, conditions look more challenging.

The introduction of an additional two per cent Stamp Duty surcharge announced in the Autumn Budget will act as a further deterrent to a market which already faces heightened regulatory and taxation challenges. Whilst the sector continues to adapt to meet these challenges, we do expect BTL purchase activity to contract modestly (seven per cent) to £9 billion in 2025.

Chart 2: Buy-to-let lending, £ billions

Source: UK Finance forecasts Notes: Dotted lines denote forecast figures

Overall arrears expected to fall back but some long-term cases work through to possession

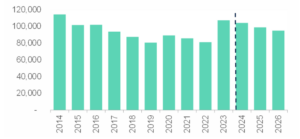

The responsible lending regime in operation for the past ten years, together with low unemployment and extensive lender forbearance, has greatly mitigated the extent of payment problems, even in the face of the considerable cost and rate pressures of the last three years. Perhaps most importantly, the interest rate stress test that forms part of affordability assessments has given customers the resilience to cope, even as Bank Rate rose by a cumulative 515 basis points from the end of 2021 through to August 2023.

Inevitably, arrears did increase through 2023 as these pressures took their toll on some customers. However, having risen through 2023, the number of customers in arrears barely changed in the first half of 2024, before falling back in the second half. Arrears are expected to end the year at 104,200, three per cent down on the number seen at the end of 2023. Next year, with expected cuts in Bank Rate and households seeing some real-terms wage growth, we expect further improvement, with arrears ending 2025 at 99,000 cases.

Chart 3: 1st charge mortgages in arrears

Source: UK Finance Notes: 1: Arrears measured as those representing more than 2.5 per cent of outstanding mortgage balance 2: Figures to the right of the dotted line denote forecast figures

Although fewer recent customers are falling behind and overall arrears numbers are expected to continue to fall, there remain cases where payment problems are more entrenched. A small minority of customers in deeper arrears have not been able to recover and move back towards paying status and, for some of these, all forbearance options have been exhausted.

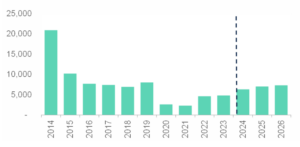

Where possession has become the only option, it is important that this process happens as quickly as possible, so that the remaining equity that can be released to the customer on sale of the property and repayment of the mortgage. This is even more important in the current higher rate environment where each missed payment builds up an arrears balance at a faster rate.

In 2024 there were some 6,300 mortgage possessions. Although this was up 31 per cent on 2023, numbers remain far lower than those seen in previous cycles. The increase reflects a move towards efficient operation, following the dislocations of the pandemic years, as the industry and court system work through these long-term cases to help customers exit their mortgage debt with the maximum amount of equity.

Chart 4: 1st charge mortgage possessions

Source: UK Finance Notes: Figures to the right of the dotted line denote forecast figures

In 2025, we expect a further modest increase in possessions of eleven per cent, to 7,000 cases, as this return to full capacity continues and the industry works to help more customers with no other options exit their mortgage as smoothly as possible.

Kindly shared by UK Finance