Huge rent demand and price rises continue across the UK

Huge rent demand and price rises continue across the UK, as the average UK rent price reaches another record high of £1,061 p.c.m., according to Homelet.

HomeLet has released the Rental Index figures for September 2021, with the vast rental demand rippling across the country.

The headlines from this month’s report are:

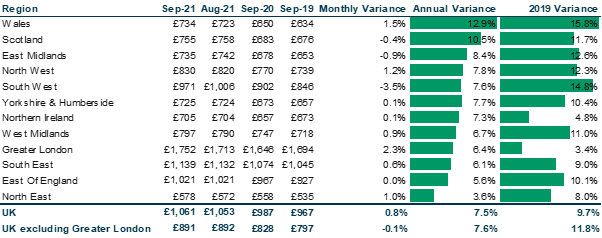

- The average rent in the UK has hit another record high of £1,061, up 5%on the same time last year, and up 0.8% from the previous month’s figures.

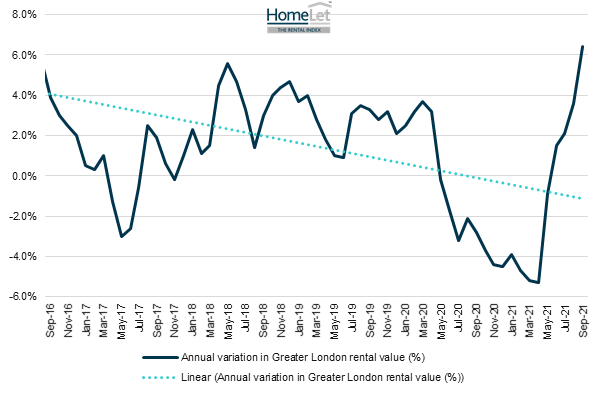

- London continues to march towards normality, with another price rise. An annual increase of 4%has taken the average price to £1,752 PCM; the monthly jump of 2.3% is the biggest in the country.

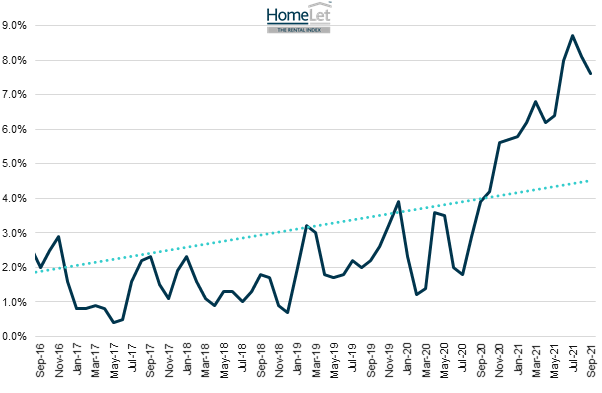

- Excluding London, the average UK rent price is up to £891 PCM, up 7.6% YOY.

- The South West of England has seen a significant monthly drop in rent price, with the average rent now at £971, down 5%compared to last month.

- Elsewhere, every single region has seen a YOY price rise, with Wales (12.9% rise) and Scotland (10.8%) seeing the most significant annual increases.

The HomeLet Rental Index provides the most comprehensive and up-to-date data on rental values in the UK.

The trends reported within the HomeLet Rental Index are from data on actual achieved rental values for just-agreed tenancies arranged in the most recent period – providing an in-depth insight into the lettings market and what’s happening right now across the UK.

Commenting on the latest data, Matthew Carter, HomeLet & Let Alliance Head of Marketing, said:

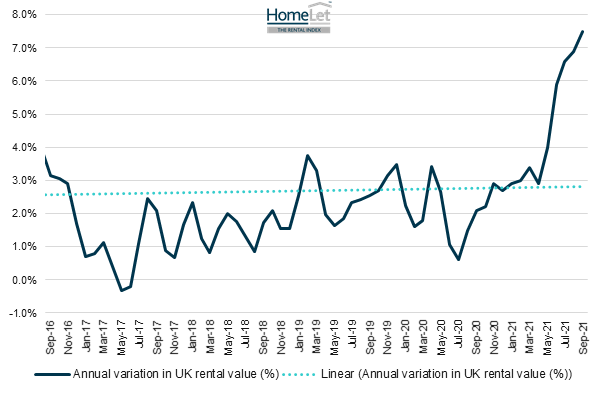

“UK rents are up by 9.7% on pre-pandemic levels (2019), but most of the increases have happened this year. At first, we saw rents outside London surge whilst prices in the capital dipped, but we’re now seeing rents in London rise much more rapidly, fueling the record rental levels we see across the country.

“Typically, rental prices rise in line with inflation and wage growth; that’s something we’ve continued to see. Despite record rents, tenants moving home spend a similar percentage of their income on their monthly rent. In September, the average household spent 29.6% of their gross income on rent, compared with 30.9% in September 2019, before the pandemic.

“Housing follows the same fundamental laws of economics as other goods that consumers need. Ultimately demand, coupled with lower stock levels for certain types of property, are driving up rental values. The concern is that we’re at a point where there are some areas with exceptionally high demand.

“Landlords and the lettings market have faced a continued raft of changes and legislation; the Government needs to carefully consider how any future policy might impact the 4.5 million households in the private rented sector. The Governments push on homeownership shouldn’t be done to the detriment of an industry that plays a critical role in UK housing.”

Table: Final Rental figures from the September 2021 HomeLet Rental Index

Chart 1: Annual Variance in UK Rent

Chart 2: Annual Variance in UK Rent (Excluding Greater London)

Chart 3: Annual Variance in Greater London Rent

Head to https://homelet.co.uk/homelet-rental-index/ for more information.

Kindly shared by HomeLet

Main photo courtesy of Pixabay