Housing market brushes off cost-of-living squeeze to hit new record high

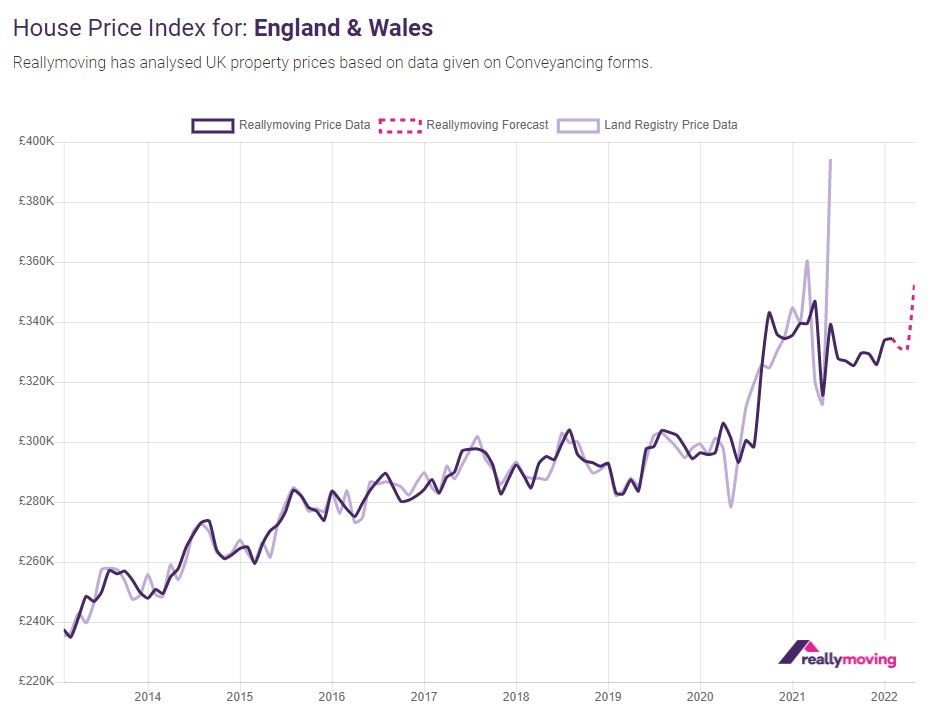

The shortage of homes for sale and continued strong demand from buyers will drive housing market prices up by 5.5% over the next three months (March to May 2022) to a new all-time high of £352,984, according to the reallymoving House Price Forecast February 2022, released today (21 March).

Key points from publication:

- The average property price is set to rise sharply this spring to new all-time record of £352,984

- A fall of 0.9% in March and 0.2% in April will be wiped out by a 6.7% surge in May

- Stock shortage and fierce buyer competition is forcing prices upwards despite inflationary pressures

- Annually, price growth will hit 11.9% in May, albeit against a notably low average price in May 2021

Despite signs of a slowdown at the start of the year which will result in a fall in registered sale prices in March and April, the strength of demand continues to propel the market upwards with the rising cost of living as yet having little impact on buying decisions.

Reallymoving captures the purchase price buyers have agreed to pay when they search for conveyancing quotes through the comparison site, typically 12 weeks before they complete. This enables reallymoving to provide a three – month house price forecast that historically has closely tracked the Land Registry’s Price Paid data, published retrospectively.

Based on deals agreed between buyers and sellers over the last three months, prices will fall by 0.9% in March and 0.2% in April before surging upwards by 6.7% in May – a direct result of buyer competition for a limited supply of homes during February. News in early February of a second base rate rise in three months, taking interest rates to 0.5%, has had little effect on demand, with many movers keen to do a deal as quickly as possible and lock in a fixed rate deal at the lowest price.

Conflict in Ukraine and the impact of sanctions on Russia, particularly on the cost of energy and fuel, is likely to have an impact on affordability and consumer confidence going forward, but so far this has been masked by the stock shortage forcing buyers to compete for homes.

What does this mean for First-Time Buyers?

The rising cost of living, which is already being felt across the board in the shops, at the petrol pump and paying for goods and services, will impact those trying to save for a deposit particularly hard. Incomes are rising too but not enough to keep up and less disposable income means less money to put away at the end of each month, while rents are at record highs. Those who have managed to save a deposit or benefit from the help of the Bank of Mum and Dad will be keeping an eye out for signs of the market running out of steam, but with mortgage costs also rising now could be a good time to lock in a low fixed-rate deal ensuring mortgage repayments are cheaper for longer.

What about second-steppers?

Finding a property to buy remains the big challenge for second-steppers. Those with a good level of equity will be in a better position to absorb rising prices and borrowing costs, as well as the higher costs of running a larger home.

Many families are starting to feel the pinch and with a significant amount of uncertainty about the war in Ukraine, how long the conflict could last and the longer-term impact on the UK, we could see demand from second-steppers begin to fall in the next few months, but we’re seeing little indication of this yet.

Rob Houghton, CEO of reallymoving, comments:

“Last month we saw some early signs that the market may be beginning to slow but the latest data shows prices rising sharply in May based on activity in February, suggesting that for now the housing market will continue to defy expectations.

“We’re seeing a clash of post-pandemic driven buyer demand and a cost-of-living crisis which is only now really beginning to bite, and as yet it remains a seller’s market and the supply/demand imbalance is continuing to push up prices.

“It’s too early to assess the impact on consumer sentiment from the war in Ukraine and if uncertainty grows and prices rises become more painful, I expect we’ll see the tables begin to turn.

“First Time Buyers are stuck between a rock and a hard place, watching prices go up along with mortgage rates, while facing the challenge of trying to save while paying record high rents – and a shortage of homes to buy.

“Many will be tempted to hold out for price falls but our advice would always be to move when you have all your ducks in a row in terms of raising a deposit, securing a mortgage and finding the right home to buy at a price you can afford. Buying with a long-term view – at least 3 to 5 years – will help you to ride out any short-term fluctuations, rather than trying to call the market.”

Kindly shared by Reallymoving

Main photo courtesy of Pixabay