House prices rise for fifth straight month, with growth now at 15-year high – Halifax House Price Index

House prices rise for fifth straight month, with growth now at 15-year high, according to the latest Halifax House Price Index.

Headlines:

- Average UK property price hits a new record high of £272,992

- Quarterly house price inflation now at its strongest level since late 2006

- Welsh average property price breaks past £200,000 for the first time eve

|

Average house price £272,992 |

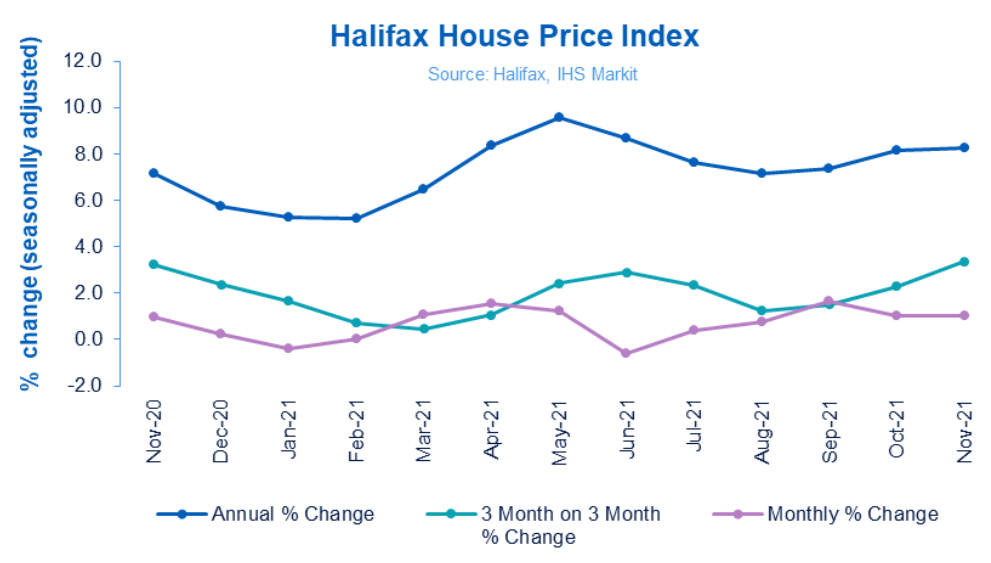

Monthly change +1% |

Quarterly change +3.4% |

Annual change +8.2% |

Russell Galley, Managing Director, Halifax, said:

“UK house prices rose again in November, with the value of the average property increasing by another 1%, or £2,808, tipping the annual rate of inflation up to 8.2%. This is the fifth straight month that average house prices have risen, with typical values up by almost £13,000 since June, and more than £20,000 since this time last year.

“On a rolling quarterly basis the uptick in house prices was 3.4%, the strongest gain since the end of 2006, bringing the new average property price up to a record high of £272,992. Since the onset of the pandemic in March 2020, and the UK first entering lockdown, house prices have risen by £33,816, which equates to £1,691 per month.

“The performance of the market continues to be underpinned by a shortage of available properties, a strong labour market and keen competition amongst mortgage providers keeping rates close to historic lows. Those taking their first step onto the property ladder are also playing an important role in driving activity, with annual house price inflation for first-time buyers at 9.1% compared to 8.8% for home-movers.

“We see this across different property types too, with double-digit annual price inflation for flats (+10.8%) over the last year compared to slower gains for detached properties (6.6%). This could suggest the ‘race for space’ is becoming less prominent than it was earlier in the pandemic, with industry data also showing the overall number of completed transactions has fallen back since the end of the Stamp Duty holiday.

“Looking ahead, there is now greater uncertainty than has been the case for quite some time, with interest rates expected to rise to guard against further increases in inflation. Economic confidence may be also be dented by the emergence of the new Omicron virus variant, though it remains far too early to speculate on any long-term impact, given insufficient data at this stage, not to mention the resilience the housing market has already shown in challenging circumstances.

“Leaving aside the direct impact of a possible resurgence in the pandemic for now, we would not expect the current level of house price growth to be sustained next year given that house price to income ratios are already historically high, and household budgets are only likely to come under greater pressure in the coming months.”

Regions and nations house prices:

- Wales remains by far the strongest performing nation or region in the UK with annual house price inflation of 14.8%. Buying a property in Wales has never been so expensive, with the average house price breaking through the £200,000 barrier for the first time in history (average price of £204,148). Northern Ireland also continues to record double-digit annual growth (10.0%, average house price of £169,348).

- House prices also continue to rise in Scotland, with the average property now up 8.5% year-on-year, with the average price of £191,140 also the most expensive on record. In England, the North West remains by far the strongest performing region (+11.4%), which is its highest rate of growth since 2005 (average house price of £209,287).

- London continues to lag the rest of UK in its rate of house price growth, with annual inflation of just 1.1%, though this was up slightly from October. However at an average of £521,129 properties in London continue to be much more expensive than in all other parts of the country.

Housing activity:

- HMRC monthly property transactions data shows UK home sales decreased in October 2021. UK seasonally adjusted residential transactions in October2021 were 76,930 – down by 52.0% from September’s figure of 160,220 (down 48.4% on a non-seasonally adjusted basis). The latest quarterly transactions (August 2021-October 2021) were approximately 14.2% lower than the preceding three months (May 2021- July 2021). Year on year, transactions were 28.3% lower than October 2020 (30.1% lower on a non-seasonally adjusted basis). (Source: HMRC, seasonally-adjusted figures)

- The latest Bank of England figures show the number of mortgages approved to finance house purchases fell for a fifth consecutive month in October 2021, by 6% to 67,199. Year on year, the October figure was 32% below October 2020. (Source: Bank of England, seasonally-adjusted figures)

- The latest results from the RICS Residential Market Survey report a softening in sales but buyer enquiries returning to positive growth in October. Agreed sales showed a fourth consecutive negative reading of -9%, though up from -13% in September. New buyer enquiries in October improved with a net balance of +10% (up from +1%), with new instructions remaining in negative territory for a seventh month in succession, at -20% (-33% previously). (Source: Royal Institution of Chartered Surveyors’ (RICS) monthly report)

Kindly shared by Halifax

Main article photo courtesy of Pixabay