House prices on downward path in first quarter, according to reallymoving’s House Price Forecast

The housing market in England and Wales is on a downward trajectory in the first quarter of 2021 with price falls accelerating month on month, according to the latest reallymoving House Price Forecast.

Headlines:

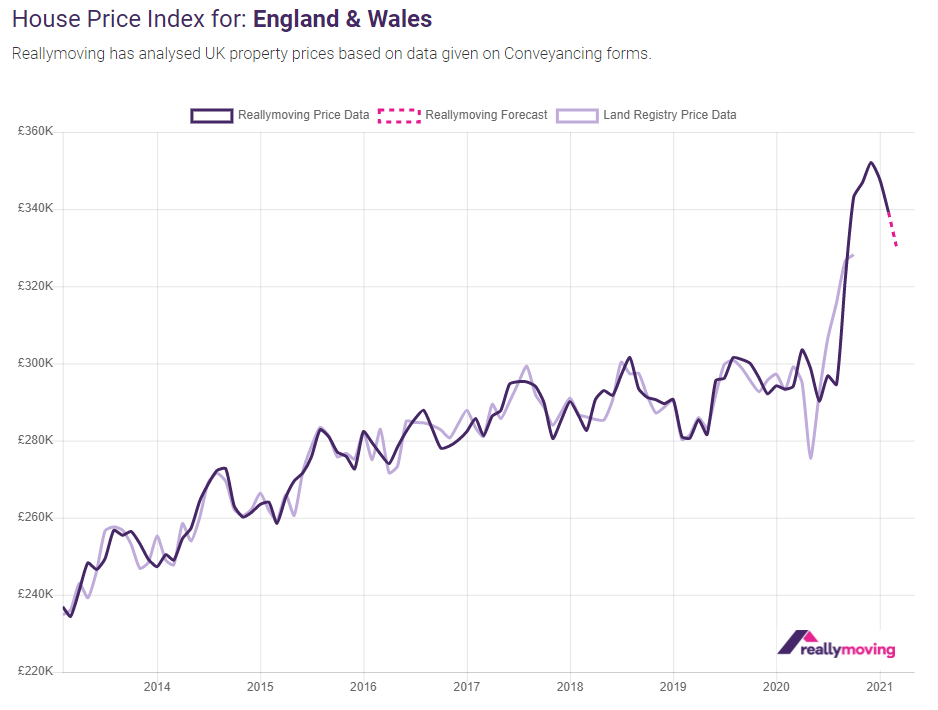

- House prices will fall by 6.2% in the first quarter of 2021, following December peak

- Decline will accelerate month on month (-1.2% in January, -2.5% in February, -2.6% in March)

- Average house price to fall from £352,106 in December 2020 to £330,295 by March

Exceptional levels of buyer activity through the summer and early autumn created a boom which saw the housing market diverge from wider economic trends, but this was unsustainable and it is now entering a period of readjustment.

Reallymoving captures the purchase price buyers have agreed to pay when they search for conveyancing quotes through the comparison site, typically 12 weeks before they complete. This enables reallymoving to provide an accurate three- month house price forecast that historically has closely tracked the Land Registry’s Price Paid data, published retrospectively (see graph).

Pandemic-induced anxiety, regional restrictions on movement and continued uncertainty over Brexit meant that demand for property tailed off in the last three months of 2020, although it remained significantly higher than during the same period in 2019. This will be reflected in price falls in the first quarter of this year, bringing to an end an extraordinary period of growth.

While temporary measures to mitigate the impact of the pandemic remain in place, such as the furlough scheme, a ban on repossessions and a stamp duty holiday, a second extended national lockdown is eroding consumer confidence and job security, despite the vaccine roll-out bringing hope for a return to normal life later this year. Average prices in England and Wales will decrease by 1.2% in January, 2.5% in February and a further 2.6% in March – totalling a 6.2% over the first three months of the year.

Price falls are likely to attract First Time Buyers to the market later in the spring who may have held off as prices rose over the last few months, particularly if lenders continue to warm towards higher loan to value loans and ease restrictions around gifted deposits.

Once the stamp duty holiday has ended pressure on conveyancers, surveyors and removals firms will ease, alleviating congestion in the system and bringing more reliability to the home move process.

Rob Houghton, CEO of reallymoving, comments:

“Considering the wider economic context of the post-lockdown property market boom, it was never a matter of if it would end, but when. In the second half of 2020 buyers faced stiff competition for homes, forcing them to pay more and in many cases wiping out the stamp duty saving, but already this year we’re seeing demand falling to more normal levels and prices heading back down again. The extent of the decline depends on the length of the current lockdown and the Chancellor’s generosity in mitigating its impact, the speed of the vaccine roll out and the subsequent economic recovery. The market is yet to be truly tested by the end of the furlough scheme and mortgage payment holidays, both of which are currently masking job losses and distressed property sales.

“As we head towards the end of the stamp duty holiday on 31st March sellers should prepare for an increase in gazundering, where buyers reduce their offer just prior to exchange. A large number of deals will be hinged on an assumed stamp duty saving and if they fail to complete in time, buyers will suddenly need to find a significant amount of cash – or renegotiate the price.

“It’s not all bad news though, with a Brexit deal finally agreed that brings to an end four years of uncertainty, and positive action from lenders to reintroduce high loan to value mortgages and overturn bans on gifted deposits. Combined with declining prices and the end of the stamp duty holiday, we could see favourable conditions for First Time Buyers to make a return to the market later this year.”

Kindly shared by reallymoving.com

Main article photograph courtesy of Pixabay