House-price-to-income ratio has eased, but higher rates offset affordability benefits

Although the house-price-to-income ratio has eased in recent weeks, the higher rates offset affordability benefits.

Headlines:

-

- Cost of a typical UK home now 6.7 times average earnings, down from a peak of 7.3 last summer.

- The impact of rising interest rates has constrained improvement in overall housing affordability.

- Westminster and City of London the least affordable local area in the UK to buy a home.

- Inverclyde in Scotland the most affordable place in the country.

- Surrey Heath has seen biggest improvement in affordability over the last year.

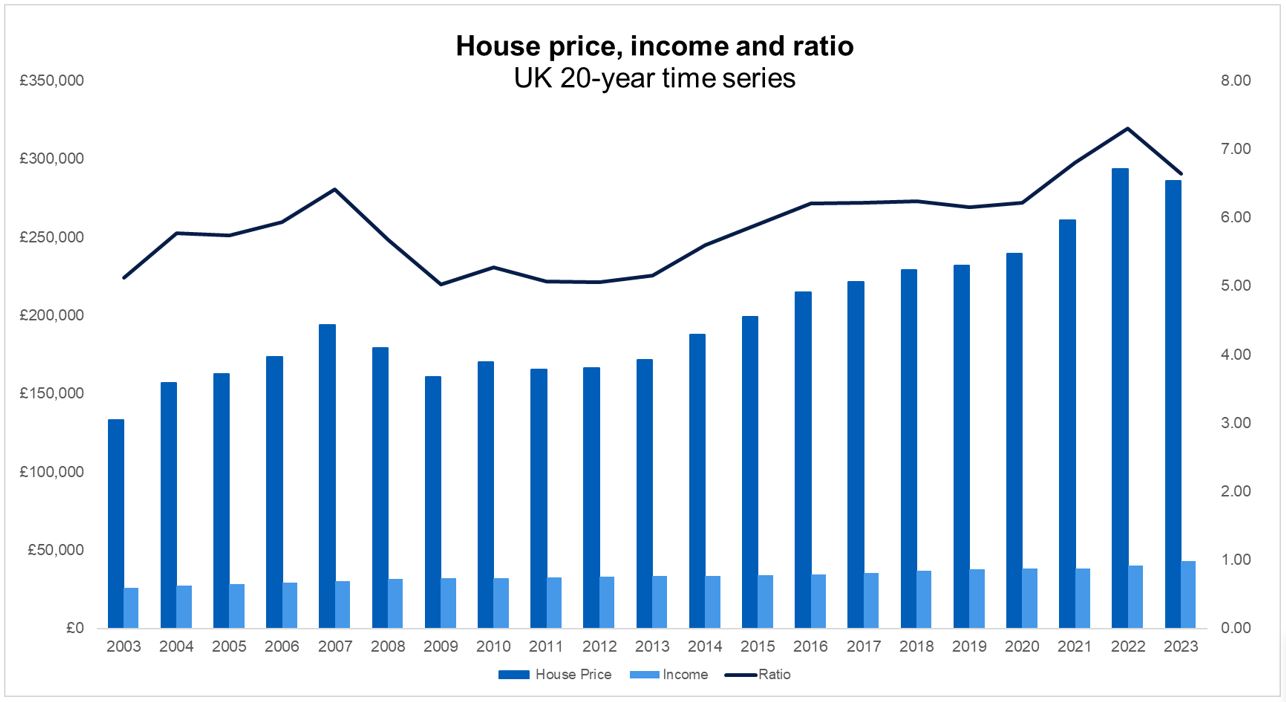

Downward pressure on property prices following last summer’s peak, combined with strong wage growth, has seen the UK’s house price to income ratio fall back from a record high, according to new research by Halifax, the country’s biggest mortgage lender.

The analysis – based on data from the Halifax House Price Index – compared typical house prices to average earnings across the UK.

At its peak in June 2022, the cost of a typical UK home was £293,586, while the average annual earnings of a full-time worker were £40,196. This put the house price to income ratio at 7.3, the highest (or least affordable) level ever recorded.

A year on, the average house price had fallen to £286,276. Coupled with strong wage growth (around +7% over the last year), as annual earnings reached £43,090, the house price to income ratio fell to 6.7.

This is still somewhat higher than the ratio of 6.2 recorded in early 2020, demonstrating the continued legacy of surging property price inflation over recent years, brought about by increased buyer demand during the pandemic, incentives such as the Stamp Duty holiday, and record low interest rates.

Impact of rising interest rates

While the narrowing gap between house prices and incomes will be welcomed by prospective home buyers – and the housing market has been showing signs of resilience, with an uptick in activity recently – improvement in the overall affordability of housing costs for owners has been offset by the impact of rising mortgage rates.

Typical monthly mortgage costs have increased by +22% over the last year, from £1,020 to £1,249. That’s based on the typical monthly cost of a 5-year fixed rate mortgage, with 25-year term and a 25% deposit (average interest rates of 2.9% and 5.0% respectively). That equates to mortgage costs as a percentage of income rising from 30% to 35% over the last year.

Compared with the start of 2020, on the same basis, the monthly cost of a typical mortgage has now increased by +65% (from £731 based on an average interest rate of 1.7%) when it made up 23% of average earnings.

While those figures are stark, they are not without modern precedent. Looking back to the previous peak in house prices in 2007 – prior to the recent era of record low interest rates – the house price to income ratio was 6.4.

However the typical cost of a mortgage as a percentage of average earnings was actually higher than today’s 35%, at 37%. This was based on a 2007 average house price of £192,943, earnings of £30,262, a mortgage rate of 6.1%, and a monthly mortgage cost of £941.

Kim Kinnaird, Mortgages Director, Halifax, commented:

“The sharp rise seen in interest rates over the last year has meant the sums now look very different for both homebuyers and those looking to remortgage.

“Typical monthly mortgage payments are up by around a fifth, which is a big jump at any time, but particularly during a wider cost of living squeeze.

“We should remember the preceding 15 years have been characterised by historically low interest rates.

“Mortgage costs as a proportion of income are now comparable to those seen in 2007, despite the significant rise in house prices seen over the last decade and a half.

“Of course much has changed in the housing market and wider economy since then.

“Banks carry out much tougher affordability checks to make sure borrowers can manage repayments when rates go up, and the average loan-to-value is considerably lower.”

Nations and regions comparison

The impact of higher interest rates isn’t felt equally across the country, depending on the average house price and earnings in each area.

However the average house price to income ratio has fallen in every nation and region over the last year, with the exception of Wales, where it rose from 6.7 to 6.8.

Despite recording one of the slowest rates of house price growth of any UK region or nation over the last year (-2.6%), London remains by far the most expensive place in the country to buy a home, with an average property price of £533,057. Based on regional earnings, this puts the house price to income ratio at 9.3 (compared to 10.0 a year ago), the highest of any region. Typical mortgage costs in the capital now account for 49% of earnings (up from 42% last year), again the biggest proportion of anywhere in the UK.

By contrast, the North East of England remains the most affordable UK region in which to buy a home, with an average house price of £168,240 and a house price to income ratio of 4.9. This means that, along with Scotland, it is the only part of the UK with a ratio lower than 5.0, having fallen from 5.2 over the last year. Mortgage costs represent 26% of average incomes, also the lowest anywhere in the country (up from 22% last year).

Least and most affordable local areas

Greater London and the South East of England account for the majority of the least affordable local areas to buy a home. Westminster and City of London tops the table, where average prices are 16.0 times average earnings, followed by Kensington and Chelsea (15.7) and Moles Valley (13.2).

At the other end of the scale, northern locations dominate the list of most affordable local areas. Inverclyde on the west coast of Scotland is the most affordable place in the UK to buy a home, with typical house prices just 2.9 times average earnings, the only local authority area with a ratio below 3.0. It’s followed by Dumfries and Galloway (3.2) and East Ayrshire (3.3), with the most affordable area outside of Scotland being Hull (also 3.3).

Surrey Heath in the South East has seen the sharpest improvement in the house price to earnings ratio of any location over the last year, falling from 11.8 to 9.6 (-2.2). Marginally behind on the list is Cambridge in Eastern England, also falling from 11.8 to 9.6 (-2.2).

Bucking the trend, Pembrokeshire in Wales saw the biggest deterioration in house price affordability of any local area over the last year, with the house price to income ratio rising from 5.8 to 6.9 (+1.1).

First-time buyer affordability

At a national level, the typical first-time buyer property price is 5.4 times average earnings, down from 5.8 last year.

However overall mortgage costs have increased by 25% for first-time buyers over the last year, from an average payment of £1,095 per month up to £1,364, as a result of higher interest rates. As a proportion of income, monthly mortgage costs have risen from 30% to 36%. This is based on typical first-time buyer property prices and the average interest rate for a 5-year fixed deal, with a 25-year term and 5% deposit (average interest rates of 3.5% and 5.7% respectively).

The real-life financial situation for many first-time buyers will be quite different though, with recent Halifax research showing that almost two-thirds (63%) are joint applicants and able to call on more than one salary.

According to UK Finance, the average household income of a first-time buyer mortgage application last year stood at just under £60,000, which would put the equivalent house price to joint-income ratio at around 3.8.

Recent industry figures also show that more than half of first-time buyers are now opting for 30-year mortgage terms. This would reduce the average monthly mortgage payment from £1,364 to £1,265.

Kim Kinnaird, Mortgages Director, Halifax, continued:

“We don’t yet know what the ‘new normal’ looks like for mortgage rates and house prices over the longer term.

“But we expect the market to rebalance as both buyers and sellers adjust their expectations to reflect higher costs and lower demand.

“It’s likely the gap between average earnings and property prices will narrow over time, which will be welcome news to first-time buyers in particular, especially in areas which could offer better value for money.”

Kindly shared by Halifax