HomeTrack publish their UK House Price Index for January 2023

HomeTrack publish their UK House Price Index for January 2023, which asks the question of how the market is performing at the start of 2023.

Key points from publication:

-

- House price growth ground to a standstill in Q4 2022, dragging the annual rate of house price inflation lower to +6.5%

- Most regions registered small price falls in Q4 2022

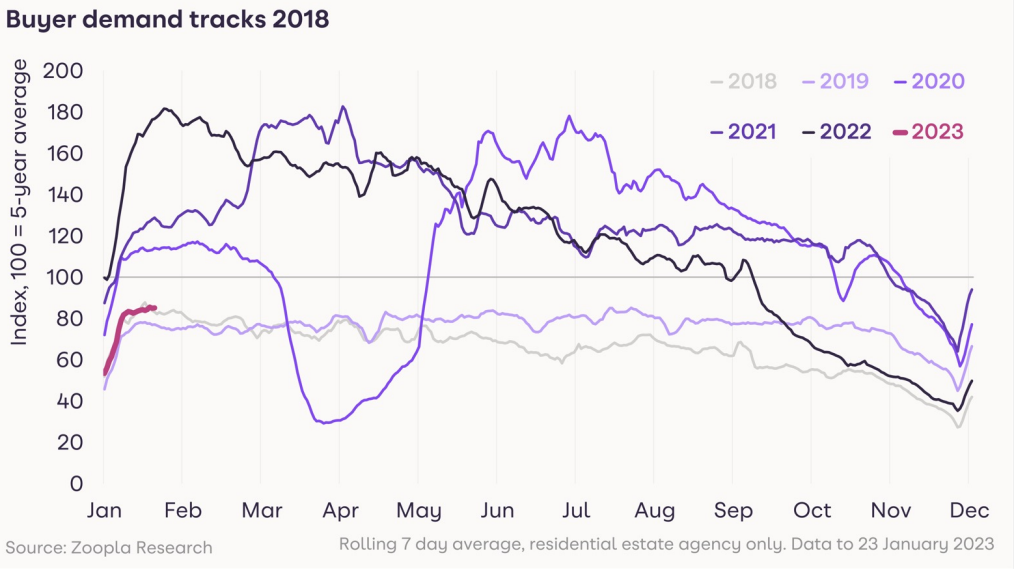

- Demand has rebounded to pre-pandemic levels, in line with 2018 and 10% higher than in 2019

- It’s going to be a slow start to Q1. Early buyers are focusing on flats with a shift away from houses in response to higher borrowing costs and the hit to buying power

- We expect demand to improve further in the coming months as mortgage rates continue to fall and would-be movers realise that large price falls are unlikely to materialise

|

+6.5% |

10% |

27% |

|

Current UK house price growth (year on year) |

Homebuyer demand above 2019 levels |

Buyers looking for 1- and 2-bedroom flats in January 2023 |

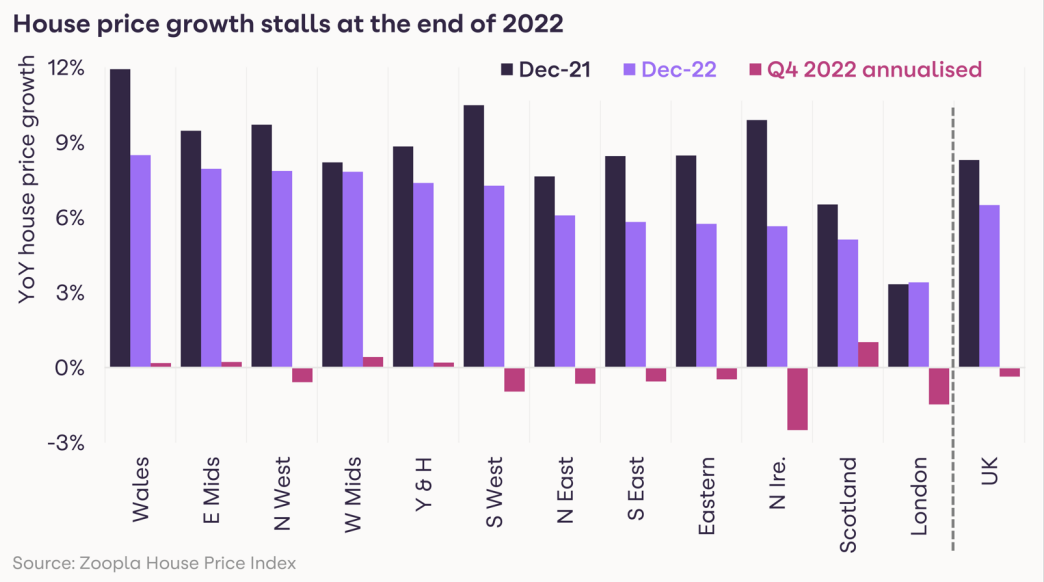

Momentum in price inflation falls away quickly

House price growth stalled in Q4 2022 in response to the 50% drop in buyer demand in the final months of 2022. This will feed into a rapid slowdown in the annual rate of price growth in coming months. At the end of 2022, UK house price inflation had slowed to 6.5% from 8.3% at the end of 2021 – a trend matched across all regions except London.

Most areas recorded small price falls in Q4 2022 as buyers negotiated harder on price. Moreover, the discounts to asking prices to achieve a sale widened quickly at the end of 2022. But this gap between asking and achieved prices is now holding at 3% to 4% and there is no sign of this worsening at this stage.

This is important because if this gap widens, sellers will feel under increasing pressure to reduce asking prices putting further downward pressure on headline prices. Additional modest price reductions are likely over Q1 2023 as sellers continue to adjust asking prices in line with what buyers are prepared to pay.

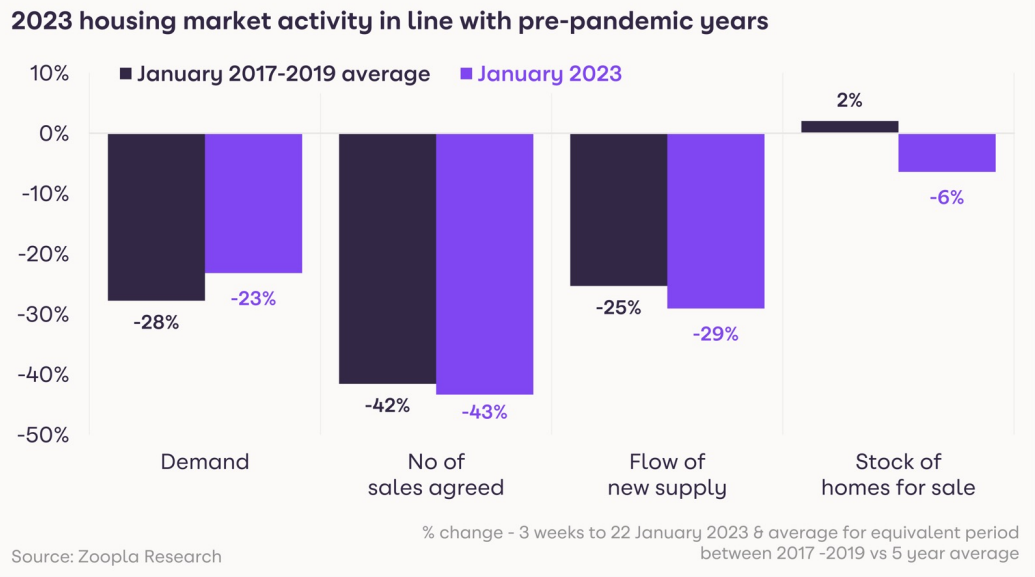

Demand rebounds in line with pre-pandemic years

Demand for homes has rebounded in the first few weeks of 2023 but remains well below the levels of January 2020-2022. Current buyer interest is in line with the pre-pandemic years and 10% ahead of 2019.

This is not surprising. The last 3 years have been exceptional with the pandemic reshaping how households think about housing, driving more moves. Higher mortgage rates and living costs as well as weak consumer confidence have brought activity levels back to normal.

On a regional basis, demand and sales agreed are holding up in the North East, Scotland and Wales where home values are below the national average. Market conditions remain weaker in the South East, South West and the East Midlands, where prices are higher or have grown rapidly over the last 2 years, exacerbating affordability pressures.

Start of 2023 a slow burn

The start to 2023 will be more of a slow burn than in recent years. A portion of households hoping to move in the coming year will be waiting to see whether house prices start to fall more quickly in Q1, as well as how much further mortgage rates are likely to fall back. Mortgage rates for new business are now generally below 5% and look set to remain in the 4 to 5% range in 2023. This is a much better prospect than the 6% to 6.5% levels at the end of last year, but buyers will remain cautious in the next few weeks.

As the outlook becomes clearer after Easter, we believe that demand is likely to pick up further. How much depends on the economic outlook and the strength of the labour market as well as the trajectory of consumer price inflation and what this means for interest rates.

More supply boosts choice and reduces pressure on prices

The other notable change in recent months has been a continued growth in the number of homes for sale. A scarcity of supply has been a key feature of the market in 2022, adding to the upward pressure on home values. This is now reversing, although the number of homes for sale remains 6% below the 5-year average. There is now an average of 23 homes for sale per estate agent, up from a low of just 14 homes in early 2022.

More supply boosts choice for would-be buyers and will also act to reduce the upward pressure on home prices. A key risk for sales volumes in the year ahead is unrealistic seller expectations. Anyone serious about selling in 2023 needs to make sure their home is competitively priced and in line with what buyers are prepared to spend in the local market. The majority of homeowners have made sizeable gains in their home value over the pandemic, meaning there is more room for realism on pricing.

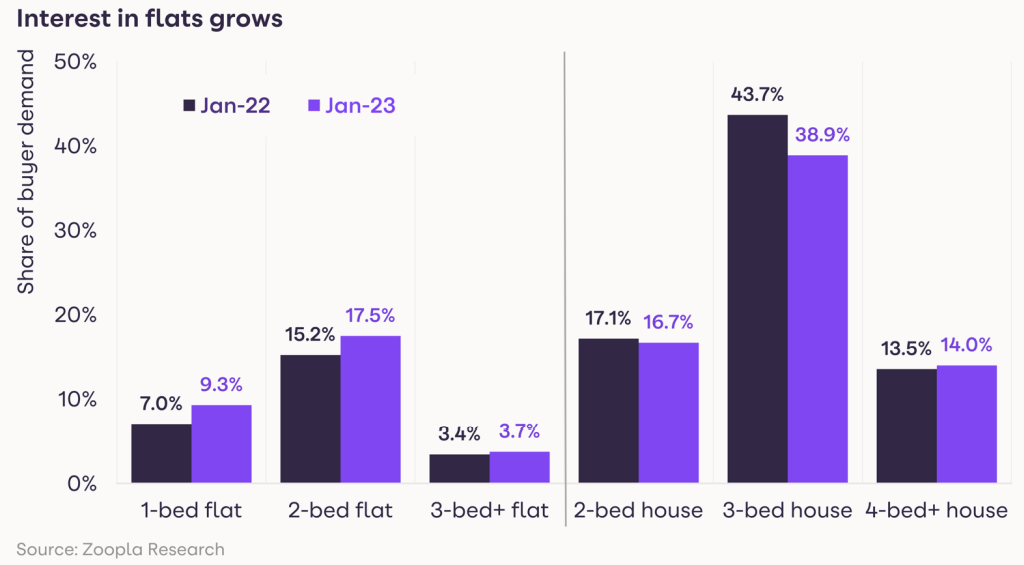

Early 2023 buyers shifting preferences towards flats

One clear trend from the first few weeks of 2023 is that buyers are becoming more value-conscious in response to the hit to buying power from higher mortgage rates. We have seen a clear shift in demand towards flats with a decline in buyers looking for 3-bed houses.

Our data reveals that 27% of new buyers are looking for 1- and 2-bed flats, up from 22% a year ago. In contrast, demand for 3-bed houses has fallen 5 percentage points to 39%, although they are still the most in demand homes across the UK. This is a trend we are seeing across all areas of the UK in the first few weeks of the year. In London, 1- and 2-bed flats account for 49% of demand, up from 42% a year ago.

This is all part of the shift back towards cities and better value-for[1]money homes in accessible and more affordable suburbs we reported last month. It also reflects the fact that a proportion of existing homeowners may be holding back until the outlook becomes clearer. We expect to see continued demand from first-time buyers looking to secure their first home and escape the rapid growth in rents.

The differential in pricing between flats and houses is stark in many areas, supporting this shift in demand as the early year buyers look for better value for money. Outside London, the average 2-bed flat is listed for sale on Zoopla at £196,000, which is almost £100,000 cheaper than an average 3-bed home (£293,000). 1-bed flats are £150,000 cheaper.

Demand for flats grows in markets adjacent to big cities

Some of the biggest increases in demand for flats have been seen in towns adjacent to London such as Slough, Watford, Chelmsford, Guildford and Dartford where the relative price differential is attractive for those who work locally or in London and are able to work more flexibly. The same is true in other regional cities but to a lesser degree such as Huddersfield, Stockport and Wakefield.

Outlook

It’s early days to get a clear read on the market outlook for 2023. The economic outlook has improved slightly in recent weeks but the squeeze on household disposable incomes is very real with a direct impact on sales activity.

That said, the pressure on incomes combined with the costs of running homes is likely to drive a certain amount of movement in the market in 2023. Sizeable amounts of embedded equity in many millions of homes may also encourage more movement and downtrading to release equity and cut the energy bills, supporting home moves in 2023.

Our latest Value of Housing report found that the total value of homes in the UK is over £10.5 trillion. With circa £1.6 trillion of mortgage value, there is almost £8 trillion in housing equity in the UK.

In the short term, we expect further, low single-digit price falls in H1 2023 but the housing market is in better shape to deal with the headwinds than in previous economic cycles.

Kindly shared by HomeTrack

Main photo courtesy of Pixabay