Number of home sales in 2023 predicted to be at lowest levels since 2012, driven by almost a third fewer mortgaged sales

London, 30th August 2023: Zoopla House Price Index: Number of home sales in 2023 predicted to be at lowest levels since 2012, driven by almost a third fewer mortgaged sales.

Key points from publication:

-

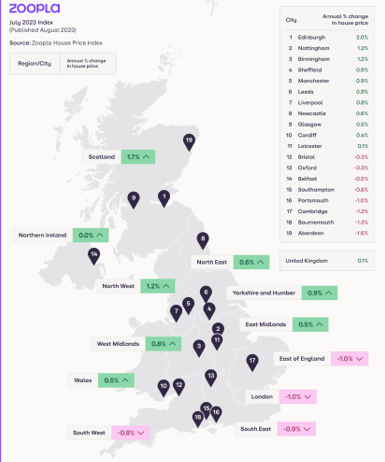

- Annual UK house price growth slows to +0.1% – the lowest since 2012

- Geography remains a key factor with house price growth ranging from +1.7% in Scotland to -1% in London

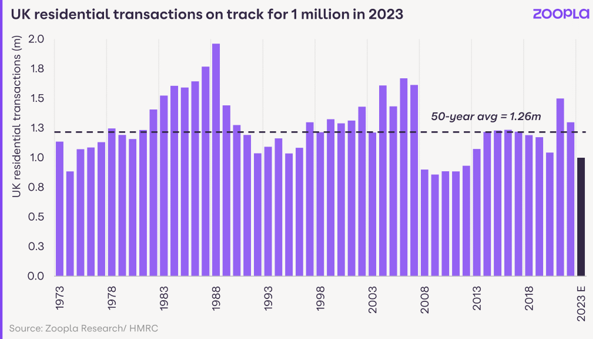

- Housing transactions on track for one million sales completions in 2023 – but total sales 21% lower than 2022 and lowest since 2012

- Cash-buyer sales expected to hold in line with 2022 level while mortgage backed sales likely to be 28% lower as higher rates impact mortgage reliant demand

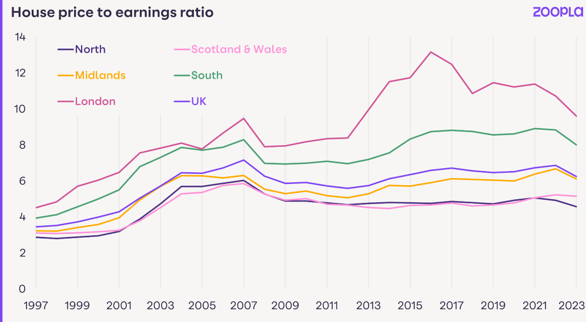

- Faster earnings growth improving housing affordability as measured by price to earnings ratio

- Lower mortgage rates key to improved demand and more sales in 2024

The number of housing sales completing over 2023 is on track to be a fifth (21%) down on 2022 and the lowest number of sales since 2012 – a total of one million sales completions in 2023. This is equivalent to the average household moving just once every 23 years – an increase of six years since 2021, Zoopla’s latest House Price Index reveals.

Cash buyers hold steady as mortgaged sales drop

Based on H1 trends, cash sales are predicted to fall just 1% over 2023 compared to 2022 levels. However, the number of mortgaged sales is projected to be almost a third (28%) lower, with the biggest driver of this drop in sales a direct result of higher mortgage rates.

However, existing homeowners using a mortgage typically account for a third of annual sales with this group more likely to wait until the outlook for mortgage rates improves. As a result, new sales of three- and four-bed homes are down by up to 40% in July compared to the same period over the last five years, while sales of smaller – and therefore more affordable – homes have fallen to a smaller degree.

New buy-to-let purchases are also being squeezed by higher mortgage rates, with BTL mortgaged purchases accounting for 8% of sales a year. The typical buy-to-let purchaser in southern England needs to inject 40-50% of the property value as equity to get the numbers to stack up which is not a strong proposition for a gross rental yield of less than 5%, below the base rate.

Affordability improves as earnings rise quickly

Housing affordability remains the primary barrier to more sales – both the level of house prices and the cost of mortgage repayments. The challenge is greatest in southern England where the household income to buy an average priced home remains high at over £75,000 in many market areas. Higher mortgage rates over the last year have increased average mortgage repayments by 23% or £216 per month.

Mortgage rates have been falling in recent weeks albeit slowly and they remain over 5%. Mortgage rates need to fall below 5% to improve affordability and stimulate more home moves.

Affordability is improving relative to earnings as wages rise quickly, up 7% over the last year. Housing affordability, on a house price to earnings basis, looks set to improve by 9-10% over 2023 as prices register modest falls and average earnings increase. The UK house price to earnings ratio will be in line with the 20-year average at the end of 2023 at 6.3x. Surprisingly, affordability has improved the most in London where the price to earnings ratio will move to single digits for the first time in 11 years as house price growth continues to lag earnings growth.

Commenting on the latest report Richard Donnell, Executive Director at Zoopla, says:

“House price growth has slowed rapidly over the last year as demand weakens in the face of higher mortgage rates.

“Prices are falling more in southern England where higher mortgage rates have priced more people out of the housing market, weakening demand.

“While UK house prices are 0.1% higher over the year, it is the number of sales that have been hit hardest by higher borrowing costs, especially amongst mortgage-reliant buyers.

“Cash buyers are more immune and on track to account for more than one in three sales in 2023.

“Mortgage rates have started to fall slowly but rates need to fall below 5% before we see an increased appetite to move home in the second half of 2023.”

Carl Jenkinson, Director at Venture Properties, says:

“We are still seeing strong activity in the market despite some turbulent months due to mortgage rate increases, which has in turn made some clients more cautious.

“However, our prices have now stabilised with a little more competition on the market, and our location is still seeing great signs of growth with buyers thanks to continued investment from employers and companies relocating to the North.

“We have already seen many lenders reducing rates over the last few weeks and expect this to be the same over the coming weeks, which is making some clients become ‘rate chasers’ waiting for the best deals.

“Our buy-to-let investors have fallen slightly due to the mortgage rates and the criteria involved, although our rental stock remains in high demand.”

Kindly shared by Zoopla