Higher mortgage rates push buyer demand down 18% as the South of England bears brunt of house price falls

Zoopla House Price Index: Higher mortgage rates push buyer demand down 18% as the South of England bears brunt of house price falls.

Key points from publication:

-

- Higher mortgage rates have reduced buyer demand by 18% in the last two months alone as the recent spike in mortgage rates appears close to peaking

- Annual UK house price growth slows to +0.6% as Southern England bears brunt of larger house price falls

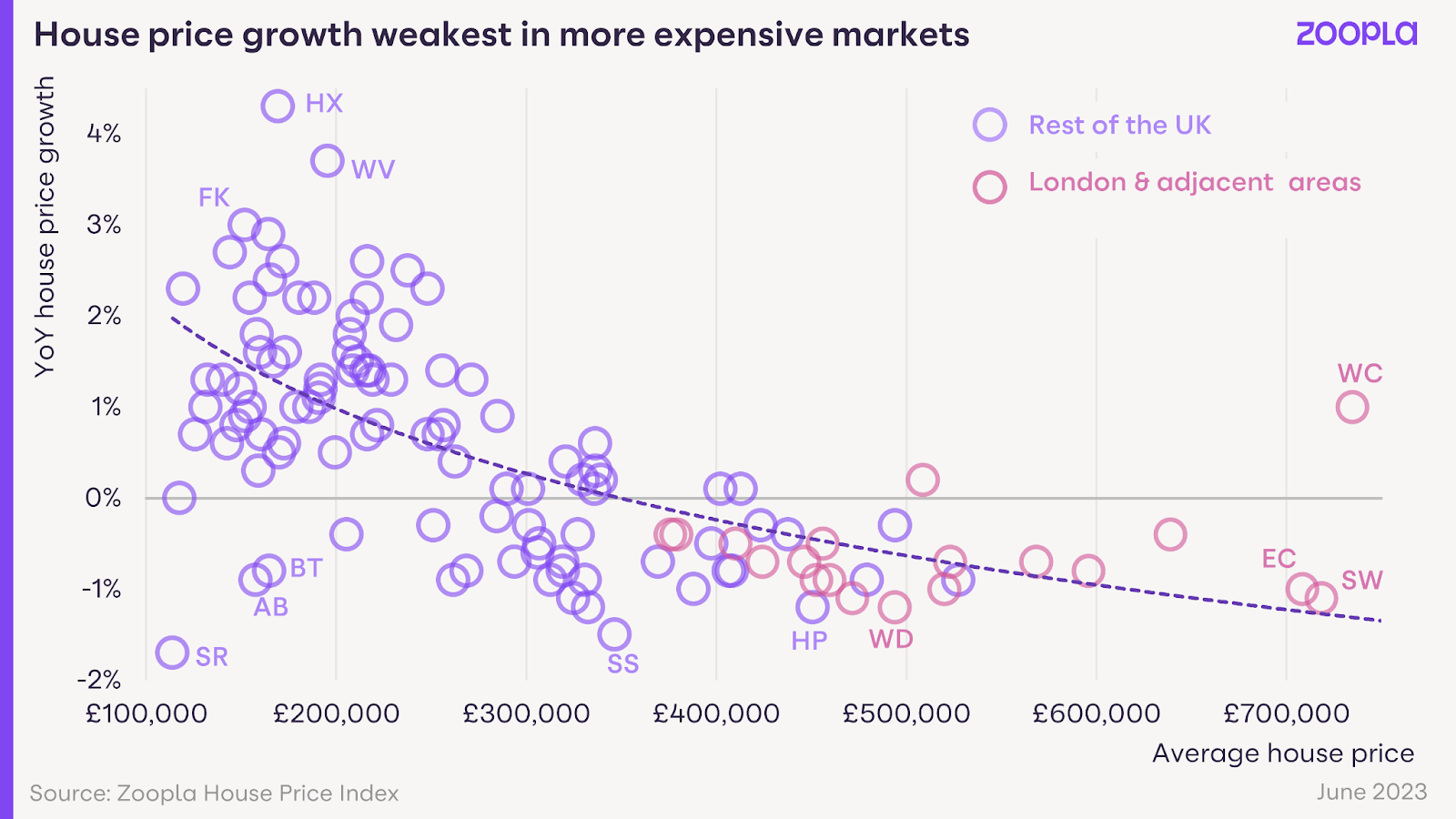

- Housing markets with average prices over £300,000 are experiencing year on year price falls – new sales of three and four bedroom family homes are down 41% as buyers ‘wait and see’

- More affordable areas around the country are less exposed to the impacts of higher borrowing costs – areas such as Halifax and Wolverhampton are still registering annual house price growth of over 3.5%

- Further modest price falls in H2 will be concentrated across Southern England where the impact of higher mortgage rates on buyer demand will be greatest

- UK house prices expected to be 5% lower than predicted in 2023

London, 28th July 2023: The effect of rising mortgage rates over the last two months has impacted buying power and reduced demand for homes by 18%, Zoopla’s latest House Price Index reveals. This decline in demand is less stark than that recorded after the 2022 mini-budget but year on year is down by over a third (40%). However, committed buyers and sellers remain in the market with sales agreed only 17% lower than this time last year.

UK house price growth slows to +0.6% – unless you’re in Southern England

Weaker demand and rising supply have driven a slowdown in UK house price growth which currently sits at +0.6% (June 2023) compared to +9.6% (June 2022).

But for homeowners in Southern England the effects of higher mortgage rates is having a greater impact on buying power where house prices are highest, and as a result house prices are falling up to -0.6% across all four regions (South East, South West, South East and London).

This is in stark contrast to the rest of the country where house prices in more affordable areas continue to register annual house price growth of over 1% – peaking at 1.9% in Scotland. This regional divide is only set to widen in the second half of 2023 with further price falls expected across higher-value markets.

Affordability and strength of local economies is important

Areas in South East England are experiencing larger price falls, particularly in commuter markets such as Southend (-1.5%), Watford (-1.2%) and North West Hertfordshire (-1.1%), whilst prices are also falling in some lower-value markets such as Sunderland (-1.7%) Aberdeen (-0.9%) and Northern Ireland (-0.8%).

In these areas, local economic factors are impacting demand in addition to mortgage rates and cost-of-living pressures. House prices continue to increase at an above-average rate in affordable markets next to major employment centres., with the highest rate of annual price growth in Halifax (4.3%), Wolverhampton (3.7%) and Falkirk (3.0%).

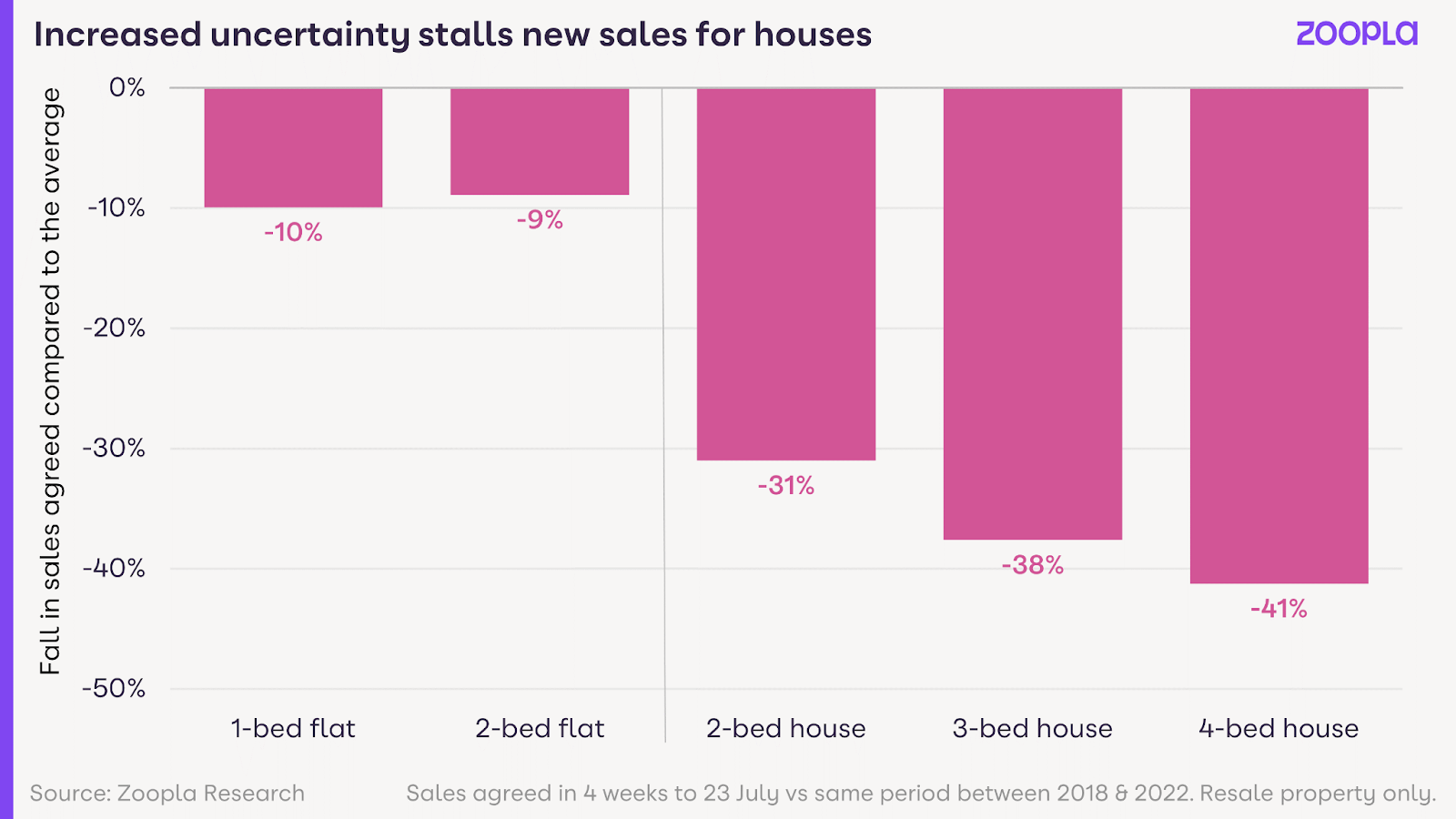

Mortgage rates also impacting size of property

Higher house prices mean larger mortgages, bigger deposits and a higher household income to buy. With more households priced out of the market, reducing demand and pushing prices lower, some would-be buyers are delaying moving – sales volumes are expected to be a quarter (23%) lower in 2023 compared to 2022.

Buyers are also shifting to buy smaller, lower value homes. As a result, new sales of three and four bedroom family homes are down by up to 41% when compared to the same time period (the last four weeks) over the last five years.

Commenting on the latest report Richard Donnell, Executive Director at Zoopla, says:

“Higher mortgage rates have hit home buyer demand once again after a sustained improvement over the Spring as mortgage rates fell to 4%.

“House prices increased slightly over the last 3 months to June, but higher mortgage rates and weaker demand mean we expect a return of modest price falls in H2.

“Overall we expect prices to be 5% lower by the end of the year, still 15% higher than pre-pandemic levels.

“The impact of higher mortgage rates is far from uniform across the country.

“It all depends on housing affordability in local housing markets.

“Activity levels and prices in Southern England have been hit hardest by higher borrowing costs while the most affordable parts of the UK continue to see prices rising slowly. ”

Matt Thompson, Head of Sales at Chestertons, says:

“Although there still is a vast number of buyers wanting to move as soon as possible, rising interest rates have forced others to be more cautious, review their financial situation and calculate a more conservative budget.

“Whilst this resulted in fewer new buyers entering the market last month, we expect activity to pick up again once buyers have adjusted their criteria and lenders are bringing more products to the market again.

“Recently, the property market has been predominantly driven by buyers who are seeking a home rather than an investment.

“Areas such as Battersea Park, Islington and Camden have proven popular as they offer a wide choice of property styles, nearby amenities, transport links and schools.”

Kindly shared by Zoopla

Main article photo courtesy of Pixabay