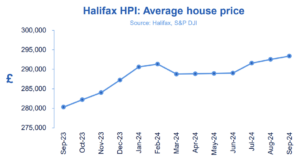

Halifax HPI for September 2024: House prices rise for third straight month

The Halifax HPI for September 2024 has been published, with the data showing that house prices have risen for the third straight month.

Key pointers:

-

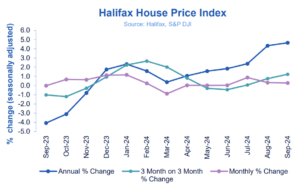

- House prices increased by +0.3% in September, matching rise seen in August

- Year-on-year prices are up +4.7%, still the strongest rate since November 2022

- Higher annual growth continues to reflect the base impact of weaker prices a year ago

- Typical property now costs £293,399 (compared to £292,540 in August), highest since June 2022

- Average amount paid by first-time buyers now around £1,000 less than two years ago

- Northern Ireland continues to record the strongest annual house price growth in the UK

Key indicators:

|

Average house price |

Monthly change |

Quarterly change |

Annual change |

|

£293,399 |

+0.3% |

+1.2% |

+4.7% |

Amanda Bryden, Head of Mortgages, Halifax, said:

“UK house prices climbed for the third month in a row in September, with a slight increase of +0.3%, or £859 in cash terms.

“Annual growth edged up to +4.7%, the highest rate since November 2022.

“This brings the average property price up to £293,399, just shy of the record high of £293,507 set in June 2022.

“It’s essential to view these recent gains in context.

“While the typical property value has risen by around £13,000 over the past year, this increase is largely a recovery of the ground lost over the previous 12 months.

“Looking back two years, prices have increased by just +0.4% (£1,202).

“Market conditions have steadily improved over the summer and into early autumn.

“Mortgage affordability has been easing thanks to strong wage growth and falling interest rates.

“This has boosted confidence among potential buyers, with the number of mortgages agreed up over 40% in the last year and now at their highest level since July 2022.

“While improved mortgage affordability should continue to support buyer activity – boosted by anticipated further cuts to interest rates – housing costs remain a challenge for many.

“As a result, we expect property price growth over the rest of this year and into next to remain modest.”

Spotlight on first-time buyers:

The average amount paid by first-time buyers has increased by +4.2% over the past year, which equates to an extra £9,409 in cash terms. This brings the typical first-time buyer property price up to £232,769, its highest level since May 2024.

However, that’s still about £1,000 less than the average amount paid by a first-time buyer two years ago (£233,760), a decrease of around -0.4%.

Nations and regions house prices:

Northern Ireland continues to record the strongest property price growth of any nation or region in the UK, rising by +9.7% on an annual basis in September. The average price of a property in Northern Ireland is now £203,593.

House prices in Wales also recorded strong growth, up +4.4%, compared to the previous year, with properties now costing an average of £224,119.

Scotland saw a more modest rise in house prices, where a typical property now costs £205,718, +2.1% more than the year before.

The North-West once again recorded the strongest house price growth of any region in England, up by +5.1% over the last year, to sit at £234,355.

London continues to have the most expensive property prices in the UK, now averaging £539,238, up +2.6% compared to last year. This is still some way below the capital’s peak property price of £552,592 set in August 2022.

Housing activity:

-

- HMRC monthly property transaction data shows UK home sales decreased in August 2024 compared to the previous month. UK seasonally adjusted (SA) residential transactions in August 2024 totalled 90,210 – down by – 0.4% from July’s figure of 90,610 (up +7.6% on a non-SA basis). Quarterly SA transactions (June 2024 – August 2024) were approximately +1.6% higher than the preceding three months (March 2023 – May 2024). Year-on-year SA transactions were +5.4% higher than August 2023 (+10.3% higher on a non-SA basis). (Source: HMRC)

- Latest Bank of England figures show the number of mortgages approved to finance house purchases increased in August 2024, by +3.8% to 64,858. Year-on-year the figure was +43.4% above August 2023. (Source: Bank of England, seasonally-adjusted figures)

- The RICS Residential Market Survey results for August 2024 show an improvement in sales market activity. New buyer enquiries has a net reading of +15%, up from +4%, with agreed sales up to +6%, from -1%. New instructions have also improved with a net reading of +7%, up from +3%. (Source: Royal Institution of Chartered Surveyors (RICS) monthly report)

UK house prices Historical data National: All Houses, All Buyers (Seasonally Adjusted):

|

Period |

Index Jan 1992=100 |

Standardised average price £ |

Monthly change % |

Quarterly change % |

Annual change % |

|

September 2023 |

483.4 |

280,332 |

0.0 |

-1.0 |

-4.1 |

|

October |

486.7 |

282,221 |

0.7 |

-1.2 |

-3.1 |

|

November |

489.8 |

284,039 |

0.6 |

-0.3 |

-0.8 |

|

December |

495.3 |

287,244 |

1.1 |

0.9 |

1.8 |

|

January 2024 |

501.1 |

290,608 |

1.2 |

2.2 |

2.3 |

|

February |

502.4 |

291,338 |

0.3 |

2.7 |

1.6 |

|

March |

498.0 |

288,781 |

-0.9 |

2.0 |

0.4 |

|

April |

498.1 |

288,862 |

0.0 |

0.8 |

1.1 |

|

May |

498.2 |

288,931 |

0.0 |

-0.3 |

1.6 |

|

June |

498.4 |

289,042 |

0.0 |

-0.4 |

1.9 |

|

July |

502.8 |

291,585 |

0.9 |

0.1 |

2.4 |

|

August |

504.5 |

292,540 |

0.3 |

0.8 |

4.3 |

|

September |

505.9 |

293,399 |

0.3 |

1.2 |

4.7 |

Next publication:

The next Halifax House Price Index for October 2024 will be published at 07:00 on Thursday, 7th November 2024.

Kindly shared by Halifax