Halifax HPI for October 2024: Average house price edges up to hit record high

Halifax have published their House Price Index (HPI) for October 2024, showing average house price edges up to hit record high.

Key points from publication:

-

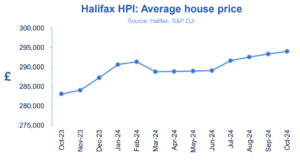

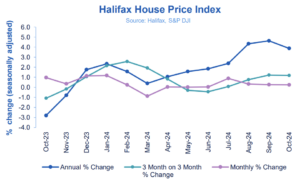

- House prices increased by +0.2% in October, a fourth consecutive monthly increase

- Year-on-year prices are up +3.9%, easing from +4.6% in September

- Typical property now costs £293,999, surpassing previous peak set in June 2022 (£293,507)

- Northern Ireland continues to record the strongest annual house price growth in the UK

Key indicators:

|

Average house price |

Monthly change |

Quarterly change |

Annual change |

|

£293,999 |

+0.2% |

+1.2% |

+3.9% |

Amanda Bryden, Head of Mortgages, Halifax, said:

“Average UK house prices nudged up +0.2% in October, continuing the positive momentum of recent months.

“This brought the annual growth rate to +3.9%, slightly lower than in September.

“The average property price has reached a record high of £293,999, surpassing the previous peak of £293,507 set in June 2022, towards the end of the pandemic-era ‘race for space’.

“That house prices have reached these heights again in the current economic climate may come as a surprise to many, but perhaps more noteworthy is that they didn’t fall very far in the first place.

“Despite the headwind of higher interest rates, house prices have mostly levelled off over the past two and a half years, recording a +0.2% increase overall.

“That’s a significant slowdown compared to the +21% rise we saw in the equivalent period from January 2020 to the summer of 2022.

“Despite the affordability challenge, market activity has been improving. The number of new mortgages agreed recently reached its highest level in two years.

“This aligns with average mortgage rates dropping steadily since spring – now over 160 basis points lower than in summer 2023 – coupled with continued positive income growth.

“Looking ahead, borrowing constraints remain a challenge for many buyers.

“Following the budget, markets expect the Bank of England to cut rates more slowly than previously anticipated, which could keep mortgage costs higher for longer.

“New policies like higher stamp duty for second home buyers and a return to previous thresholds for first-time buyers might also affect demand.

“While we expect house prices to keep growing, it will likely be at a modest pace for the rest of this year and into next.”

Nations and regions house prices:

Northern Ireland continues to record the strongest property price growth of any nation or region in the UK, rising by +10.2% on an annual basis in October. The average price of a property in Northern Ireland is now £204,242.

House prices in Wales also recorded strong growth, up +5.6%, compared to the previous year, with properties now costing an average of £225,543.

Once again Scotland saw a more modest rise in house prices, where a typical property now costs £206,480, +1.9% more than the year before.

The North0West remains the region of England with the strongest growth, up by +5.9% over the last year, to sit at £235,587.

London continues to have the most expensive property prices in the UK, now averaging £543,308, up +3.5% compared to last year.

Housing activity:

-

- HMRC monthly property transaction data shows UK home sales increased in September 2024 compared to the previous month. UK seasonally adjusted (SA) residential transactions in September 2024 totalled 91,820 – up by 0.9% from August’s figure of 91,020 (down -9.5% on a non-SA basis). Quarterly SA transactions (July 2024 – September 2024) were approximately +0.2% higher than the preceding three months (April 2023 – June 2024). Year-on-year SA transactions were +8.9% higher than September 2023 (+2.0% higher on a non-SA basis). (Source: HMRC)

- Latest Bank of England figures show the number of mortgages approved to finance house purchases increased in September 2024, by +1.1% to 65,647. Year-on-year the figure was +49.3% above September 2023. (Source: Bank of England, seasonally-adjusted figures)

- The RICS Residential Market Survey results for September 2024 show continued improvement in sales market activity. New buyer enquiries net reading of +14% was broadly in line with last months +16% and the third consecutive monthly positive reading. Net agreed sales also remained stable at +5% from +6%, with new instructions increasing to a net reading of +22% from +9%. (Source: Royal Institution of Chartered Surveyors (RICS) monthly report)

UK house prices Historical data National: All Houses, All Buyers (Seasonally Adjusted):

|

Period |

Index Jan 1992=100 |

Standardised average price £ |

Monthly change % |

Quarterly change % |

Annual change % |

|

October 2023 |

488.1 |

283,053 |

1.0 |

-1.1 |

-2.8 |

|

November |

489.8 |

284,039 |

0.4 |

-0.2 |

-0.8 |

|

December |

495.3 |

287,244 |

1.1 |

1.0 |

1.8 |

|

January 2024 |

501.1 |

290,608 |

1.2 |

2.1 |

2.3 |

|

February |

502.4 |

291,338 |

0.3 |

2.6 |

1.6 |

|

March |

498.0 |

288,781 |

-0.9 |

1.9 |

0.4 |

|

April |

498.1 |

288,862 |

0.0 |

0.8 |

1.1 |

|

May |

498.2 |

288,931 |

0.0 |

-0.3 |

1.6 |

|

June |

498.4 |

289,042 |

0.0 |

-0.4 |

1.9 |

|

July |

502.8 |

291,585 |

0.9 |

0.1 |

2.4 |

|

August |

504.5 |

292,540 |

0.3 |

0.8 |

4.3 |

|

September |

505.8 |

293,305 |

0.3 |

1.2 |

4.6 |

|

October |

507.0 |

293,999 |

0.2 |

1.2 |

3.9 |

Next publication:

The next Halifax House Price Index for November 2024 will be published at 07:00 on Friday, 6th December 2024.

Kindly shared by Halifax