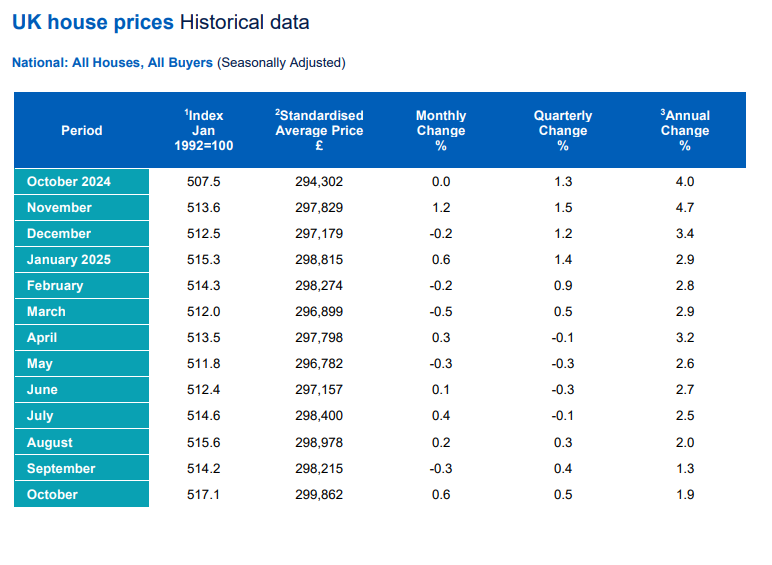

Halifax House Price Index – October

UK house prices rise at fastest pace since January

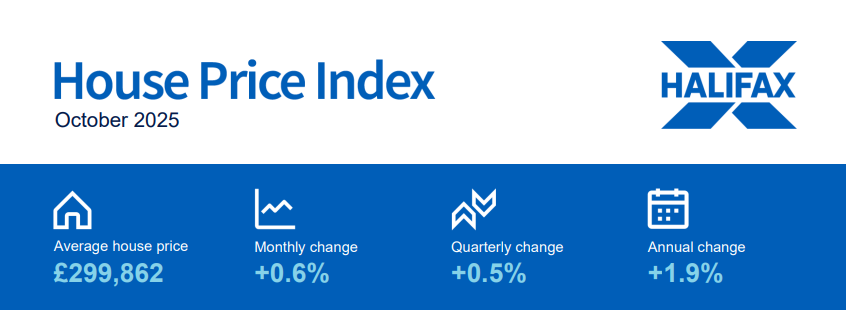

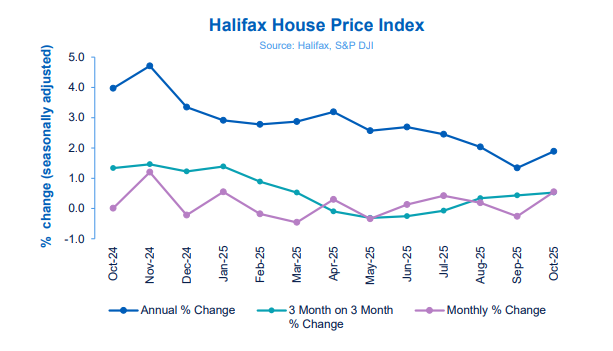

- House prices rose by +0.6% in October vs a fall of -0.3% in September

- Fourth time in last five months that the average price has increased

- Average property price now £299,862, edging up to a new record high

- Annual rate of growth rises to +1.9% (up from +1.3% in September)

- Mortgage approvals reach highest level this year, indicating resilient demand

- Northern Ireland continues to lead annual house price growth in the UK

Amanda Bryden, Head of Mortgages, Halifax, said:

“October saw the biggest monthly rise in UK house prices since January this year, with the value of the average UK home increasing by +0.6% (£1,647). That brings the typical property price up to £299,862 – the highest on record – while annual growth also increased to +1.9% (from +1.3%).

“Demand from buyers has held up well coming into autumn, despite a degree of uncertainty in the market, with the number of new mortgages being approved recently hitting its highest level so far this year.

“There is no doubt that affordability remains a challenge for many. Average fixed mortgage rates are currently around 4% and likely to ease down further, but with property prices at record levels, moving home can feel like a stretch.

“Rising costs for everyday essentials are also squeezing disposable incomes, which affects how much people are willing or able to spend on a new property.

“Even so, while there has been some volatility, the market has proven resilient over recent months, as many buyers opt for smaller deposits and longer terms to help make the numbers work. With house prices rising more slowly than incomes for almost three years now, we expect the trend of gradually improving affordability to continue.”

Nations and regions house prices

Northern Ireland continues to post the strongest rate of annual property price inflation, with average values up +8.0% over the past year (up from +6.4% last month). The typical home now costs £219,646.

Scotland recorded annual price growth of +4.4% in October, up to an average of £216,051.

In Wales, property values rose +2.0% year-on-year to £229,558.

In England, the North East recorded the highest annual growth rate, with property prices rising by +4.1% to £180,924.

London and the South East saw prices fall slightly in October on an annual basis, by -0.3% and – 0.1% respectively. The capital remains the most expensive part of the UK, with an average property now costing £542,273.

Housing activity

- HMRC monthly property transaction data show UK home sales increased in September 2025. UK seasonally adjusted (SA) residential transactions in September 2025 totalled 95,980 – up by +1.1% from August’s figure of 94,910 (down -2.4% on a non-SA basis). Quarterly SA transactions (July 2025 – September 2025) were approximately +17.8% higher than the preceding three months (April 2025 – June 2025). Year-on-year SA transactions were +3.7% higher than September 2024 (+7.9% higher on a non-SA basis). (Source: HMRC)

- Latest Bank of England figures show the number of mortgages approved to finance house purchases increased in September 2025 by +1.5% to 65,944. Year-on-year the figure was +0.5% above September 2024. (Source: Bank of England, seasonally-adjusted figures)

- The RICS Residential Market Survey results for September 2025 indicates continued weakness in the sales market. New buyer enquiries posted a third consecutive negative net balance of -19%, slightly down from -18% in August. Agreed sales improved to -16% from -24%, while new instructions remained in negative territory for the second month at -15% (previously -4%). (Source: Royal Institution of Chartered Surveyors (RICS) monthly report)