HALIFAX House Price Index: March 2025

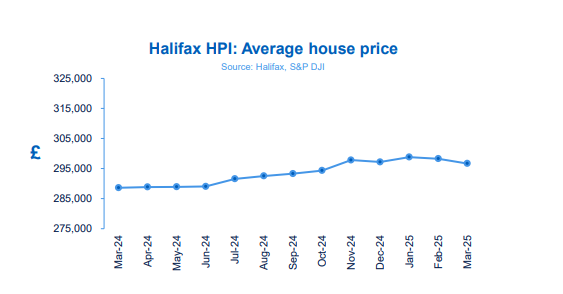

Average UK house price falls in March

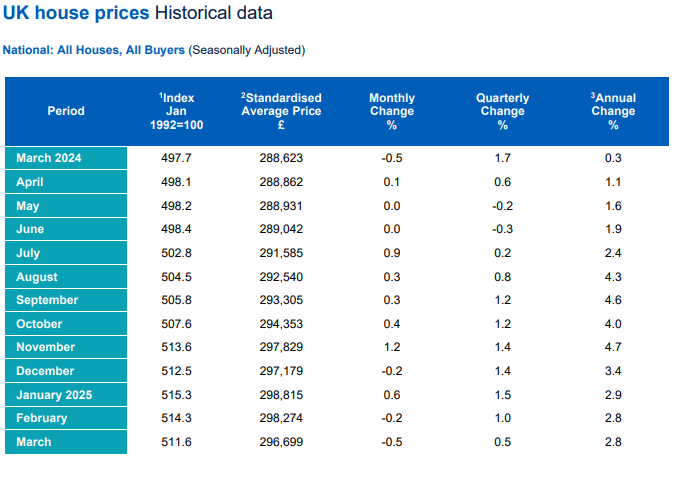

- House prices fall by -0.5% in March (vs -0.2% in February)

- Average property price now £296,699 (compared to £298,274 in previous month) • Annual rate of growth remains at +2.8%, unchanged from February

- Northern Ireland sees house prices rise at fastest pace (+6.6%)

Amanda Bryden, Head of Mortgages, Halifax, said:

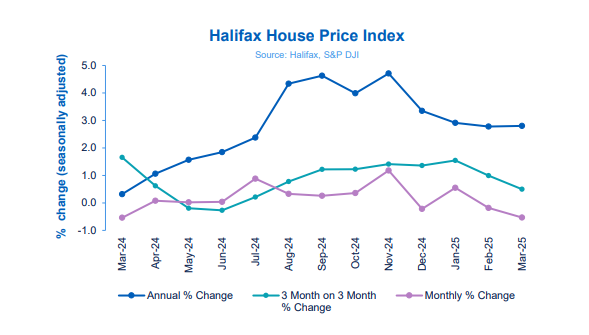

“UK house prices fell by -0.5% in March, a drop of £1,575. Despite this, the annual growth rate remained steady at +2.8%, with the typical UK property now valued at £296,699.

“House prices rose in January as buyers rushed to beat the March stamp duty deadline. However, with those deals now completing, demand is returning to normal and new applications slowing. Our customers completed more house sales in March than in January and February combined, including -1.0 0.0 1.0 2.0 3.0 4.0 5.0 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24 Dec-24 Jan-25 Feb-25 Mar-2 % 5 change (seasonally adjusted) Halifax House Price Index Annual % Change 3 Month on 3 Month % Change Monthly % Change Source: Halifax, S&P DJI Average house price £296,699 Monthly change -0.5% Quarterly change +0.5% Annual change +2.8% the busiest single day on record. Following this burst of activity, house prices, which remain near record highs, unsurprisingly fell back last month.

“Looking ahead, potential buyers still face challenges from the new normal of higher borrowing costs, a limited supply of available properties to choose from, and an uncertain economic outlook.

“However, with further base rate cuts anticipated alongside positive wage growth, mortgage affordability should continue to improve gradually, and therefore we still expect a modest rise in house prices this year.”

Nations and regions house prices

Northern Ireland continues to record the strongest annual property price growth of any nation or region, rising by +6.6% in March, house prices here average £206,620.

Scotland recorded the second strongest house price growth, increasing to +4.3% last month, compared to +3.8% in February. The average house price here is now £213,750.

Property prices in Wales were also up +3.7% in March, to an average £227,332.

In England, Yorkshire and Humberside also saw strong growth, up +4.2% compared to the previous year, with properties now costing an average £215,807.

London saw the slowest annual house price growth, from +1.5% in February to +1.1% in March. The capital retains the top spot for the highest average house price in the UK, at £543,370

Housing activity

- HMRC monthly property transaction data shows UK home sales increased in February 2025. UK seasonally adjusted (SA) residential transactions in February 2025 totalled 108,250 – up by 13.0% from January’s figure of 95,790 (up 10.1% on a non-SA basis). Quarterly SA transactions (December 2024 – February 2025) were approximately +4.6% higher than the preceding three months (September 2024 – November 2024). Year-on-year SA transactions were +28.1% higher than February 2024 (+24.2% higher on a non-SA basis). (Source: HMRC)

- Latest Bank of England figures show the number of mortgages approved to finance house purchases decreased in February 2025, by -0.8% to 65,481. Year-on-year the figure was +8.2% above February 2024. (Source: Bank of England, seasonally-adjusted figures)

- The RICS Residential Market Survey results for February 2025 show sales market activity soften. New buyer enquiries returned a net balance reading of -14%, from -1% with agreed sales also in the negative at -13%, from +2%. New instructions returned a net balance of +12% (from +24%) extending its run of positive read

Kindly shared by Halifax Picture courtesy of Adobe