Halifax House Price Index – June 2025

House prices hold steady as market activity picks up pace

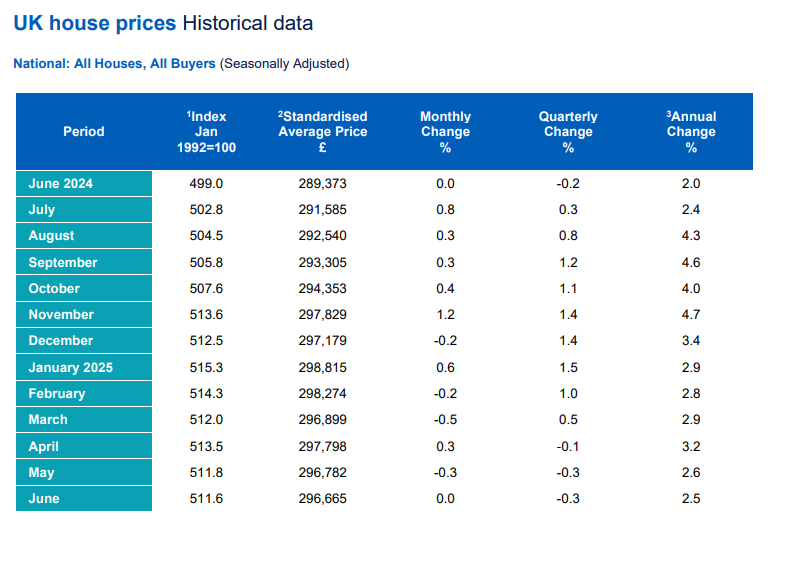

- House price growth flat in June at 0.0% vs dip of -0.3% in May

- Average property price now £296,665 compared to £296,782 last month

- Annual rate of growth edges down to +2.5% from +2.6 in May

- First-time buyer numbers have returned to pre-stamp duty change levels

- Northern Ireland has by far the strongest annual price growth in the UK

Amanda Bryden, Head of Mortgages, Halifax, said:

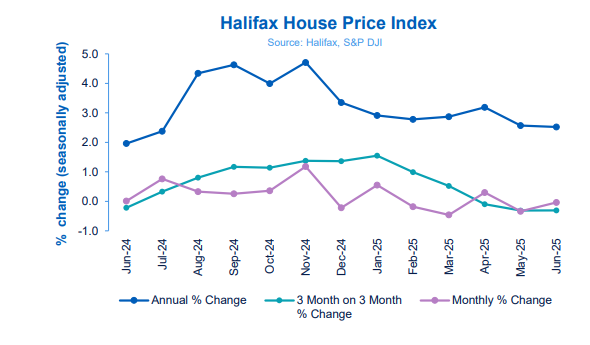

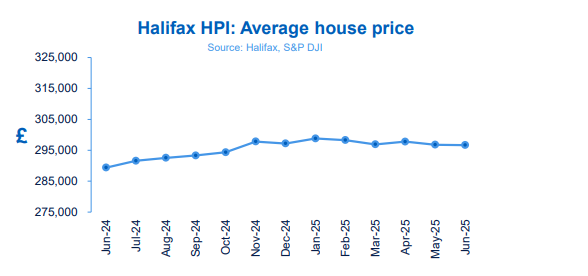

“The UK housing market remained steady in June, with the average property price effectively unchanged over the month, following a slight drop of -0.3% in May. At £296,665, the average house price is still around +2.5% higher than this time last year.

“The market’s resilience continues to stand out and, after a brief slowdown following the spring stamp duty changes, mortgage approvals and property transactions have both picked up, with more buyers returning to the market. That’s being helped by a few key factors: wages are still rising, which is easing some of the pressure on affordability, and interest rates have stabilised in recent months, giving people more confidence to plan ahead.

“Lenders have also responded to new regulatory guidance by taking a more flexible approach to affordability assessments. Over the last two months, we’ve already helped an additional 3,000 buyers – including more than 1,000 first-time buyers – access a mortgage they wouldn’t have qualified for before.

“Of course, challenges remain. Affordability is still stretched, particularly for those coming to the end of fixed-rate deals. The economic backdrop also remains uncertain; while inflation has eased, it’s still above target, and there are signs the jobs market may be softening.

“But with markets pricing in two more rate cuts from the Bank of England by year end, and the average rate on newly drawn mortgages now at its lowest since 2023, we continue to expect modest house price growth in the second half of the year.”

Nations and regions house prices

Northern Ireland once again recorded the fastest pace of annual property price inflation in the UK, up by +9.6% over the past year. The typical home now costs £212,189.

Scotland recorded the next strongest annual house price growth in June, increasing by +4.9% with average prices now at £214,891.

Property prices in Wales were up +3.9%, to an average of £229,622.

Among English regions the North West has the highest rate of property price inflation, up +4.4% over the last year to £241,938.

Housing activity

- HMRC monthly property transaction data show UK home sales increased in May 2025. UK seasonally adjusted (SA) residential transactions in May 2025 totalled 81,470 – up by +25.1% from April’s figure of 65,110 (up +42.3% on a non-SA basis). Quarterly SA transactions (March 2025 – May 2025) were approximately +7.6% higher than the preceding three months (December 2024 – February 2025). Year-on-year SA transactions were – 11.8% lower than May 2024 (-13.3% lower on a non-SA basis). (Source: HMRC)

- Latest Bank of England figures show the number of mortgages approved to finance house purchases increased in May 2025 by +3.9% to 63,032. Year-on-year the figure was +3.3% above May 2024. (Source: Bank of England, seasonally-adjusted figures)

- The RICS Residential Market Survey results for May 2025 indicate a persistently soft sales market. New buyer enquiries recorded a net balance of -26%, marking the fifth consecutive month of negative readings, though slightly improved from -32%. Agreed sales remain relatively unchanged at -28% compared to -30% the previous month, continuing a four-month negative trend. Meanwhile, the net balance for new instructions saw a modest increase to +7%. (Source: Royal Institution of Chartered Surveyors (RICS) monthly report)

Kindly shared by Halifax

Image curtesy of Adobe Stock