Fall in demand for five-year fixed deals, according to LMS

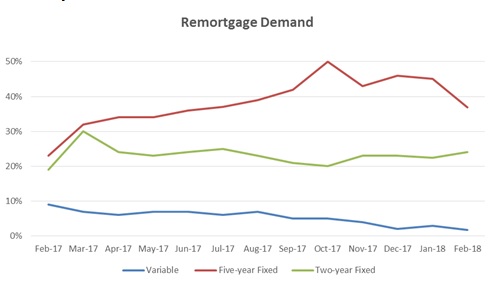

Demand for five-year fixed rate remortgages has fallen to the lowest proportion of the market since July 2017, according to conveyancing service provider, LMS.

- Five-year fixed deals drop to 37% of the remortgage market in February, down from 45% in the previous month

- Lowest level of five-year fixed rate remortgages in the market since July 2017

- Increase in demand for two-year fixed remortgages, as consumers seek cheaper deals following base rate rise

Five-year fixed rate remortgages fell to 37% of the market in February – down from 45% in the previous month. This is the lowest level of five-year fixed rate remortgages in the market since July.

The decline has been driven by more consumers opting for cheaper two-year fixed rate deals to balance out the cost of November’s base rate rise. The proportion of borrowers choosing fixed two-year remortgages has increased to 24% in February, up from 22% the month before. This is the highest level of two-year fixed rate remortgaging in seven months.

The two-year fixed remortgages are available with an average fixed rate of 2. 35% in February.[1]

Nick Chadbourne, chief executive of LMS, said:

“Consumer interest in fixed five-year deals has dipped as many borrowers opt for the lower rates on offer from two-year products. This is a significant shift from what we’ve seen in recent months, suggesting the popularity of five-year deals may have peaked.

“The move towards two-year deals is likely a result of borrowers offsetting the cost of November’s base rate increase by switching to a shorted fixed rate period when they remortgage. Few borrowers will want to risk a variable rate mortgage with potential increases to the base rate likely to be on the way later this year, but with incomes squeezed, demand for longer term fixed deals has slipped.”

Rise in remortgaging as consumers move to shorter fixed-rate deals

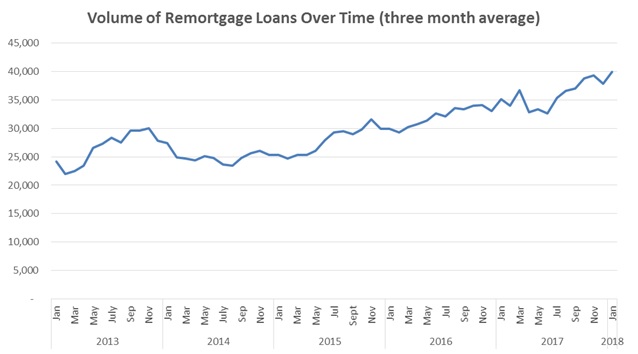

Homeowners are now prepared to remortgage more frequently to get a better deal. In February 2017, 17% of borrowers expected to remortgage again in 8 years’ time, but one year later, just 10% of borrowers expect to wait this long.

Meanwhile, 39% of borrowers are planning to refinance in 5 to 6 years’ time. This is an 11 percentage point increase from February 2017.

The long-term shift towards more regular remortgaging can be seen in the surge in total remortgage lending which reached a nine year high in January, increasing 20.3% year-on-year[2].

Nick Chadbourne added:

“In the short term, reports of Bank England’s upcoming rate increase is putting pressure on homeowners to move away SVR and remortgage sooner rather than later. The longer term increase in lending is due to borrowers being more aware of the potential savings on offer through remortgaging. There is now much more information on the deals available to borrowers from brokers as well as price comparison sites.

“The record high volumes of remortgage seen at the end of 2017 illustrates the ongoing challenge of developing a smoother, more efficient process. At LMS, we’re continuing to strive to deliver improvements with innovative technology such as ECOT. These improvements will provide all stakeholders within the conveyancing process more efficient methods of transacting.”

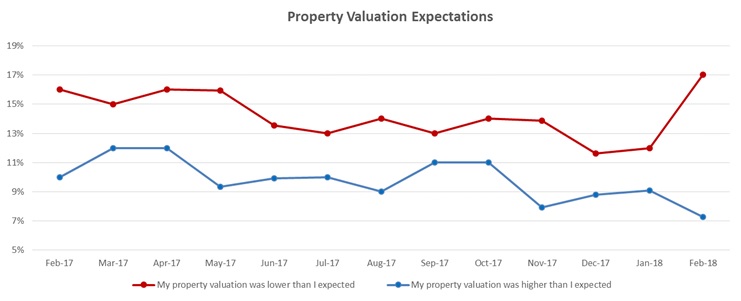

More homeowners receiving lower than expected valuations

The proportion of homeowners receiving a lower than expected property valuation for remortgaging purposes has risen to of borrowers in February – up from 12% in January. The increase has been driven by slower house price growth, with average house prices increasing 0.5% month-on-month in February[3].

Nick Chadbourne said:

“Homeowners are used to house prices rising, so the slowdown in the market may come as a surprise to some. Overall market conditions are still re-balancing following the base rate rise and the uncertain political landscape. This must make accurate valuations more complex – homeowners who have not re-mortgaged for 5 or 6 years will nearly always be over optimistic and valuers naturally fall on the side of caution. While this increase only represents a single percentage point uplift year-on-year, it has reached a new milestone. Should the trend continue it will impact overall deal conversion levels, however as the market adjusts it may well balance out. Watch this space.”

[1] Moneyfacts – Feb 2018

[2] https://www.ukfinance.org.uk/remortgages-in-january-2018-reach-nine-year-high/

[3] http://www.acadata.co.uk/LSL%20Acadata%20E&W%20HPI%20News%20Release%20February%2018.pdf

Kindly shared by LMS