Equity release market rises 8% in Q3 as older homeowners unlock nearly £11m per day

Almost £11 million of property wealth was unlocked by UK homeowners aged 55+ each day from July to September as equity release market activity rose 8% to £988m in Q3, according to the latest quarterly market figures from the Equity Release Council, the UK sector representative body.

Headlines:

- Equity release products provide £988m of funding to over-55 homeowners in Q3, up by 8% from £911m in Q2

- 33,000 new customers have used property wealth to support their finances so far this year, supported by regulated financial and independent legal advice

- Average withdrawals per customer remain steady

The figures show the market experienced its busiest quarter of 2019 to date, both in terms of new plans agreed and total property wealth accessed by new and returning customers. A total of 11,419 new customers opted to release cash from their properties in Q3 2019 – a 6% increase on the previous quarter – following a detailed process of regulated and qualified financial advice and independent face-to-face legal advice.

The money unlocked is used for a wide range of purposes, including supplementing pension incomes; providing a ‘living inheritance’ to family; making home improvements or age-related adaptations; paying off existing mortgages or other debt; and meeting other regular or one-off expenses.

Ageing Population Prompts Industry Response and Market Growth

So far this year, over 33,000 new customers have chosen to access their property wealth using equity release. This exceeds the total number of new plans agreed in any full year from 1991-2016, since consumer safeguards and industry standards were first introduced to the market nearly 30 years ago.

The trend points towards the increasing role of property wealth in retirement planning conversations as research shows that over 50% of homeowners aged 45+ see property wealth as part of their later life plans. This is matched with growing customer participation in the market and an increasing range of flexible products to meet wider consumer needs.

The three busiest quarters recorded for equity release activity have all come in the 15-month period between Q3 2018 and Q3 2019. However, average withdrawals have remained stable as the market has grown. The average first instalment of a drawdown plan was £63,222 in Q3 2019, compared to £64,793 two years ago, while the average lump sum plan was £95,557 vs £100,389 in Q3 2017.

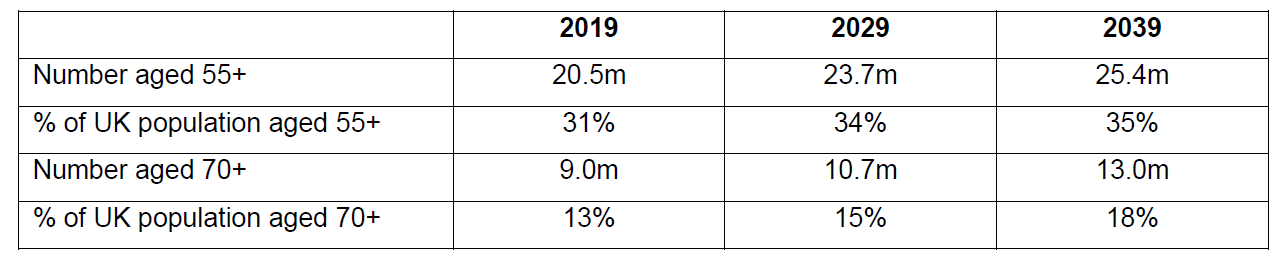

Official demographic projections show that the number of people aged 55+ will increase by nearly 5m or 23% over the next 20 years to make up more than a third of the UK population. Those aged 70 or above – 70 being the average age for taking out a drawdown lifetime mortgage, the most common product choice when unlocking property wealth – will increase from 9m to 13m: a rise of 4m or 44%.

Table 1: Population projections for over-55s and over-70s – 2019, 2029 and 2039

Source: Equity Release Council analysis of Office for National Statistics (ONS) 2018-based population projections

With retirement incomes required to last an increasingly long time, the Council’s research highlights the important contributing role that property can play in later life financial plans. Bricks and mortar contribute 35p in every £1 of household wealth across all age groups, rising to 40p for over-65s and 47p among over-75s.

David Burrowes, Chairman of the Equity Release Council, said:

“As a nation with an ageing population and a growing need to support longer lives, it is important not to overlook property wealth in modern retirement planning conversations. Today’s equity release market is offering new solutions to fund later life, by combining rigorous consumer protections with more product choices and flexibility to help people meet their financial needs and goals.

“The result of buying property and making mortgage payments during their working lives is that bricks and mortar become many people’s single biggest financial asset when they reach later life. Industry, regulators and government must continue to promote and encourage lifelong savings habits and support consumers to take a joined-up approach to later life planning. One that takes a holistic view about consumer choices, needs and outcomes and considers all wealth and assets into account.”

To download the full press release, which includes references, click here: Q3 2019 lending figures.

Kindly shared by Equity Release Council