England and Wales homebuyers to save over £300 million in stamp duty relief

New homebuyers in the UK are set to save over £300 million over the next three months thanks to continuing relief in Stamp Duty Land Tax following the Covid-19 pandemic.

New analysis from Muve, a leading conveyancer in the UK, uses historical data from the Land Registry and its own data on First-Time Buyers to estimate the future value of Stamp Duty Land Tax (SDLT) savings over the course of Q3 2021.

The significant cut in place until 30th June helped thousands of people cut the cost of buying a home and triggered a record 22% rise in transaction volumes. Despite the fact that the more considerable stamp duty savings have now come to an end, there is still plenty of money to be saved under the new rate.

From July 1st to September 30th, a smaller but still significant stamp duty cut is in place, reducing SDLT by as much as £2,500 for those buyers who complete before September 30th. This cut is worth more than £300 million and will ensure that the property market stays buoyant for months to come.

It is estimated that over the next three months, 53% of housebuyers will take advantage of SDLT relief, with the remaining 47% being First-Time Buyers (FTBs) and those purchasing low-value properties below £125,000, who do not benefit from the added SDLT saving.

Across England and Wales, First Time Buyers make up more than a third of purchases each year. Under the current rules, FTBs are exempt from Stamp Duty if the house they are buying is less than £300,000, meaning they are set to save thousands of pounds in SDLT.

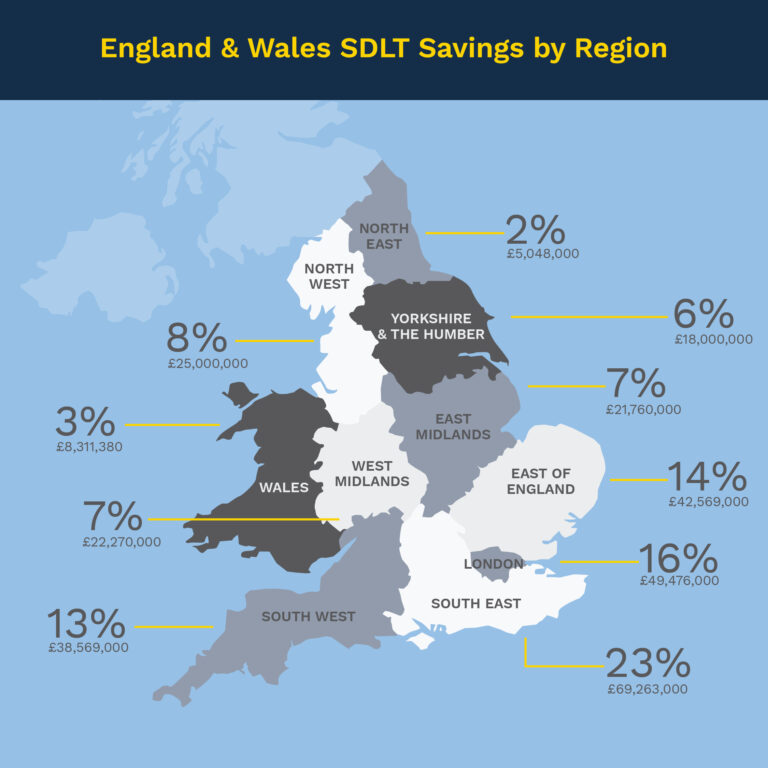

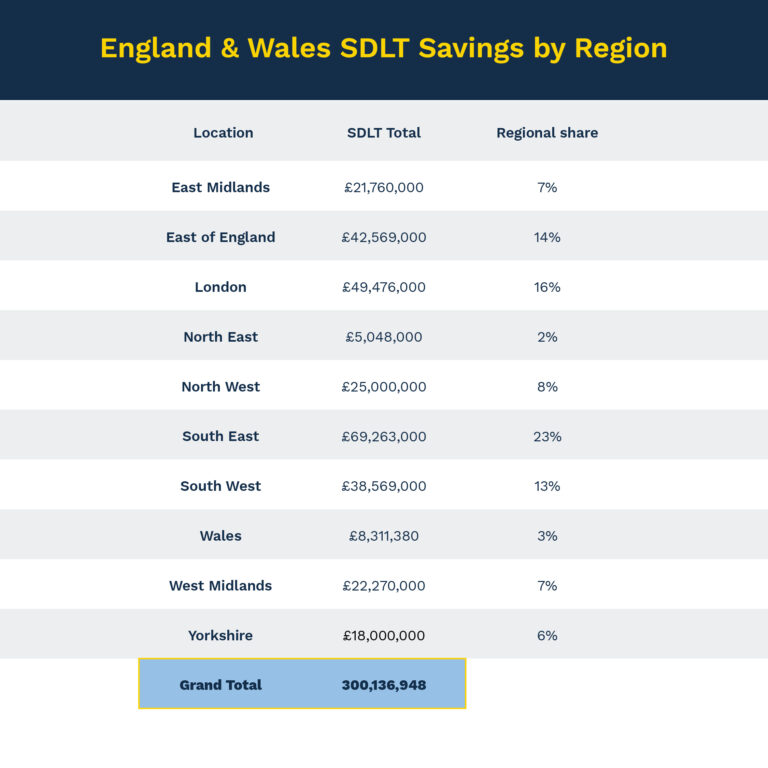

According to the data, homebuyers looking to complete in the South East of England are expected to enjoy the largest savings, taking 23% of the national share. The North East of England will take the smallest percentage of savings, with just 2% of the national share.

David Jabbari, CEO of Muve, said:

“While many might have believed that Stamp Duty savings were washed away as the deadline of June 30th rolled around, that isn’t the case. There are still significant savings to be made for those who complete on their new home before October 1st.

“The conveyancing industry has been a very busy place since SDLT relief was introduced in 2020, and despite the deadline for the biggest savings having passed in June this year, we still find ourselves extremely busy. The housing market is in a very healthy state right now, and that is something that the government will be looking to sustain as we begin the economic recovery from the Covid-19 pandemic.

“For those looking to take advantage of SDLT savings, our advice is to act fast and find a conveyancer like Muve with a proven record of swift transactions on a guaranteed timeline for completion. The sooner you start, the more likely you are to be able to complete before the September 30th deadline.”

Kindly shared by Muve

Main photo courtesy of Pixabay