Despite demand falling UK house prices are still rising

The latest research by TwentyEA shows that, despite demand falling for property in the UK, house prices are still rising.

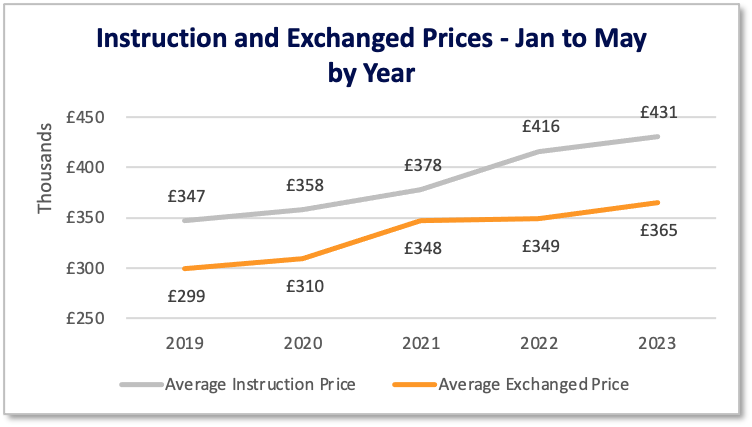

New research from TwentyEA shows that asking prices at original instruction have risen nearly 3.5% in the last year and over 24% since 2019, representing a compound annual growth rate (CAGR) of 4.4% per annum.

Exchanged prices have also grown at a healthy 4.7% over the course of the last year and over 22% since 2019. On the average property, growth in the last year equates to £16,000, with £66,000 since 2019.

In percentage terms, the gap between the initial asking and exchanged prices is roughly the same in 2023 as it was in 2019. In fact, aside from the ‘magical’ year of 2021, the percentage gap is roughly the same across all other years.

Katy Billany, Executive Director of TwentyEA, comments:

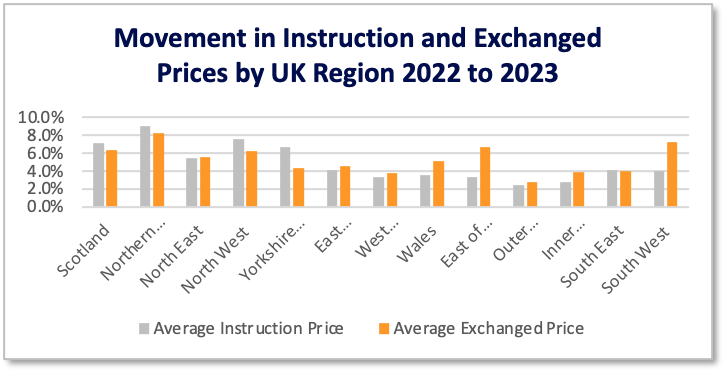

“The growth in instruction prices year on year has been highest in Northern Ireland (9%), the North West (7.5%) and Scotland (7.1%).

“In terms of exchanged prices, Northern Ireland again saw the highest growth rate at 8.2% and the only other region above 7% was the South West.

“Outer London saw the lowest exchanged price growth at 2.8.”

Price changes

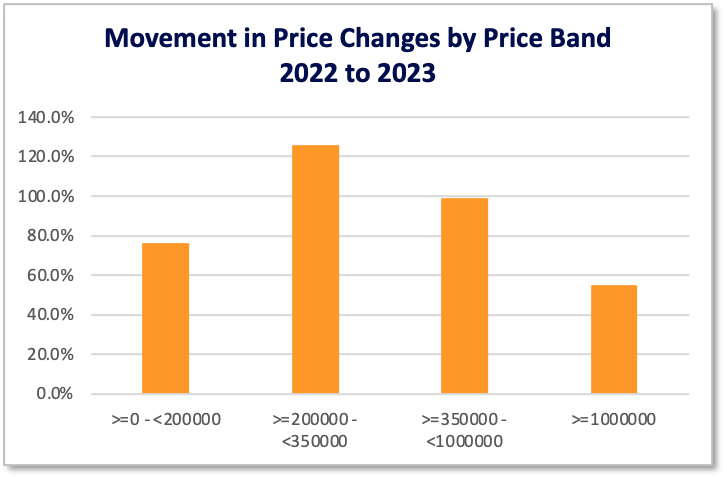

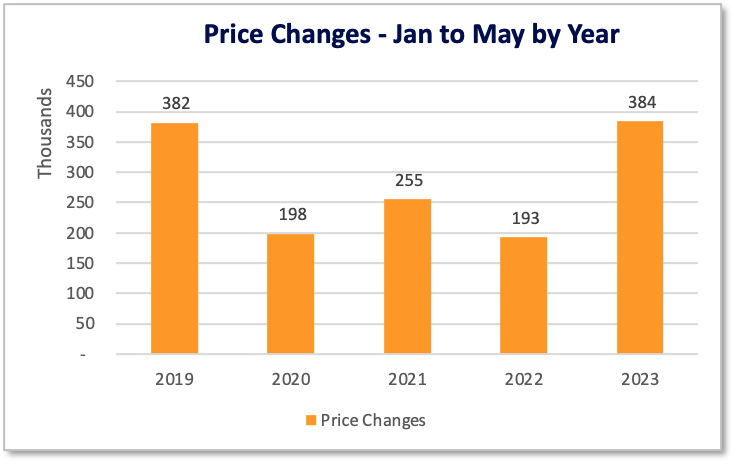

Price changes on listings have increased in every price bracket, but most notably in the £200k to £350k range. A feature of 2023 to date has been the substantial increase in the volume of price changes on listings.

Katy continues:

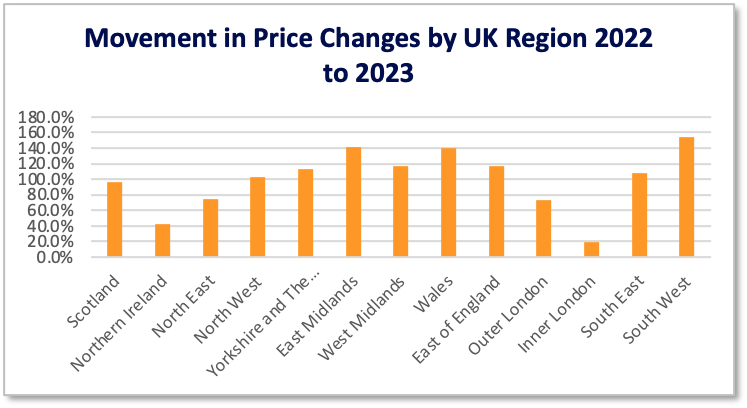

“Looking at the last year’s movement in isolation (with growth close to 100%), it suggests that it may be an issue in 2023.

“However, when we compare the data to pre-pandemic 2019, we see that the level in 2023 is in fact the ‘norm’.

“As we can see from our research, London and Northern Ireland have experienced the smallest growth in price changes (19% and +43% respectively).”

TwentyEA has over 15 years of experience providing data to the residential property market professionals and holds the UK’s biggest and richest resource of factual life event data including the largest, most comprehensive source of home mover data compiled from more than 29 billion qualified data points.

TwentyEA is part of the TwentyCi group of companies that use data science to improve commercial outcomes for clients.

For further information please visit here, or email [email protected].

Kindly shared by TwentyEA

Main article photo courtesy of Pixabay