Demand for two-year fixed rate deals rises

First look at the new interest rate environment.

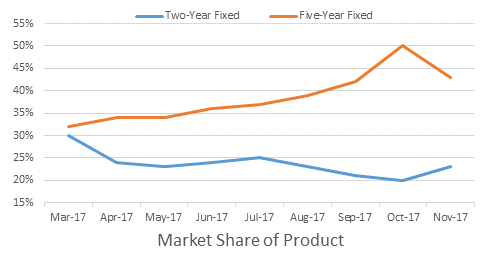

- Two-year fixed rate deals bounce back – accounting for 23% of all remortgages

- Demand for five-year fixed rate deals reduces from 50% to 43%

- Interest rate rise impacts borrower behaviours as they seek to lower monthly bills

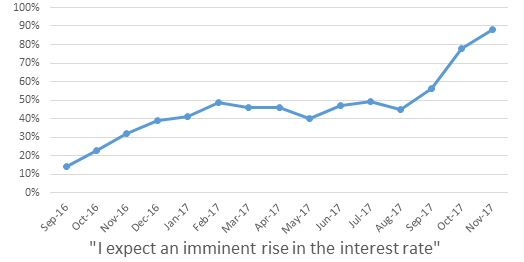

Demand for two-year fixed deals rose for the first time in four months following the interest rate rise on 2 November, according to conveyancing service provider, LMS.

After declining from a 30% market share in March to a 20% market share in October – the second lowest figure on record – demand rose in November, with two-year fixed deals making up 23% of all remortgages.

LMS says the increase in the market’s appetite for two-year fixed deals – the largest since March – is a first glimpse at the new interest rate environment and its effect on borrower behaviour.

Kindly shared by LMS