Cost-of-living crisis: Young homeowners unfairly impacted

Cost-of-living crisis: Young homeowners unfairly impacted by state of mortgage market, study by Uswitch has revealed.

From skyrocketing house prices to stagnating wages, young people have been facing many obstacles when buying their first home. But as the mortgage market continues to be impacted by rising interest rates, how much of the burden are young homeowners expected to take on?

As part of their mortgage statistics report, the experts at Uswitch.com investigated how much young people are affected by the state of the mortgage market.

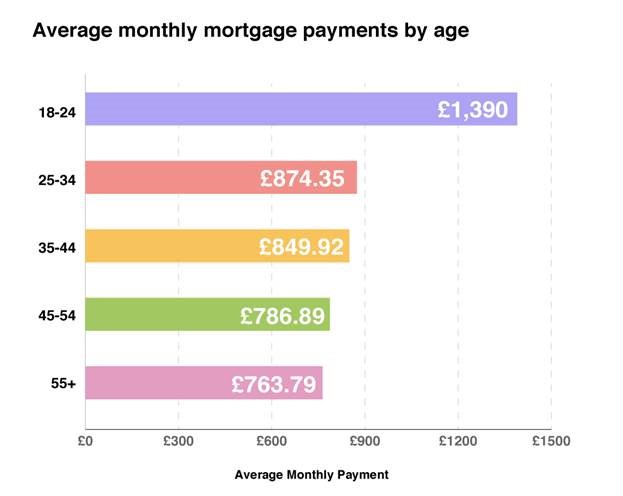

Monthly mortgage repayments by age:

The mortgage statistics report can reveal that 18- to 24-year-olds spend £1,390.90 a month in mortgage repayments, the highest of all age brackets. This is 59% more than 25- to 34-year-olds’ average monthly repayment of £874.35 – the second most expensive. In fact, this difference becomes greater the larger the age gap.

Those 55 and older have the cheapest monthly payments, averaging just £763.79. This is almost half (45%) of the average monthly repayments for 18-24-year-olds, suggesting that a lack of capital forces young people to accept higher mortgage repayments.

Additionally, 0.99% of 18-24-year-olds have monthly repayments exceeding £3,000. While this figure is smaller than other payments in this age bracket, it is far greater than the percentage of other ages paying this amount. On average, 0.48% of 45- to 54-year-olds repay over £3,000 a month for their mortgage: the second largest portion from all ages analysed, but still less than half the percentage of 18-24-year-olds.

Luke, 23 years old, from Southend-On-Sea, working in Finance, said:

“We did a lot of research before applying for a mortgage to make sure we were getting the best deal with the lowest rates.

“Beyond that, we’re saving where we can, cutting back on some luxuries – moving back in with our parents before moving into our new home was especially useful to save up for the deposit and mortgage payments.”

The original length of mortgage term by age:

|

Age |

18-24 |

25-34 |

35-44 |

45-54 |

55+ |

|

Average original length of mortgage term |

26.09 |

29.44 |

27.2 |

24.52 |

22.73 |

25- to 34-year-olds have the longest mortgage terms on average at almost thirty years (29.44). On average, 57.25% of homeowners in this age bracket have a mortgage term of 30 years or longer. The average length of a 25- to 34-year-old’s mortgage is 30% longer than the initial mortgage term for those aged 55 and over (22.73 years). While those aged 18-24 have a shorter period of 26.09 years, this will more than likely increase due to the recent introduction of 50-year mortgages in the UK.

Kester, 31 years old, from Nottingham, working in IT & Telecoms, said:

“We’re having to watch the market closely, as when our current term ends in a few months we’ll likely be paying double.

“The best thing for us to do is to keep up to date with the market and look for a new mortgage deal as early as possible, as right now it’s more difficult than ever to find a deal that’s a good fit.”

What types of mortgages are young homeowners currently on?:

|

18-24 |

25-34 |

35-44 |

45-54 |

55+ |

|

|

Fixed-rate mortgage |

41.58% |

80.73% |

79.84% |

70.84% |

56.56% |

|

Standard variable rate mortgage |

25.74% |

11.96% |

13.49% |

20.24% |

35.66% |

|

Tracker mortgage |

17.82% |

4.15% |

3.72% |

7.47% |

6.56% |

|

Discounted mortgage |

14.85% |

3.16% |

2.95% |

1.45% |

1.23% |

While fixed-rate mortgages are the most popular across all age brackets, they are utilised far less by 18- to 24-year-olds. At least half of every other age bracket has a fixed-rate mortgage, but only 41.58% of 18- to 24-year-olds opted for this deal. When it comes to those aged 25-34, fixed-rate mortgages make up around 80% of them, suggesting that the recent increase in interest rates will be much less substantial for this age bracket.

Marissa, 28 years old, from Newcastle, working in Marketing, said:

“In terms of staying ahead of rising payments, having a fixed-rate mortgage deal has made paying our mortgages much simpler.

“We haven’t been affected by rising interest rates, which has meant our payments have been consistently lower than other homeowners.”

Claire Flynn, mortgage expert at Uswitch.com, comments on how you can manage your finances as a first-time buyer:

“1. Give your finances a health check: a good credit history is essential to getting a good mortgage deal, so be sure to check your credit report for the full picture of all your outstanding debts. It’s vital to make sure that all the information is correct, as any mistakes may hurt your chances of securing a loan.

“2. Try to reduce spending: not only does lowering your spending help save for a deposit, but fewer outgoing payments will increase your chances of being accepted for a loan. You could reduce your spending without making any lifestyle changes by:

-

- “Cutting the costs of your debts: Look at your credit card statements to find out your outstanding balance, interest rate and how much you’re paying each month. If you are being charged a high interest rate, move debts to a 0% balance transfer credit card to lower interest payments, although make sure you’re aware of all the terms and conditions before you do.

- “Switching (or re-contract) your broadband, digital TV and mobile provider: If your contract has come to an end, make sure you shop around for deals. A comparison site like Uswitch can suggest a wide range of offers from across the market. It’s likely you’ll save money if you combine your broadband, digital TV and mobile into a bundle from a single supplier.

- “Paying less for insurance: From car to pet insurances, never let any policy roll over automatically when it ends. Take the time to consider your options, research the market and compare quotes to make sure you get a chance to find cheaper insurance deals and cut your premiums.

- “Checking benefits and taxes: Review your income tax code and council tax band to ensure you’re being taxed correctly. If you have been paying more tax than you should, you might be able to claim your tax back.

“3. Apply with caution: Don’t be tempted to make multiple mortgage applications just to see what kind of offers you can get. Every time you apply for a mortgage, it will be noted on your credit report, and can negatively impact your credit score. Instead, consider using an online mortgage comparison calculator or talking to a mortgage broker to get a better understanding of what deals are the right fit for you.”

Please find the full report here.

Kindly shared by Uswitch.com

Main picture courtesy of Pixabay