Conveyancing hits Brexit buffers as 10% drop activity means slowest quarter for 2 years

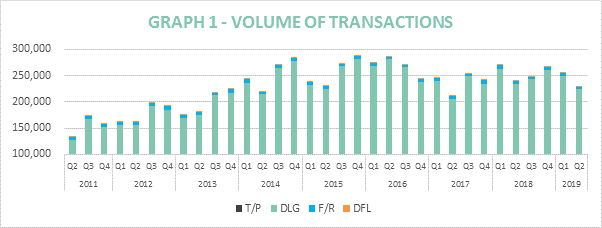

22 August 2019 – Total conveyancing transaction volumes fell by over 10% on a quarterly basis and 20% since Q2 2016 as conveyancing hits the Brexit buffers.

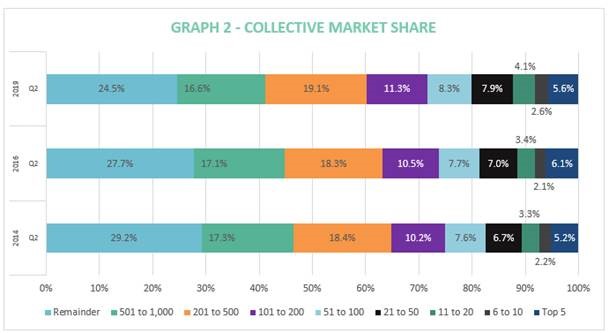

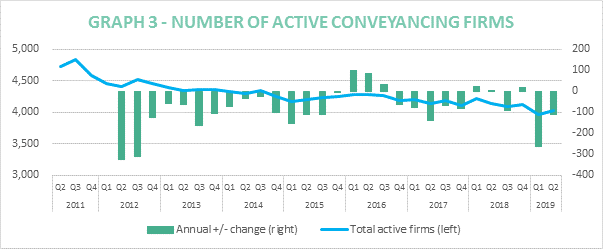

The top 200 conveyancing firms now collectively control two fifths of the market – a record share, and the number of active conveyancing firms in England and Wales at the second lowest level on record despite a slight quarterly increase (2%) to just over 4,000 (4,036).

Quarterly conveyancing volumes have dropped below 230,000 cases for the first time in two years (228,994), a decrease of over 10% compared with Q1, according to the Q2 2019 Conveyancing Market Tracker from Search Acumen, the property data insight and technology provider.

The dip is also a 20% decrease from Q2 2016 – before the EU referendum – where the number of transactions was above 280,000 (286,485).

The tracker – which monitors business performance and competitive pressures in the conveyancing market – found that the top 1,000 conveyancing firms experienced a 10% drop in cases, collectively completing 20,000 fewer transactions (19,651) compared to Q1 2019.

Top 200 firms take two-fifths market share

The latest data for Q2 2019 shows that the top 200 conveyancing firms now control more of the market (39.7%) than ever before. While this is a modest increase of less than half a percentage point on Q1 2019 (39.3%), it represents a significant long-term gain from the 31.9% share which the top 200 firms held back in Q2 2011.

The most notable gains in market share have taken place at the middle of the market. In the past five years, firms ranked from 201st – 500th have increased their collective share from 18.4% to 19.1%, those ranked 101st – 200th have seen their share rise from 10.2% to 11.3%.

Market consolidation remains the order of the day

Despite a slight quarterly increase (2%) in the number of active conveyancing firms in England and Wales, consolidation prevails in Q2 2019. The number of active firms dropped below the 4,000 mark for the first time (3,961) in Q1. While there was an increase of 75 active firms in the last quarter, bringing the total to 4,036, this remains the second lowest tally on record.

The Q2 2019 figure is 3% down on the equivalent period last year when 4,144 firms were in operation, and a 6% decrease since 2016 when the EU referendum took place, marking a fallout of 245 firms over a three-year period.

Andy Sommerville, Director of Search Acumen, comments:

“Our latest assessment of conveyancing activity has found that Brexit has truly begun to bite for the sector, even before it has truly arrived. After three years of increasing uncertainty, we’re finally seeing the result of the ‘wait and see’ approach that many homeowners and prospective buyers in England and Wales are taking while Westminster continues to wrangle over the nature of our exit from Europe.

“This Brexit-fuelled market stasis is exacerbating the consolidation trend that has been underway over the last few years. Smaller conveyancing firms who were already struggling to compete are now facing tougher conditions, while those who have been able to gain a larger foothold are now taking a bigger slice of activity than ever before.

“But it’s not all doom and gloom. Looking at the figures more closely, we can see that average monthly transactions are still healthier than the pre-referendum. Conveyancing firms that have established themselves in the strong middle are doing more with less and continuing to thrive in the midst of a challenging market.

“We talk to many law firms on a daily basis about the challenge of doing more with less. They are always excited by the prospects of advancing technology to increase efficiencies and offer clients more – particularly in niche or specialist areas such as the new build sector. But the jump from theory to practice is still too much for many firms and practitioners, who continue to work just as hard as they have for decades without the benefit of better outputs.

“We don’t expect an improving market until Brexit is resolved, so the time is now for firms to make the leap. To increase market share and take advantage of changing market dynamics, conveyancers must think differently and be ready to embrace new ways of doing business.”

Kindly shared by Search Acumen