Buying houses almost £1,400 cheaper than renting – Halifax

According to the latest analysis of data by Halifax, buying houses rather than renting a property is on average almost £1,400 cheaper.

Key points from analysis:

- Annual homeownership costs were £1378 cheaper than renting in 2021

- The cost gap is greatest in Scotland and the North West (22%)

- Annual saving for homeowners over £400 more than 10 years ago

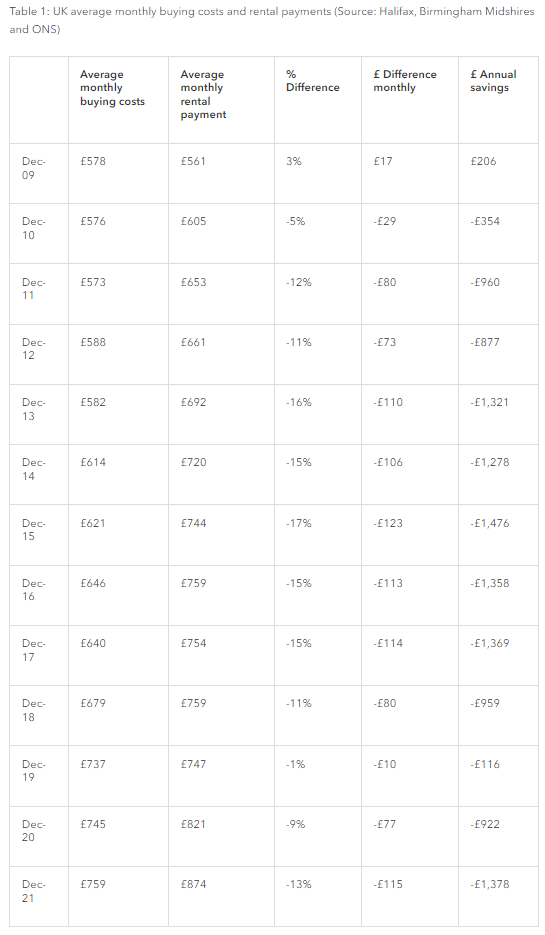

The monthly housing costs for first-time buyers are now £115 (13%) lower than the cost of renting an equivalent home, and the difference could add up to more than £27,600 over a 25-year mortgage, according to analysis by Halifax.

The Halifax Buying vs Renting Review is based on the housing costs associated with a mortgage on a three-bed home, compared to the average monthly rent of the same property type.

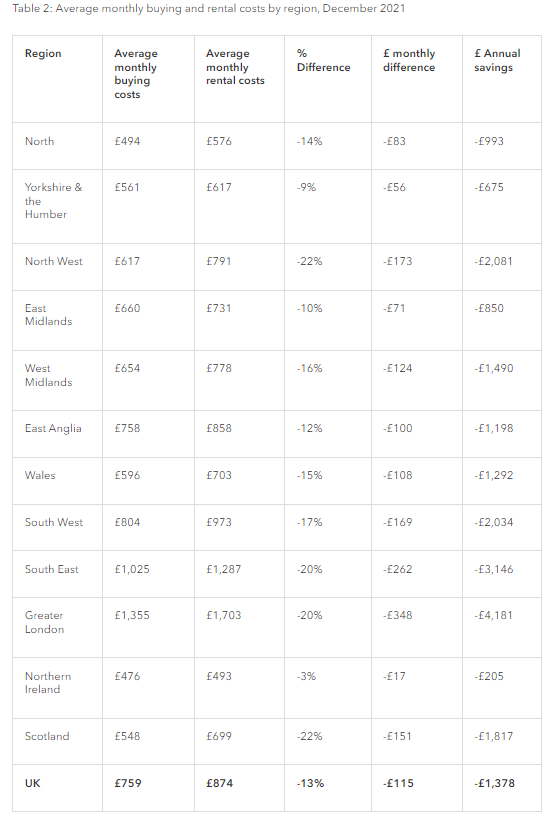

Last year, monthly rental costs grew by 6% to £874, while buying costs grew just 2% to £759, a monthly difference of £115, or £1,378 for the full year.

Having narrowed in each of the last three years, the gap is now at its widest since 2017, and is over £1,200 greater than its historical low in 2019 (£116 annual saving). However, the current difference (£1,378) is not as great as in 2015, when annual ownership costs were £1,476 less than those for renting.

The biggest differences proportionately were in Scotland and the North West at 22%, while the gap between annual rent and ownership in absolute terms was greatest in London, where renting is £4,181 more costly. The smallest gap was seen in Northern Ireland, where renting was just £17 per month (3%) higher than ownership. (£205 per year) (See Table 2)

Esther Djikstra, Mortgages Director, Halifax, said:

“Over the last year, we have seen record numbers of buyers entering the market, moving to bigger properties and taking advantage of the Stamp Duty holiday. However, historic lows for interest rates have kept mortgage costs down, compared to rents.

“For the second year running, buyers in Scotland see the greatest proportional difference in costs compared to renters and are joined this year by those in the North West of England, where rents are over a fifth more than buying costs.”

“Still, before homebuyers can benefit from lower monthly costs, a deposit needs to be put together, still the greatest challenge for many first-time buyers.

“The £62,000 average deposit we see in our data may be an unimaginable sum to potential first-time buyers, but it’s much higher than many need to get a foot on their housing ladder.

“Deposits from 5% are available and, based on the average house price, mean putting down a £12,500 deposit – significantly less than the average.”

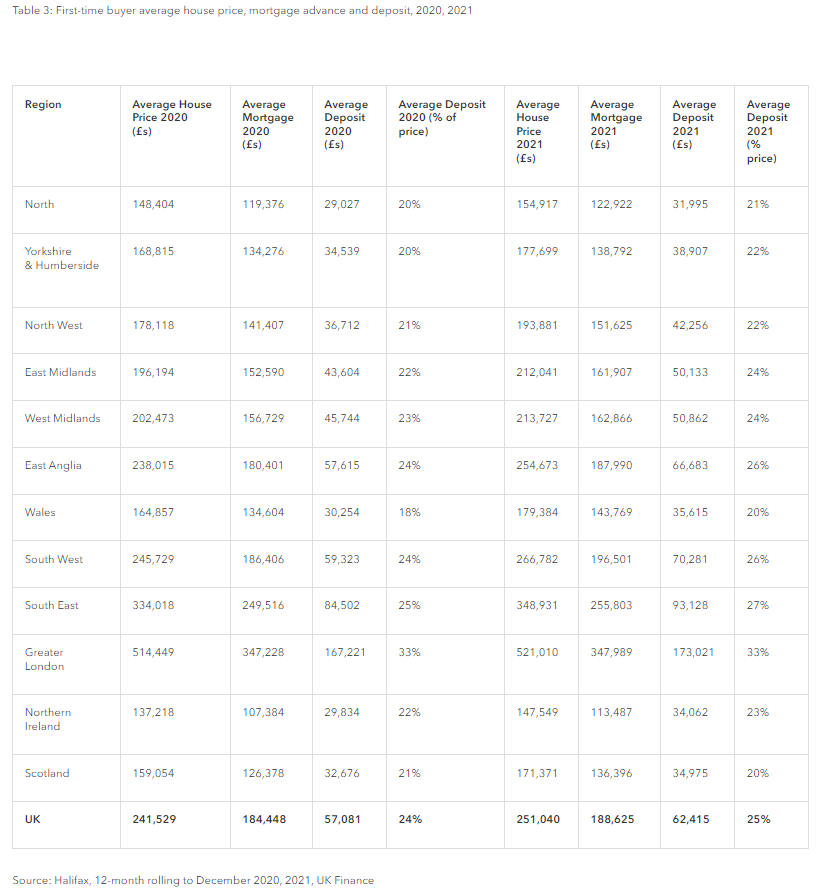

The average deposit, as a proportion of house price, rose only marginally from 24% in 2020 to 25% in 2021. However, in absolute cost terms it rose £5,334 to £62,415, a growth of 9%. (See Table 3)

Kindly shared by Halifax

Main photo courtesy of Pixabay