Build-to-rent boom drives significant new housing supply across the UK

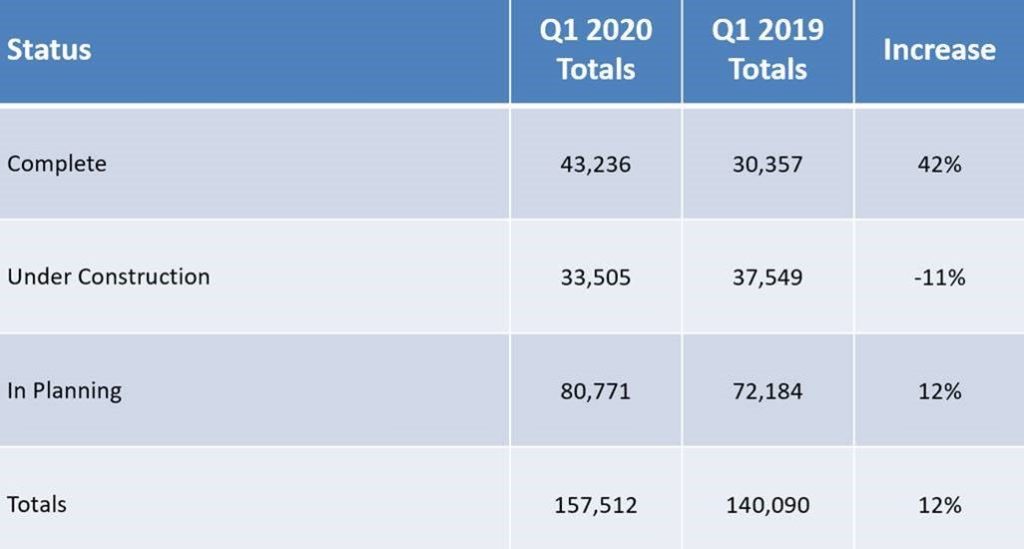

20 April 2020, London: Research published today by the British Property Federation (BPF) shows that there are now 157,512 build-to-rent homes – new, high-quality and professionally-managed homes built for renters – complete, under construction or in planning across the UK.

This is a 12 per cent jump against the same period last year.

To aid transparency on the sector and its growth, the research has been produced by Savills, commissioned by the BPF, and draws on Molior data in London. It is published quarterly as an interactive map on the BPF’s website.

Today’s findings reveal that between Q1 2019 and Q1 2020, the number of completed build-to-rent homes rose by 42 per cent, the number under construction decreased by 11 per cent and the number in planning jumped by 12 per cent.

Table 1: Total number of build-to-rent homes recorded at the end of Q1 2020 vs at Q1 2019

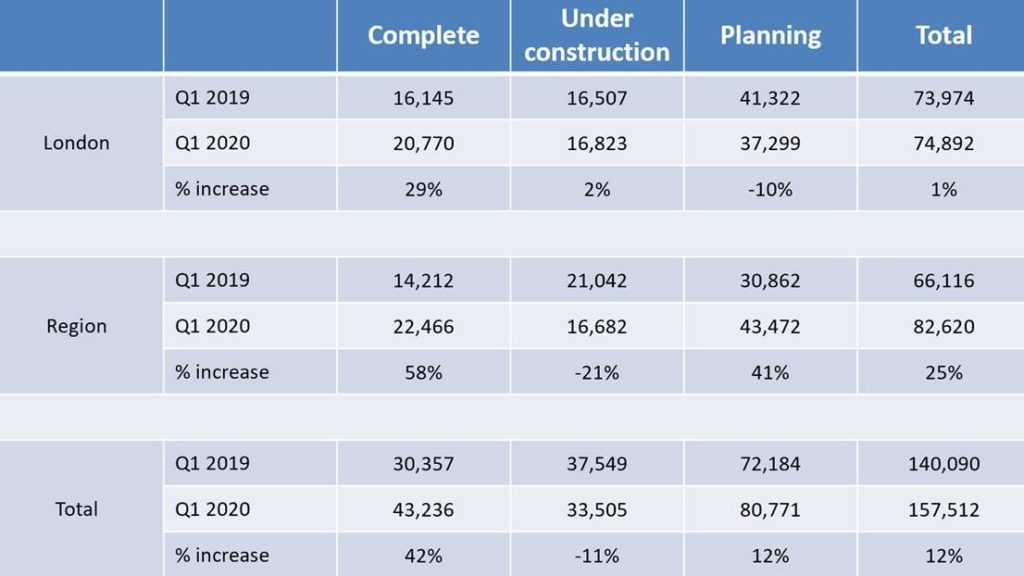

Outside of London, the sector continues to see a significant rise in the number of homes completed with a jump of 58 per cent in the last 12 months across the regions.

With significantly higher volumes of homes moving from under construction to complete, growth in the number of homes under construction has been relatively static in London with a 2 per cent rise and has decreased in the regions with a drop of 21 per cent.

With a robust pipeline of new built-to-rent homes in planning across the regions, which rose by 41 per cent in the past year, the number of homes under construction should rise again.

London, however, has seen a decrease in the number of homes in planning, falling by 10 per cent since the end of Q1 2019.

Table 2: Total number of build-to-rent homes recorded at the end of Q1 2020 vs at Q1 2019 in London and the regions

While professional investment firms typically finance build-to-rent and manage the development for the long-term, the research today also shows the breakdown of types of organisation actually building the new homes. Local developers are currently responsible for building 28 per cent of the market, with UK housebuilders (27%), major UK developers (17%), contractors (14%), registered providers (9%) and major international developers (3% making up the rest.

It is too early to see the impact of coronavirus on the build-to-rent sector’s housing pipeline but, on behalf of its members, the BPF pledges the build-to-rent sector’s commitment to supporting its customers who are concerned, through no fault of their own but due to coronavirus, about how they are going to pay rent following the Prime Minister’s necessary decision to close businesses across the country and restrict people’s movement.

While the Government has announced positive emergency measures such as Local Housing Allowance to cover at least 30 per cent of market rents and income support of up to 80 per cent of £2,500 a month, professional landlords want customers to understand that if they are at immediate risk of defaulting on a rent payment because of coronavirus, temporary relief is available depending on individual financial circumstances. Please contact your landlord as soon as possible to discuss further support with payment plans.

Ian Fletcher, Director of Real Estate Policy, British Property Federation, comments:

“Pain is being felt across all sectors of the economy, but build-to-rent remains attractive to investors and we know from past experience that demand for rental housing usually leads homes-for-sale out of any recovery.

“Our statistics show that a quarter of build-to-rent delivery is now coming from major housebuilders and their support of the sector, through for example access to land, could really boost growth in this sector.

“One concern is the London pipeline – the statistics show a sharp decline in the number of homes in planning across the capital. London was a leader in championing build-to-rent and the sector’s role in adding much-needed new homes to its housing market. The imbalance between housing demand and supply has not gone away, and if anything the impact of coronavirus has shown us that a safe and secure home for everyone is fundamental, and we should be doing everything we can to ensure the capital’s housing market delivers for everyone.”

Jacqui Daly, Director, Savills residential research, adds:

“We’d expect high levels of uncertainty to increase demand for rented accommodation as people look to avoid longer term commitments such as mortgages, or if borrowing remains more constrained. At the same time, we expect to see the leveraged buy-to-let sector to remain under pressure, driving demand into build-to-rent.

“This means that once lockdown is lifted, build-to-rent developers should be confident to progress stalled developments. Also, housebuilders will face particular pressure to restore their sales rates when restrictions on doing business are lifted so we could see a greater role for build-to-rent to absorb stock. Housebuilders now account for 27% of total build-to-rent pipeline compared to just 10% just three years ago. We could see this share increase significantly over coming months.”

Kindly shared by British Property Federation (BPF)