BPF: Build-to-Rent provides secure leases and value for money

The largest-ever analysis by the British Property Foundation (BPF) and other firms of Build-to-Rent finds it provides secure leases and value for money.

Key points from analysis:

-

- Analysis of more than 40,000 residents in over 19,000 homes across England

- 92% of BTR schemes offer tenancies of up to three years and a quarter offer more than three years, highlighting the security that Build-to-Rent (BTR) provides

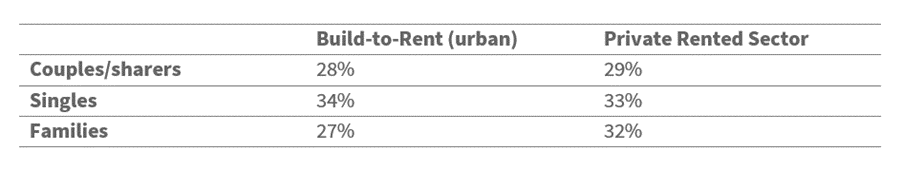

- Couples and sharers living in BTR spend less of their household income on rent than those in the wider private rented sector

The largest-ever analysis of BTR in England shows that BTR has a broad and evolving customer base similar to the wider private rented sector and is a secure and cost-effective option for today’s renters.

In its third year, the Who Lives in Build-to-Rent? report from the BPF, Dataloft, BusinessLDN, and the UK Apartment Association (UKAA) analysed 122 schemes in England totalling over 40,000 residents in over 19,000 homes, representing over 25 per cent of total completed BTR homes in the UK.

The urban component of the data, constituting 32,716 residents and 15,274 homes across 67 schemes, was benchmarked with tenants across the wider private rented sector. Amidst a highly volatile rental market, BTR was shown to offer the option of long secure leases, with 92 per cent of BTR schemes offering up to three-year leases, and a quarter (25%) offering leases of more than three years. Close to a quarter (23%) of BTR tenants are currently in tenancies of three years, and over half (53%) of leases were renewed over the last year.

BTR provides extensive amenities alongside high quality and well-managed apartments. For a single monthly cost, three-quarters (73%) of residents can access a co-working or meeting space, suiting new ways of working. Outdoor space is a core component of BTR, a much-coveted amenity, with 81% of BTR schemes having a shared garden or roof terrace. Nearly two-thirds (58%) of residents also have access to a gym, and a third (30%) fitness studios.

24-hour security, available at 69% of schemes, and concierge (85% of schemes) and parcel storage (79%) all add to the experience of living in a secure home and community.

The proportion of monthly income families, couples, and sharers spend on BTR homes is less than in the wider private rented sector, with singles paying only slightly more. BTR also adds value with its extensive range of amenities captured within the monthly rent – costs, such as gym membership or studio passes, that many renters incur separately when renting from private landlords.

Table 1: Residents’ Housing Costs – BTR (Urban) vs PRS (% of income spent on rent):

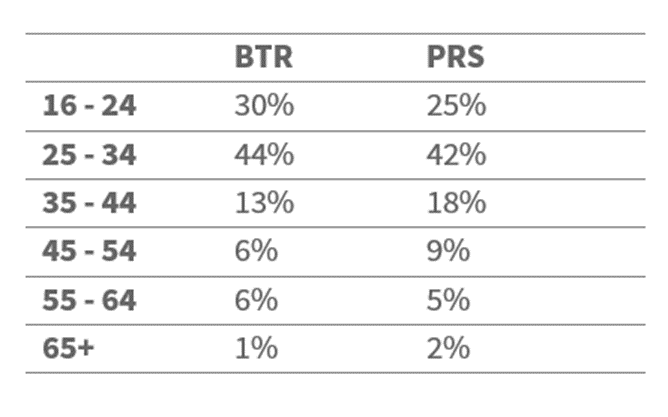

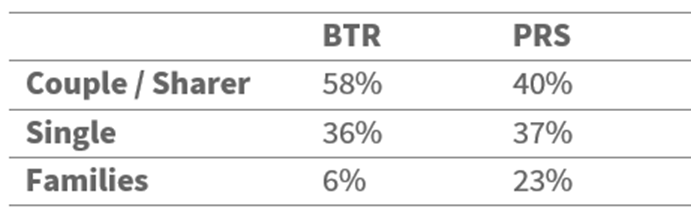

The profile of renters living in BTR and the wider private rented sector is similar across age bands, with 87% of BTR and 85% of private renters aged 44 or under. A similar percentage of renters are single occupiers in both parts of the rental market. A higher proportion of the wider PRS is let to families than BTR, but this constituency is now a key target of BTR provision, with the growth of the single-family sector (low-rise individual family homes for rent).

Table 2: Residents’ Age – BTR vs PRS:

Table 3: Household types – BTR vs PRS:

Ian Fletcher, Director of Policy, British Property Federation, comments:

“This research continues to reinforce that Build-to-Rent homes cater to a diverse tenant base, comparable to that found in the private rented sector. BTR is delivering well-designed and professionally managed homes that provide value for money for tenants with its extensive range of amenities and long secure leases.

“BTR has rapidly established itself as an important and growing part of the housing market and continues to evolve to provides homes for a wide range of customers.

“Its diversification out of core cities and into single family housing demonstrates its increasing appeal and ability to cater to housing need.”

Brendan Geraghty, CEO, UK Apartment Association, comments:

“This is amongst the most mature data available for BTR across England and points to a stabilising and predictable customer profile who are enjoying living within BTR communities.

“The report illustrates that the BTR product offering appeals to all home seekers and with its focus on quality, it’s clear that BTR is an increasingly popular and attractive choice amongst renters.

“Happy customers stay longer with the data indicating that BTR is lending a helping hand to create happy homes for all.”

Stephanie Pollitt, Programme Director, Housing at BusinesssLDN, said:

“Build-to-Rent homes are now widely established as high-quality, affordable properties that can meet the diverse needs of tenants across the capital.

“With the rising cost of living, these developments provide affordable, long-term homes for families, sharers and singles.

“The findings in this report demonstrate the importance the Build-to-Rent sector plays in helping to alleviate London’s housing crisis.”

Sandra Jones, Managing Director, Dataloft, comments:

“This research comes at a critical time in the UK rental market. Cities across the UK are faced with a shortage of homes to let which is putting acute upward pressure on rents and at a time when the cost of living is also rising.

“This report helps explain the important role that Build-to-Rent can play in alleviating shortage by showing how it is already meeting the needs of renters from a wide range of income brackets and age groups.

“While Build-to-Rent remains a small proportion of the total rental stock, its contribution is growing fast and its potential to relieve some of the pressure on supply is evident.”

Kindly shared by British Property Federation (BPF)

Main article photo courtesy of Pixabay