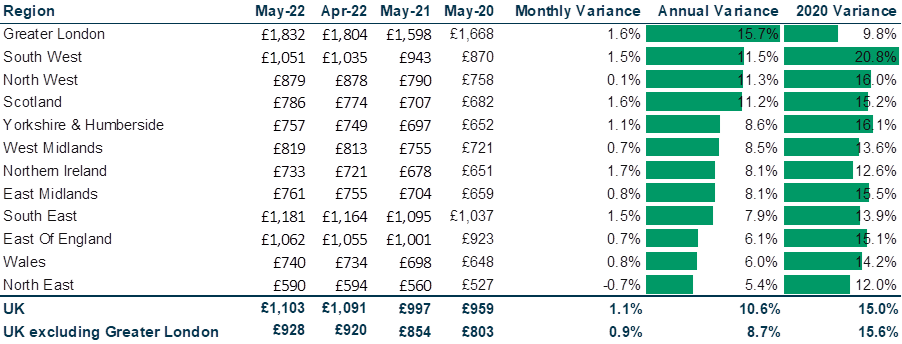

Average UK rent price rises to new record high of £1,103 p.c.m.

Average UK rent price rises to new record high of £1,103 p.c.m., according to the latest publication of the HomeLet Rental Index, which also shows average rents in the UK are up 1.1% month-on-month, with Northern Ireland seeing the largest monthly variance.

The headlines from this month’s report are:

- The average rent in the UK reaches another record high of £1,103 PCM, up 1% on last month

- When London is excluded the average rent in the UK is now £928, up 9% on last month

- Average rents in London have risen again. Rents in the capital have risen to a new average of £1,832 PCM – an increase of 6% over last month

- Northern Ireland saw the largest monthly variance, with rents 7% higher than last month

The HomeLet Rental Index provides the most comprehensive and up-to-date data on rental values in the UK.

The trends reported within the HomeLet Rental Index are from data on actual achieved rental values for just-agreed tenancies arranged in the most recent period – providing an in-depth insight into the lettings market and what’s happening right now across the UK.

Commenting on the latest figures, lettings expert Mike Dawson said:

“With continued universal pressure on households, we’re seeing tenants stay in properties for more extended periods. However, as summer approaches, we expect tenants to move at a much higher rate which means average rents for new tenancy agreements will continue on an upward trajectory.

“The rental market plays a critical role in satisfying the UK’s housing needs, and the long-awaited Renters’ Reform Bill needs to strike the right balance by protecting both tenants and landlords.

“With many landlords already exiting the market, the government’s commitment to legislation will provide the biggest change to rental law in a generation and shouldn’t risk marginalising landlords even further.”

Dawson, a director at the UK’s largest tenant referencing firm, continued:

“Whilst managing agents can provide a vital service to landlords as the market becomes more complex, there’s a genuine risk that we will continue to see a decline in the number of landlords in the UK.

“Ultimately, tenants will foot the bill if the level of stock decreases and demand grows, as we saw with the 2019 Tenant Fees Act.”

Table: Final Rental figures from the May 2022 HomeLet Rental Index:

Table: Rent to Income Ratios for All Regions:

| Region | May-22 | May-21 | Variation |

| UK | 30.5 % | 30.5 % | 0.0% |

| UK Ex London | 29.5 % | 29.6 % | -0.1% |

| North East | 24.1 % | 24.0% | 0.1% |

| North West | 29.4 % | 29.4 % | 0.0% |

| Yorkshire and The Humber | 27.0 % | 26.8 % | 0.2% |

| East Midlands | 28.8 % | 29.0 % | -0.2% |

| Wales | 29.0 % | 29.1 % | -0.1% |

| South West | 32.0 % | 32.0 % | 0.0% |

| South East | 31.3 % | 31.8 % | -0.5% |

| London | 34.0 % | 34.0 % | 0.0% |

| East Of England | 30.6 % | 31.3 % | -0.7% |

| West Midlands | 29.0 % | 29.0 % | 0.0% |

| Scotland | 26.0 % | 25.2 % | 0.8% |

| Northern Ireland | 23.4 % | 27.6 % | -4.2% |

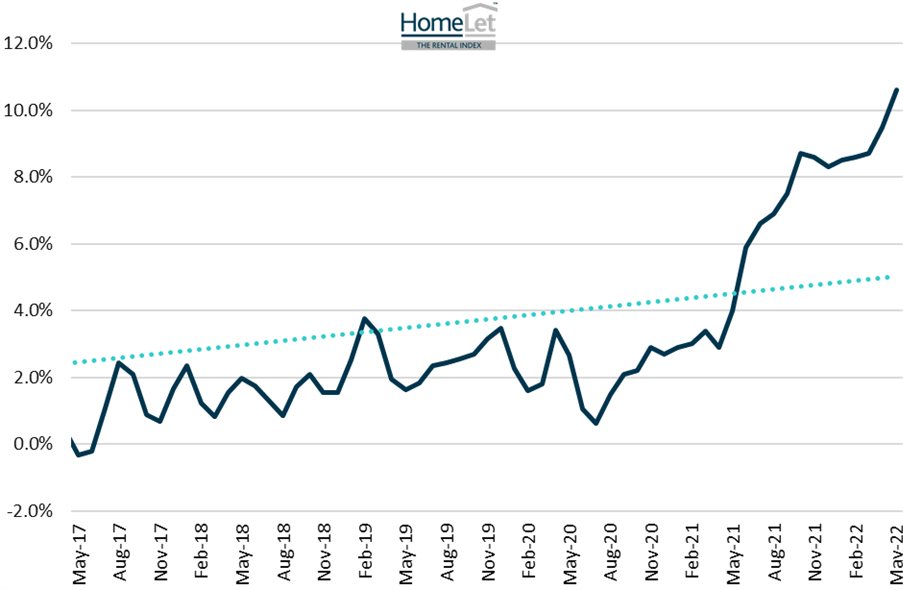

Chart 1: Annual Variance in UK Rent:

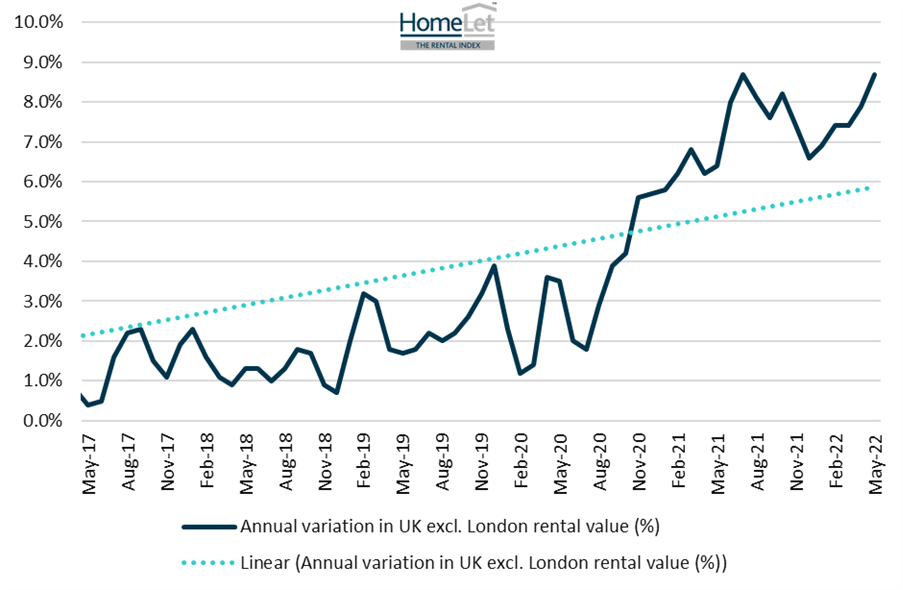

Chart 2: Annual Variance in UK Rent (Excluding Greater London):

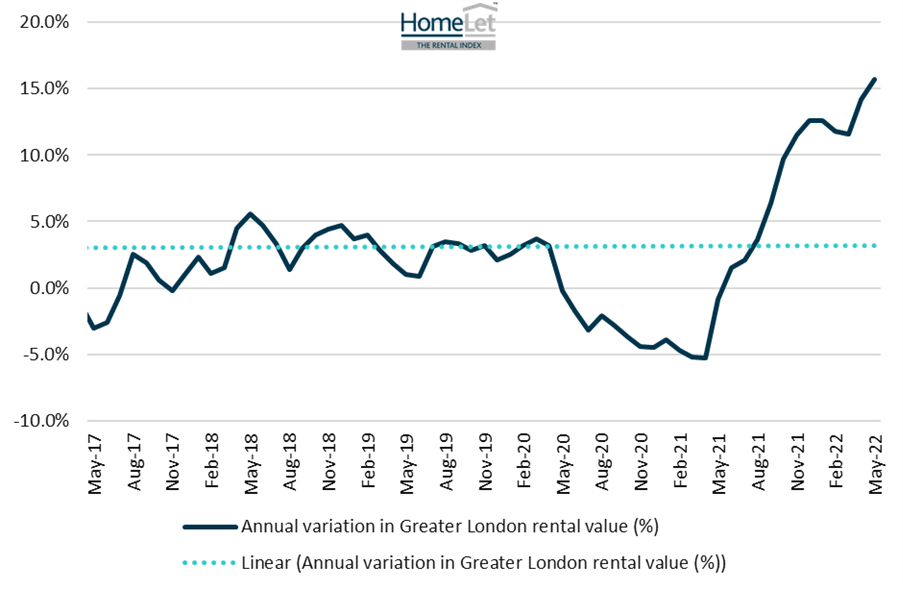

Chart 3: Annual Variance in Greater London Rent:

Head here for more information.

Kindly shared by HomeLet

Main article photo courtesy of Pixabay