Abolition of Multiple Dwellings Relief to cost UK investors an extra 400% in property tax

David Hannah, Group Chairman of Cornerstone Tax, discusses the news that the Abolition of Multiple Dwellings Relief will cost UK investors an extra 400% in property tax.

The abolition of Multiple Dwellings Relief (MDR) following Chancellor Jeremy Hunt’s Spring Budget, has brought into sharp focus the additional costs for investors when they purchase multiple properties in the UK. The loss of MDR will now result in property buyers having to pay an increased amount of tax by a staggering 400%.

Though there is, however, still the statutory rule that if you buy six or more units then the purchaser receives a non-residential rate and pays no surcharges, the UK government have generated another block to stopping the UK property market from making a recovery.

With MDR being implemented, a property buyer purchasing three apartments from a developer at £350,000 each would have paid £46,500. That same investor will now have to pay £77,750 and note, that the purchase of an individual unit would only have cost him £15,500 and so, if the transactions aren’t linked, they would still pay £46,500 in total.

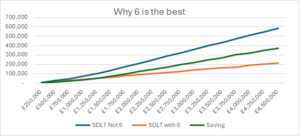

Property buyers in the UK who are now eager to buy six units and pay the 5% rate of SDLT, will in effect of have to pay £47,250 each which is less than the £77,750 they were being asked for, and only slightly more than the £46,500 that they would have paid for under MDR.

In reality, had the price been £400,000 each the six units would have been cheaper than MDR.

The chart below shows the benefit that can be obtained by applying the rule of six on multiple purchases and the effect increases dramatically as the average price per dwelling increases.

As a result of this, purchasers of multiple units will either have to increase their minimum purchase quantity to six or, conceivably team up with other multiple purchasers into buying groups.

This will enable them to buy six units collectively and to ensure that they receive the benefits of the non-residential rate and pay no surcharges whatsoever.

The consequences of the abolishment of MDR, is that the Chancellor has, therefore, restored a historical injustice in Stamp Duty Land Tax.

The UK’s Treasury and HMRC may well not see an increase in tax take but in fact a decrease, once these perfectly valid commercial arrangements become mainstream.

Kindly shared by Cornerstone Tax