£82bn coronavirus backlog of property transactions

According to the Cities Index by Hometrack, it shows that there is an £82bn backlog of property transactions as a result of the coronavirus lockdown.

Headlines:

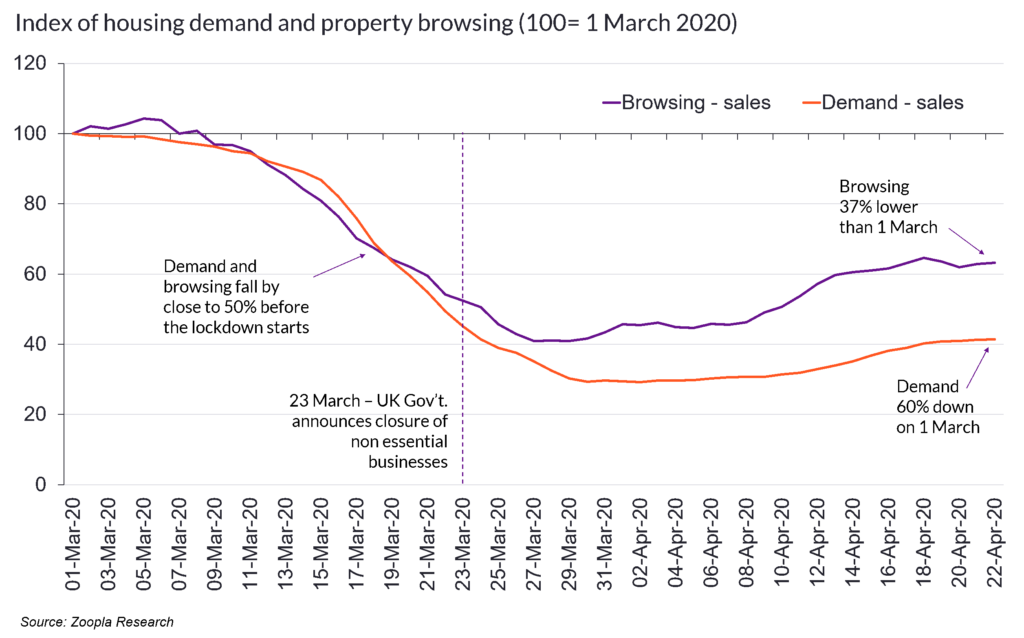

- 373,000 property transactions paused during lockdown, with a combined estimated value of £82bn, amounting to a backlog of £1bn of estate agency sales revenue

- Demand for homes fell by 70% in March. The decline bottomed out by early April and there has been a steady increase in demand over the three weeks to 19 April

- Year-on-year house price growth in March 2020 was +1.8%, but price change over the month was the lowest for a year (0.1%)

A pent-up market on hold

This month’s Cities Index, shows that a handful of sales are still progressing, but that new sales agreed are running at a tenth of the levels recorded in early March, with volumes similar to what the market would traditionally see in late-December.

Yet, some buyers seem to want to press ahead with sales – perhaps encouraged by government support for the economy and low mortgage rates.

The rate of housing fall-throughs peaked on 23 March (the day lockdown began) and has since fallen as the volume of new sales being agreed declines.

The outlook for sales progression depends upon how long the restrictions remain in place, the scale of the economic impact, and would-be buyers’ ability to proceed with sales.

Get the full report for our detailed assessment of regional demand trends, and the longer-term buyer outlook.

Detailed house price metrics – 65 cities

Our table of house price growth metrics for 65 cities reveals a high of +4.1% in Nottingham, through to a low of -2.5% in Aberdeen.

London City index – detailed view

Our full breakdown of price across Greater London indicates annual growth ranging from +2.4% in Waltham Forest to -0.8% in Enfield.

David Ross, Managing Director of Hometrack, said:

“The signs of faster recovery in pockets of the UK shown by this month’s Cities Index report will be welcomed by the industry. However, longer term predictions on value change are still uncertain as the economic and employment impact remains uncharted.

“Hometrack’s unique position has enabled us to remain at the leading edge of valuation and risk solutions throughout this time.

“Our indices and AVM products continue to perform robustly, despite the uncertainty brought about by the restrictions across the industry. This enables valuation activity to proceed with confidence.”

Subscribe to receive our new Rental Market Report

A quarterly analysis of the private rental market – featuring a new index of private rents, recording trends across 55 geographies.

Kindly shared by Hometrack