1 in 5 suffer moving day delays, costing homeowners over £15 million

Thousands of homeowners across the UK have to cancel their moving day as a result of delays, losing hundreds of pounds in the process, a new survey has revealed.

- Just under 1 in 5 homeowners (19%) who bought their home within the last 2 years experienced moving day delays because of funds not arriving on time and sellers vacating their homes late; 115,000 delayed moves

- 20,500 of these homeowners could not move in on their planned moving date because funds did not arrive in time

- 26% of those who experience delays or cancellations on their moving day incur costs, averaging just over £500; while one in seven (14%) faced costs of over £1,000. The total cost to homeowners is over £15 million

Thousands of homeowners across the UK have to cancel their moving day as a result of delays, losing hundreds of pounds in the process, a new survey has revealed.

According to the study conducted by YouGov on behalf of HomeOwners Alliance and the secure payments provider Shieldpay, a massive 115,000 home moves have been delayed each year because funds didn’t arrive on time and sellers took longer to vacate properties; while a shocking 20,500 moves had to be cancelled altogether because of funds not arriving in time.

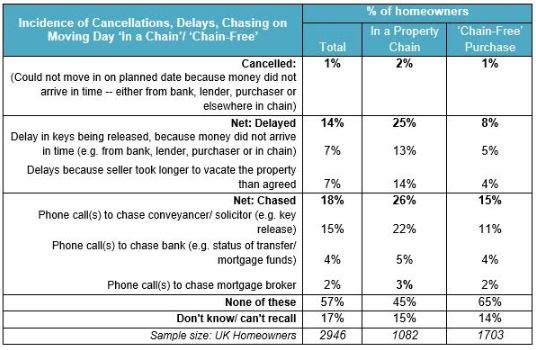

The survey found movers in a property chain are more likely to be affected by delays with one in four (25%) homeowners buying in a chain reporting delays or cancellations on moving day.

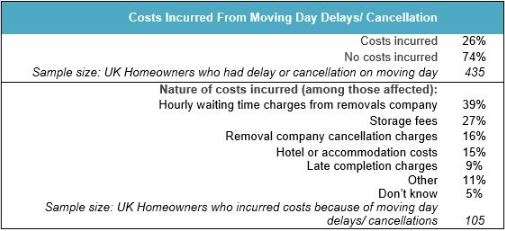

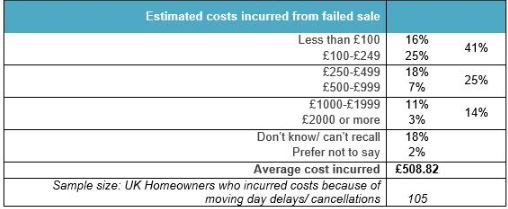

What’s more, homeowners who experience delays or cancellations are faced with more than just inconvenience with 26% of those affected incurring costs of, on average, £509 and one in seven (14%) losing over £1000.

Typical costs include hourly waiting charges from removal companies (39%), storage fees (27%), removal company cancellation charges (16%), hotel/ accommodation costs (15%) and late completion charges (9%).

Meanwhile, one in three homeowners (34%) who bought in the past two years chased either their conveyancer or lender on moving day to check the status of funds.

Geoff Dunnett, Director of Real Estate at Shieldpay, says:

“Moving house is stressful enough without further delays at crunch point. For the most part, homeowners are helpless when things go wrong and it’s rarely their fault. Real time digital payments have the power to change the system for the better, saving time, money and a great deal of stress.

Shieldpay’s instant digital escrow solution brings efficiency, transparency and certainty to the most critical part of any real estate transaction. The status of funds is visible at any time and enables parties to complete on transactions anytime, anywhere – even on the weekend.”

Commenting on the findings, Paula Higgins, Chief Executive of HomeOwners Alliance says:

“It’s ridiculous that in this day and age, where the rest of our lives run smoothly and more efficiently, that moving day nightmares are getting worse. The number of homeowners having to cancel their moving day – often losing hundreds of pounds in the process – is up 2% on a decade ago while the percentage of sellers experiencing inconvenient delays has jumped from 12% to 19%. It’s scandalous that moving house is more difficult than it’s ever been. Clearly, more needs to be done to streamline processes and put customers first. The government has stated it wants to improve the house-buying/selling process, is this really such a hard nut for industry to crack?”

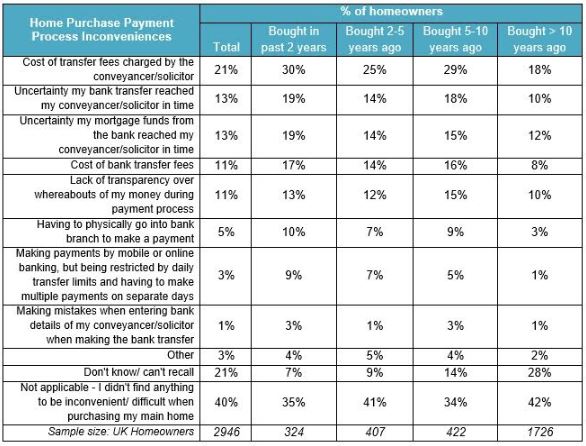

Additional findings from the research indicate that costs associated with fund transfers and the lack of certainty and transparency over the whereabouts of funds are common issues for homeowners. Conveyancer/ solicitor transfer fees (30%), bank transfer fees (17%), uncertainty the transfer reached the conveyancer in time (19%), uncertainty mortgage funds reached the conveyancer in time (19%), lack of transparency over whereabouts of money during the payment process (13%) are all difficulties for homeowners with the current home purchase process.

Key Findings

Chasing up payments and delays are commonplace on moving day:

Nearly one in five homeowners (19%) who bought their home in the last 2 years experienced moving day delays as a result of funds not arriving on time and sellers vacating their homes late; equating to over 115,000 delayed moves.

- One in seven of all UK homeowners (14%) and one in five (19%) homeowners who have bought in the past two years experienced moving day delays as a result of funds not arriving in time or sellers taking longer to vacate properties. Figure 1

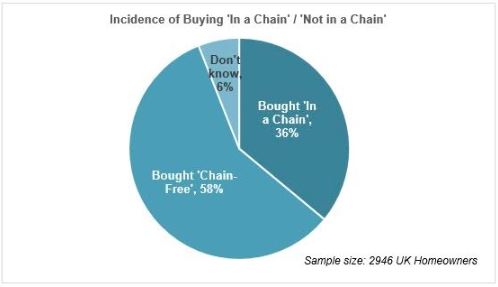

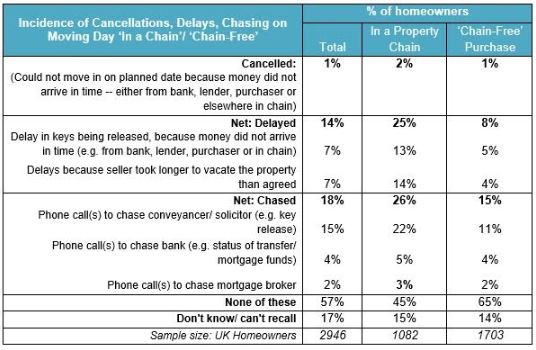

- One third (36%) of homeowners bought in a chain. ‘Property-chain buyers’ are more likely to be affected by delays. One in four (25%) homeowners buying in a chain experience moving day delays as a result of funds arriving late or sellers taking longer to vacate the property. Figure 2B

3% of homeowners who bought within the last 2 years could not move in on their planned moving date because funds did not arrive in time; equating to 20,500 cancelled moves.

- 1% of all UK homeowners and 3% of those who bought within the past two years had their move cancelled on their planned moving day because funds did not arrive in time. Figure 1

26% of those who experience delays or cancellations on their moving day incur costs, averaging just over £500. One in seven (14%) incur costs of over £1000.

- More than a quarter (26%) of those who had moving day delays or cancellations incurred costs. Costs include hourly waiting charges from removal companies (39%), storage fees (27%), removal company cancellation charges (16%), hotel/ accommodation costs (15%) and late completion charges (9%). Figure 3

- Costs average £509 with one in seven (14%) incurring costs of over £1000. Figure 4

- The total cost to homeowners is just over 15 million.3

More than one third (34%) of homeowners who bought in the last 2 years needed to chase the status of funds on moving day with their conveyancer or lender. Figure 2

- Nearly one in five of all UK homeowners (18%) and one in three (34%) who bought in the past two years chased either their conveyancer or lender on moving day to check the status of funds.

In relation to the home purchase process, costs associated with fund transfers and the lack of certainty and transparency over the whereabouts of funds are issues for homeowners.

- Among those who purchased a home in the last 2 years, top inconveniences relating to the home buying purchase process include:

- Transfer fees – conveyancer/ solicitor transfer fees (30%), bank transfer fees (17%).

- Uncertainty and lack of transparency over whereabouts of funds – uncertainty transfer reached conveyancer in time (19%), uncertainty mortgage funds reached conveyancer in time (19%), lack of transparency over whereabouts of my money during payment process (13%). Figure 5

Figure 1: Incidence of Cancellations, Delays, Chasing on Moving Day

Figure 2A: Incidence of Buying ‘In a Chain’ vs ‘Chain-Free’

Figure 2B: Incidence of Cancellations, Delays, Chasing on Moving Day: Chain vs Chain-Free Purchases

Figure 3: Incidence of & Nature of Costs Incurred from Moving Day Delays & Cancellations

Figure 4: Estimated Costs Incurred from Moving Day Delays & Cancellations

Figure 5: Home Purchase Payment Process Inconveniences & Difficulties

Kindly shared by Homeowners Alliance (HOA)