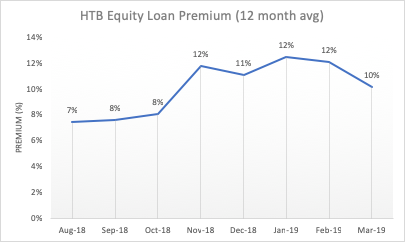

‘Help to Buy premium’ rises to 12% as First-Time Buyer activity peaks

08 April 2019: First-time buyers purchasing new homes using the Government’s Help to Buy Equity Loan scheme paid on average 12% more in February 2019 than those buying new homes without the scheme, according to new research released today by reallymoving.

- FTBs using Help to Buy are now paying 12% more than those buying new homes without HTB

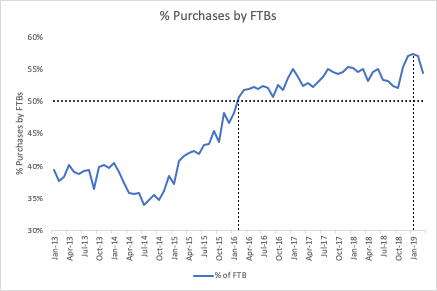

- FTBs accounted for 57% of all homebuyer activity during January and February, a record high

- 18% of all FTBs chose a new build home in January 2019, a record high

According to data collected from over 44,000 first-time buyers using reallymoving for quotes on home move services over the last twelve months, those using Help to Buy paid on average £303,000 in February compared to £270,000 paid by those buying independently.

For first-time buyers struggling to raise a deposit, the Help to Buy scheme can seem like a lifeline, enabling them to buy a new home with a deposit of just 5%, topped up with a Government loan of 20% (or 40% in London) which is interest-free for five years. However, strong demand for the scheme may be encouraging developers to charge higher prices for Help to Buy homes, while also encouraging buyers to pay over the odds by giving them greater spending power.

This so-called ‘Help to Buy Premium’ has risen sharply over recent months, with an 8% premium in October increasing to 12% in January and February 2019.

First time buyers in January and February accounted for 57% of all homebuyer activity, the highest level recorded, while almost one in five (18%) first time buyers are now choosing a new build home over a second-hand home.

Rob Houghton, CEO of reallymoving, said:

“Help to Buy is indeed helping first time buyers get onto the housing ladder, but these figures suggest that they may be paying more than the property is worth in order to get the help they need to raise a deposit. This could be either because developers are charging a premium or because first time buyers are encouraged to buy a more expensive property because the scheme gives them greater spending power.

“Either way, when they come to sell, they may find their property is worth less than they paid for it, made worse by the fact they could be competing with other new developments nearby that are available with Help to Buy, while their own property is no longer ‘new’ and therefore ineligible for the scheme.

“I urge those using Help to Buy to consider how long they intend to hold the property, whether they can afford the loan repayments on top of their mortgage when they five-year interest-free period comes to an end and how easy it will be to resell.

“Meanwhile, housebuilder financial results speak for themselves, with Persimmon last month announcing profits of over £1 billion, or £66,00 per home sold.”

Kindly shared by reallymoving.com