What will Brexit mean for house prices? – Expert predictions

Whether you’re a staunch remainer or avid Brexit supporter, there’s no denying that the UK’s impending exit from the EU has caused property market jitters – and the ongoing uncertainty around whether the UK will leave with a deal is doing nothing to calm nerves.

House price growth plummeted following the referendum in June 2016, then in September 2018 Bank of England governor Mark Carney warned that a no-deal Brexit could send house prices tumbling by a third.

So, with under three months to go until Brexit, what’s likely to happen to mortgages and house prices between now and then – and after we leave the EU?

Here, we analyse market activity before and since the Brexit referendum and give you the insider’s guide to what experts from the estate agency, building, mortgage and buy-to-let sectors think will happen over the coming months.

What’s happened to house prices since the Brexit vote?

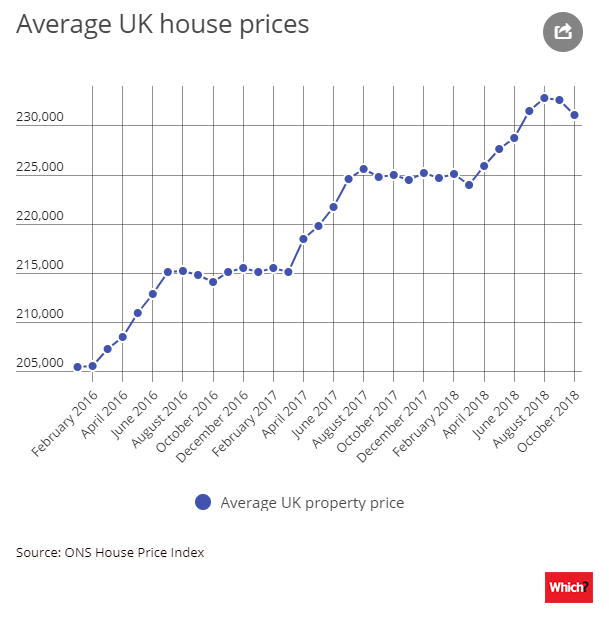

At first glance, it seems house prices did stagnate for a while following the referendum, which took place on 23 June 2016 – as you’ll see in the chart below.

However, the same period the following year saw a similar pattern, with prices remaining relatively static between July and March. Historically, price growth tends to accelerate in the spring and plateau over summer.

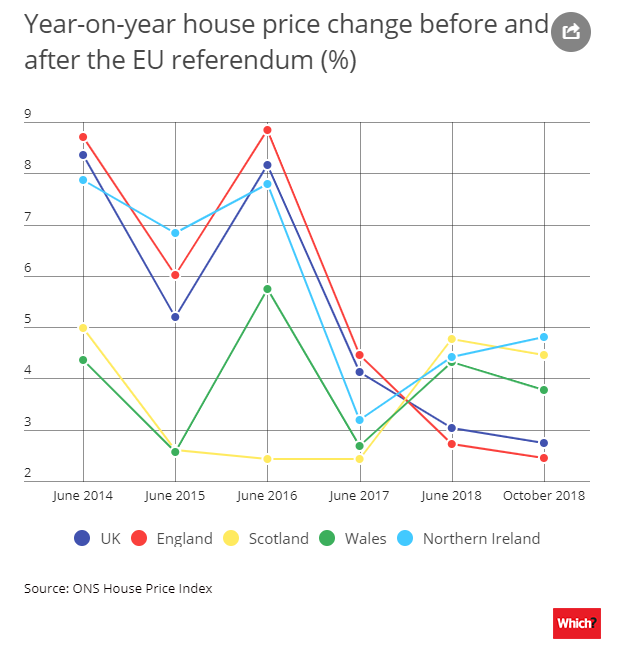

It’s perhaps more interesting to look at house price change as a percentage over the longer term.

As you can see below, the rate of house price growth plummeted in the year after the referendum everywhere in the UK except Scotland. It continued to decrease in England the following year, although it picked back up in the other nations.

But while the rate of growth decreased, house prices themselves didn’t – and many have argued the slowdown in growth is simply a long-overdue market correction.

Transaction volumes since the referendum

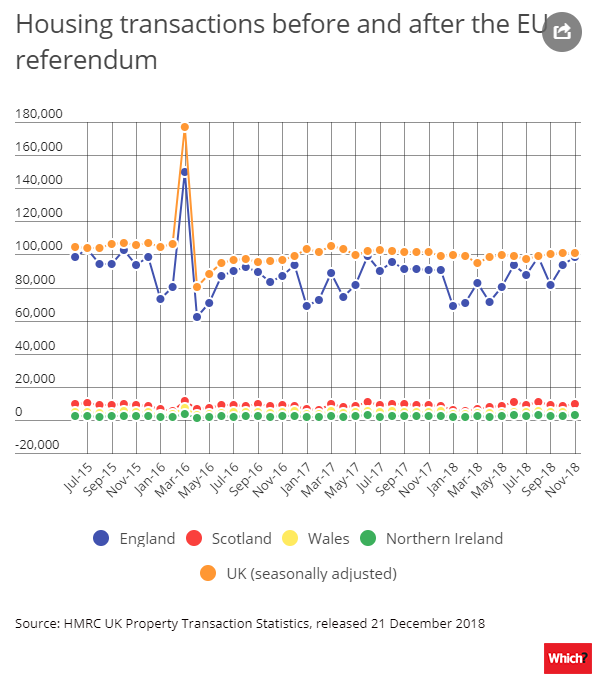

Another way of judging the health of the housing market is by looking at transaction volumes, meaning the number of property sales in any given month.

A lower number of sales can indicate market uncertainty, which is often triggered by events such as an election or a referendum.

However, as you’ll see in the graph below, the referendum doesn’t seem to have much of an impact on transaction figures.

The big spike you can see was caused by the April 2016 introduction of a 3% stamp duty surcharge for buy-to-let investors and people buying second homes, with thousands rushing to buy just before the change came in.

After the April transaction crash, numbers slowly crept up again, seemingly unhindered by the Brexit vote, although they still haven’t recovered to pre-April 2016 levels.

What’s the pre-Brexit market like for sellers?

Two commonly used measures of how the market is performing for sellers are stock per branch – which is the average amount of properties on each estate agency’s books – and time to sell.

The chart below shows a gradual uptick in both over recent months, even when seasonality is taken into account. In fact, it took an average of 60.5 days for a property to sell in September – the highest September figure since 2013 – which could be due to nervousness around buying a home in the run-up to Brexit.

Brexit house price predictions: what do the experts think?

The charts above show us what’s already happened, but what lies ahead? We spoke to a range of industry experts to find out what they believe the future holds for the UK property market, both before Brexit and beyond. Here’s what they said.

The mortgage broker: ‘Don’t just jump into a fixed rate’

David Blake of Which? Mortgage Advisers says:

‘I’m sure many potential buyers are waiting until we know more about the final deal, but this could go on a while and it’s tough putting your life on hold for an unknown.

‘Recent price drops in some regions mean that it’s becoming more of a buyers’ market, so you might be able to get a good deal. Besides, buying a property should generally be regarded as a long-term investment and, even if there is a short-term price drop, house prices will probably stabilise in the future.

‘Mortgage rates are incredibly low right now and many will want to fix into a low rate to give themselves security as we move into a period of uncertainty. But don’t just jump into a fixed-rate deal without considering the alternatives – there are plenty of flexible products that would leave your options to remortgage open if rates did start to change.

‘Let’s face it: Brexit is a complete unknown, and while a professional mortgage adviser won’t have all the answers, they will be able to explain your mortgage options to help you navigate this period of uncertainty.’

The property pundit: ‘If you want to live there long term, buy now’

Kate Faulkner, housing expert and founder of propertychecklists.co.uk, says:

‘Confidence is low and likely to dip further, with most people battening down the hatches until we have a clearer picture of what’s going to happen.

‘If you bought now, you might worry that your home could drop in value. But if you’re going to be there for five or 10 years it shouldn’t make too much difference, as the market could well correct itself by then.

‘What’s more important is whether you can find a property you want to live in long term and, if you do, whether you can afford it. If the answer to both is yes, buy it now, making sure you mitigate against the risk of price falls (for example by choosing a mortgage that would allow you to rent out a room).

‘If you’re considering buying somewhere for the short term, it’s more complicated. Transactions are likely to drop over the next six months and we don’t yet know whether house prices will fall with them. Even if they do, it’s possible interest rates could also jump back to their pre-credit crunch levels of 6-7% if there’s a no-deal Brexit.

‘In terms of the buy-to-let sector, demand from landlords has already reduced so it’s unlikely we’ll see further falls over the next 12 months. That said, it could be a great time to pick up a bargain. I’d wait until mid-November and then go shopping for deals, as people become more desperate to sell before Christmas.

‘But be wary of ploughing cash savings into property: talk to an IFA first to fully understand the tax implications and whether buy-to-let represents the best investment for you.’

The estate agent: ‘Buyers and sellers are putting their plans on hold’

Mark Hayward, chief executive, NAEA Propertymark says:

‘Brexit is undoubtedly causing uncertainty in the housing market, which in turn affects sentiment and decision-making. ‘With details of the final deal still unknown, we’re seeing both buyers and sellers putting their plans on hold. Once the details are clearer, we’ll have a degree of certainty which may trigger a flurry of activity.

‘However, we’re also entering a quieter period seasonally, as people tend to put their moving plans on hold until the new year.’

The buy-to-let expert: ‘Portfolio landlords will fare well’

Chris Norris, director of policy and practice at the National Landlords Association (NLA), says:

‘The issues troubling most landlords are the status of non-UK, and in particular EU, citizens, given their responsibilities to police the Government’s Right to Rent policy, as well as the overall impact that divergence [Brexit] will have on the stability of the housing market.

‘It is still too early to predict what impact Brexit will have on property values. A weakening of the appeal of UK investment could drive prices down or a lack of certainty could drive up interest in the relative stability of bricks and mortar.

‘Likewise, changes to immigration policy could reduce demand from those coming to the UK, or drive up interest from those taking advantage of new arrangements with states outside the EU.

‘It is likely that landlords with established, well-capitalised portfolios will fare reasonably well. However, those heavily reliant on finance may find uncertain conditions more troubling.’

The housebuilder: ‘We need skilled labour from abroad’

Stewart Baseley, executive chairman of the Home Builders Federation, says:

‘Unlike the wider housing market, where transactions have dropped considerably from the historical norm, the new-build market has remained strong in recent months – a trend we expect to continue.

‘The confirmation in the Budget of an extension to the Help to Buy scheme was welcome. The scheme is ensuring demand for new-build homes remains strong [and]… the certainty of demand is enabling builders to plan ahead to increase output in the coming years, as is demonstrated by the record high number of planning permissions being granted.

‘To enable increases to be delivered the industry needs certainty about future labour supply. It is essential that, post-Brexit, the industry continues to be able to access skilled labour from abroad if housing targets are to be met.’

Kindly shared by Which?