Increase in Break-Up Borrowing According to Conveyancing Service Provider, LMS

The proportion of borrowers remortgaging due to break-up, divorce or separation from a partner has increased to 5% of the market in May, according to conveyancing service provider, LMS.

- Proportion of borrowers remortgaging due to separation or divorce rises to 5% of market in May – up from 2%

- Remortgaging to pay off debts also rises from 13% of the market in April to 16% in May

- Demand for five-year fixed rate remortgages increases year-on-year to hit 42% of market

- Increase in equity released through remortgaging to highest level in ten months

These figures include borrowers refinancing to remove an ex-partner from their mortgage, as well as those borrowers who wish to raise additional funds to cover divorce settlements.

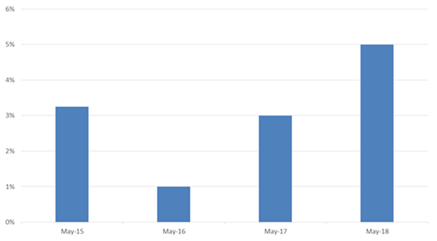

The proportion of homeowners remortgaging due to divorce has risen from 2% of the market in April. It’s also higher than May 2017 when 3% of borrowers remortgaged for this reason.

Proportion of borrowers remortgaging due to divorce or separation

The proportion of borrowers remortgaging to pay off debt has also increased to reach 16% of market in May, up from 13% in the previous month.

The most popular reason for borrowers to remortgage is reaching the end of a fixed rate deal (63%). In addition, 26% of borrowers remortgaged to fund home improvements in May.

Nick Chadbourne, chief executive of LMS, said:

“While most borrowers remortgage to switch deals or save money, we have seen an increase in remortgaging for different reasons this month, including homeowners remortgaging due to divorce or to pay off debts. As divorce becomes simpler through innovations such as the governments new online divorce system, so too is remortgaging. This may well be contributing to the use of remortgaging as a vehicle to raise fund for divorce settlements. In almost all cases customers are looking for an efficient process that delivers against both speed and value. A fees-assisted remortgage is the most appropriate vehicle, developed and refined for this process, it offers both customers and lenders great value and an efficient legal platform to make the switch.”

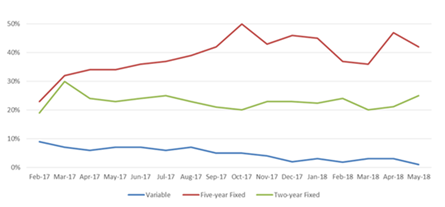

Demand for five-year fixed rate remortgaging increases year-on-year

Five-year fixed rate remortgages continue to be the most popular type of product when refinancing, with 42% of borrowers choosing these deals in May – up from 34% in the same month in 2017.

However, demand for five-year fixes has declined from April, when these deals made up 47% of the market.

Remortgage demand by product type

Nick Chadbourne added:

“Demand for five-year fixed rate remortgages remains historically high as borrowers look to protect themselves from a potential base rate increase later in the year. While the popularity of five-year deals has dipped slightly month-on-month, they continue to dominate the market as borrowers lock in current rates for the long-term.

“Lenders are operating in a competitive landscape, given the volume of different five-year fixed rate products available. Borrowers may wish to consult a broker to ensure they get the best deal to suit individual requirements.”

Increase in equity released through remortgaging

The amount of equity released through remortgage has increased to £22,600 in May, up from £14,600 in April. Equity released through remortgaging has increased to the highest level in 10 months, as the gap between the average remortgage advance and the average redemption value of the original mortgage widens.

The increase has been mainly due to a decline in the average redemption value which has fallen to £143,000 in May – down from £162,000 in the previous month.

Nick Chadbourne said:

“The increase in the gap between mortgage advances and redemptions illustrates more borrowers are remortgaging to increase the size of their loans compared to previous months.”

Kindly shared by LMS