HALIFAX House Price Index: April

Slight rise in house prices as market maintains strength

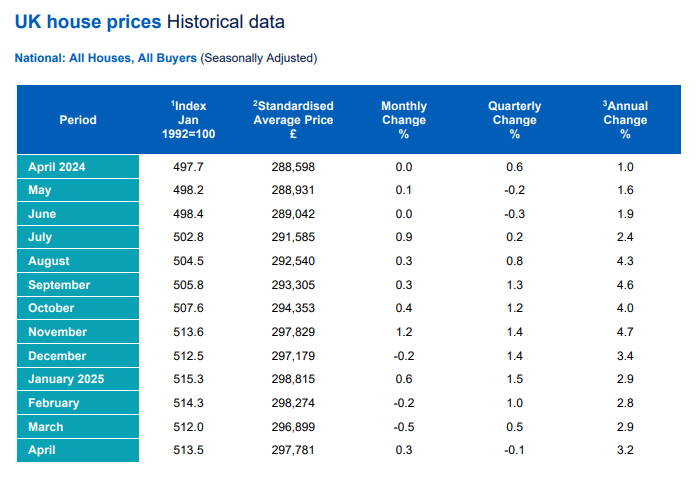

- House prices increased by +0.3% in April vs -0.5% in March

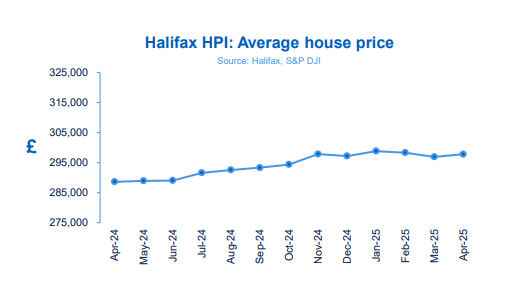

- Average property price now £297,781 compared to £296,899 in previous month

- Annual rate of growth at +3.2% up from +2.9% in March

- House prices remarkably stable over last six months, down by just £48

- Northern Ireland, Wales and Scotland see strongest annual price growth

Amanda Bryden, Head of Mortgages, Halifax, said:

“UK house prices rose by +0.3% in March, an increase of just under £900. The annual growth rate also ticked up to +3.2%, reaching its highest level so far this year. The typical UK property is now valued at £297,781.

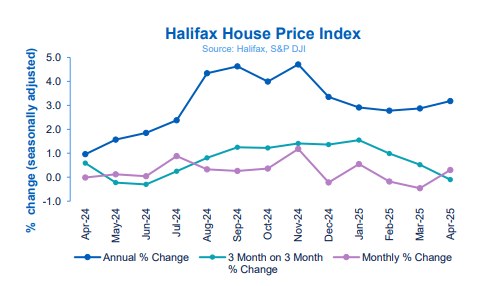

“We know the stamp duty changes prompted a surge in transactions in the early part of this year, as buyers rushed to beat the tax-rise deadline. However, this didn’t lead to a significant increase in -1.0 0.0 1.0 2.0 3.0 4.0 5.0 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24 Dec-24 Jan-25 Feb-25 Mar-25 Apr-25 % change (seasonally adjusted) Halifax House Price Index Annual % Change 3 Month on 3 Month % Change Monthly % Change Source: Halifax, S&P DJI Average house price £297,781 Monthly change +0.3% Quarterly change -0.1% Annual change +3.2% property prices, with the last six months characterised by a stability in prices rarely seen since the pandemic. While the market has cooled slightly since this rush, buyer activity remains strong in comparison to recent years.

“Mortgage rates have continued to fall, with most lenders now offering rates below 4%. Coupled with positive earnings growth that has outpaced broader inflation, these factors have helped to steadily improve affordability for many buyers.

“Overall, the market continues to show resilience despite a subdued economic environment and risks from geopolitical developments. There is likely to be a bump-up in consumer price inflation as household bills increase, but with further base rate cuts also expected, we anticipate a similar trend of modest price growth this year.”

Nations and regions house prices

Northern Ireland, Wales and Scotland recorded the strongest annual growth in house prices in the UK, with all three nations outpacing English regions.

Northern Ireland continues to post the highest level of annual property price inflation, rising by +8.1% in March. House prices now average £208,220.

Wales has the next fastest pace of annual house price growth, increasing to +4.7% last month. The average house price now stands at £229,079.

Next comes Scotland, where property prices were up +4.6% year-on-year in April, to an average of £214,011.

In England, the North West shows the strongest growth, up +4.1% on an annual basis, with properties now costing an average of £240,975. London continues to see more subdued annual house price growth of +1.3%. However the capital remains the most expensive market for properties in the UK, with an average price tag of £543,346.

The South West has the slowest rate of annual property price inflation, at +0.9%. The average house price is £304,451.

Housing activity

- HMRC monthly property transaction data shows UK home sales increased in March 2025. UK seasonally adjusted (SA) residential transactions in March 2025 totalled 177,370 – up by 61.7% from February’s figure of 109,700 (up 80.0% on a non-SA basis). Quarterly SA transactions (January 2025 – March 2025) were approximately +31.6% higher than the preceding three months (October 2024 – December 2024). Year-on-year SA transactions were +104.3% higher than March 2024 (+88.9% higher on a non-SA basis). (Source: HMRC)

- Latest Bank of England figures show the number of mortgages approved to finance house purchases decreased in March 2025, by -1.2% to 64,309. Year-on-year the figure was +4.5% above March 2024. (Source: Bank of England, seasonally-adjusted figures)

- The RICS Residential Market Survey results for March 2025 show a further weakening in sales market activity. New buyer enquiries slipped to a net balance reading of -32%, from -16% with agreed sales at -16%, from -13%. New instructions returned a net balance of +6% (from +11%), it

Kindly shared by Halifax Picture courtesy of Adobe