Knowledge Bank’s July Criteria Index reveals demand for ‘interest only’ making a come back

The latest criteria index from criteria search system, Knowledge Bank, comes from a July that brought us a welcome drop in inflation. However, it is perhaps of little surprise that the Knowledge Bank data shows searches for interest-only mortgages made a come-back, following the Chancellor’s introduction of the Mortgage Charter and the fourteenth successive rise in the Bank of England base rate.

What is less clear is whether there is a similar uplift in ISAs or endowment policies to pay these mortgages off. In the rush to save pennies now, perhaps there is not. In which case, look for a switch back to capital and repayment mortgages in a few months’ time after the six-month hiatus allowed by the Mortgage Charter.

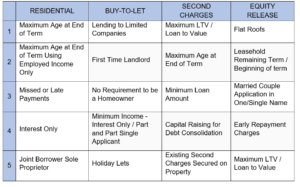

The other new entry in the top five searches for residential criteria was ‘Joint Borrower, Sole Proprietor’. This is enabling parents and other people to guarantor the mortgage, often of younger family members, while avoiding the additional stamp duty incurred by being on the house deeds of a second property. Following a two-month pause, this is once again a key search term for brokers.

It joins the persistent trends of ‘Missed or Late Payments’ and ‘Maximum Age at End of Term’, which have been the top two, highest-trending residential searches throughout 2023. This demonstrates the ongoing pressure many are under to meet their mortgage payments which is clearly prompting brokers to explore ways to ease the burden on their clients and provide greater financial flexibility.

There is increasing evidence that many people are extending their mortgage terms to make their monthly payments more manageable, which again will increase with the introduction of the Mortgage Charter. The search for new loans that will accept people with ‘Missed or Late Payments’ also backs up recent figures from UK Finance that arrears are on the rise.

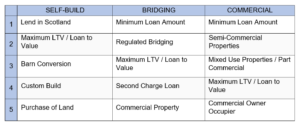

In both bridging and commercial, searches have remained pretty constant throughout the year, which demonstrates a surprising level of stability not seen in other sectors. In bridging, searches in the top three for both minimum loan amount and maximum LTV searches demonstrates that people – usually developers – are looking to maximise their investment in a property.

Consistently in the top two, most-searched for terms for bridging, for over two years is ‘regulated bridging’. With an increasing number of housing chains collapsing due to rising interest rates, there seems to be an increase in regulated bridging loans being used to enable people to break a chain and buy the property they are after, without being reliant on their own purchasers.

New in the commercial sector in July is ‘Commercial Owner Occupier’. This indicates an increased number of business owners are considering ways to buy their own commercial office or premises, perhaps to save on rising rental costs.

The search for ‘Commercial Property’ is also trending in the bridging category. As there appears to be something of an exodus from the residential buy-to-let market, it could be that some more experienced investors are looking to more tax efficient commercial property instead, to refurbish and let out or sell on.

While some are departing the buy-to-let sector, others are still keen to join its ranks. Searches for ‘No Requirements to be a Homeowner’ and ‘First-Time Landlord’ indicate that brokers are actively seeking ways to help clients get on the property ladder, especially those who cannot meet the income requirements for their own home. This reflects the affordability challenges observed in the residential sector, where buy-to-let options remain an attractive alternative for those currently unable to meet the affordability constraints to buy a property they can live in.

Knowledge Bank CEO, Nicola Firth, said:

“Brokers finding creative solutions for residential borrowers is definitely a theme, with many borrowers desperately seeking assistance with their mortgage terms and payment structures. Others, not put off by these challenges are still exploring ways to buy their first property, be it with family support or by trying to buy a rental instead to give them a foot on the housing ladder. A growing number of brokers are wisely using criteria search to identify lenders capable of offering the required lending solutions.

“Despite ongoing economic shifts, searches show how brokers demonstrate commendable care and caution when advising vulnerable applicants seeking solutions. This thoughtful approach speaks to their dedication to safeguarding their clients from potential challenges in an unpredictable market.

“In the month that saw the launch of Consumer Duty, the key role of brokers in assisting both existing and prospective borrowers has never been more important.”

During the first quarter of 2023 there were over 280,000 searches on Knowledge Bank and over five million criteria searches have been carried out to date.

The situation remains dynamic, with market watchers keenly observing the interplay between rates and inflation into the second half of the year.

Criteria Activity Tracker

Top five searches performed by brokers on Knowledge Bank during June 2023

Brokers wanting to be able to search the UK’s largest database of mortgage lending criteria, can visit: www.knowledgebank.uk

Kindly shared by Knowledge Bank

Main article photo courtesy of Adobe Stock