TwentyCI research shows the average time to exchange on a property is shortening

TwentyCI research shows that the average time for homebuyers to exchange contracts on a property is shortening.

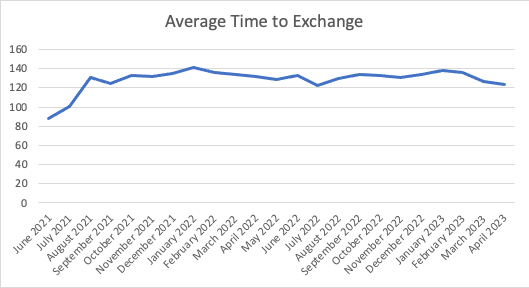

New research from TwentyCI shows that over the last six months, the average time to exchange has reduced by 7.06%, from 132.37 days in October 2022, to 123.64 days in April 2023.

Source: TwentyCI

The research also reveals that the average time to exchange a property by region does vary. In Scotland, the average time to exchange in 2023 was only 93.2 days (just over 3 months) – this is because they have a separate legal system. Northern Ireland is at the other end of the spectrum, with 175.9 days, or 5.8 months.

There is a North South divide with Northern regions taking the least time, followed by the Midlands and the Southern regions take the longest time to exchange. In the North East, it is taking just 115.9 days to exchange, followed by Yorkshire and the Humber, sitting at 116.6 days.

Time to exchange by region:

|

Region |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Scotland |

69.2 |

77.7 |

79.9 |

89.1 |

93.2 |

|

Northern Ireland |

116.6 |

116.5 |

134.7 |

169.2 |

175.9 |

|

North East |

82.0 |

89.7 |

106.3 |

121.8 |

115.9 |

|

North West |

89.2 |

96.4 |

110.1 |

128.8 |

126.3 |

|

Yorkshire and The Humber |

87.6 |

94.9 |

106.5 |

121.5 |

116.6 |

|

East Midlands |

91.2 |

96.8 |

110.8 |

128.6 |

124.7 |

|

West Midlands |

91.1 |

96.3 |

110.9 |

127.8 |

124.7 |

|

Wales |

89.5 |

92.5 |

108.9 |

123.5 |

121.5 |

|

East of England |

100.2 |

103.6 |

123.2 |

147.7 |

145.8 |

|

Outer London |

101.1 |

102.4 |

122.1 |

147.5 |

144.9 |

|

Inner London |

95.8 |

99.0 |

115.2 |

138.4 |

136.8 |

|

South East |

99.2 |

101.3 |

119.3 |

143.6 |

142.8 |

|

South West |

96.5 |

100.7 |

119.4 |

140.0 |

138.0 |

|

Grand Total |

92.4 |

97.3 |

112.6 |

132.2 |

130.2 |

The gap is widening between the time to exchange for £1m plus properties, with it now taking 15.50% longer than properties priced less than £200,000. Over the last 12 months, the price bands that have seen a reduction in the time to exchange are up to £200,000 (4.05%) and £200,000 to £350,000 (2.25%).

Time to exchange by price band:

|

Sum of Average Time to Exchange |

2019 |

2020 |

2021 |

2022 |

2023 |

|

>=0 – <200000 |

88.2 |

94.1 |

109.3 |

125.7 |

120.6 |

|

>=200000 – <350000 |

93.9 |

98.7 |

114.1 |

133.0 |

130.0 |

|

>=350000 – <1000000 |

97.4 |

99.9 |

114.7 |

137.5 |

138.5 |

|

>=1000000 |

94.2 |

94.6 |

111.4 |

133.5 |

139.3 |

Richard Hinton, Director at Pitsford Consulting, said:

“It’s great news that the time to exchange is shortening, which many conveyancing firms are working to tackle.

“Our research shows that the time has stretched out over the last six months. thanks to industry wide efforts to drive down processing times.

“We have seen some exciting new initiatives and collaborations over the last six months such as the recent Upfront Material Information pilot by residential conveyancers Thomas Legal, which has reduced transaction times reduced by up to 53 days.

“For the first time, our data is beginning to track how individual conveyancers are performing, offering the industry deeper, more granular insights into how different firms or segments are performing, be it size of firm, operating model (e.g. panel referrals via direct clients or signatories to particular improvement schemes or projects), geography etc.

“We have developed a data product that supports this focus on transaction by tracking for the first time how fast individual conveyancing firms are completing their purchase cases – sale agreed to completion.”

TwentyConvey was created by TwentyCI in collaboration with Pitsford Consulting to unlock access to the latest residential property market intelligence and lead generation sources for lawyers. Based on one of the largest homemover databases in the UK, tracking over 99% of all residential property listings, TwentyConvey gives conveyancers unparalleled insight into the market data to sharpen their competitive edge. TwentyConvey is a unique lead management resource based on the most comprehensive property market dataset available in the UK

TwentyCi is a residential property market intelligence and marketing services company that provides UK homemover data, analytics & insight for marketing and other key strategic purposes. Their experience and client portfolio encompass multiple sectors and categories, including property and estate agency groups, retailers, financial services, automotive and utilities.

For further information please visit here, or email [email protected].

Kindly shared by TwentyCI

Main article photo courtesy of Pixabay