Sales agreed reach their highest point this year as buyers and sellers cautiously re-enter the market

Zoopla issues its House Price Index, showing that Sales agreed reach their highest point this year as buyers and sellers cautiously re-enter the market.

Key points from publication:

-

- House prices have fallen by 1.3% in the last six months but the speed of falls is reducing as buyer confidence slowly improves

- Sales have reached their highest point this year – up 11% on the five-year average and encouraging more sellers into the market

- Landlords selling homes are adding to supply, accounting for 11% of properties for sale

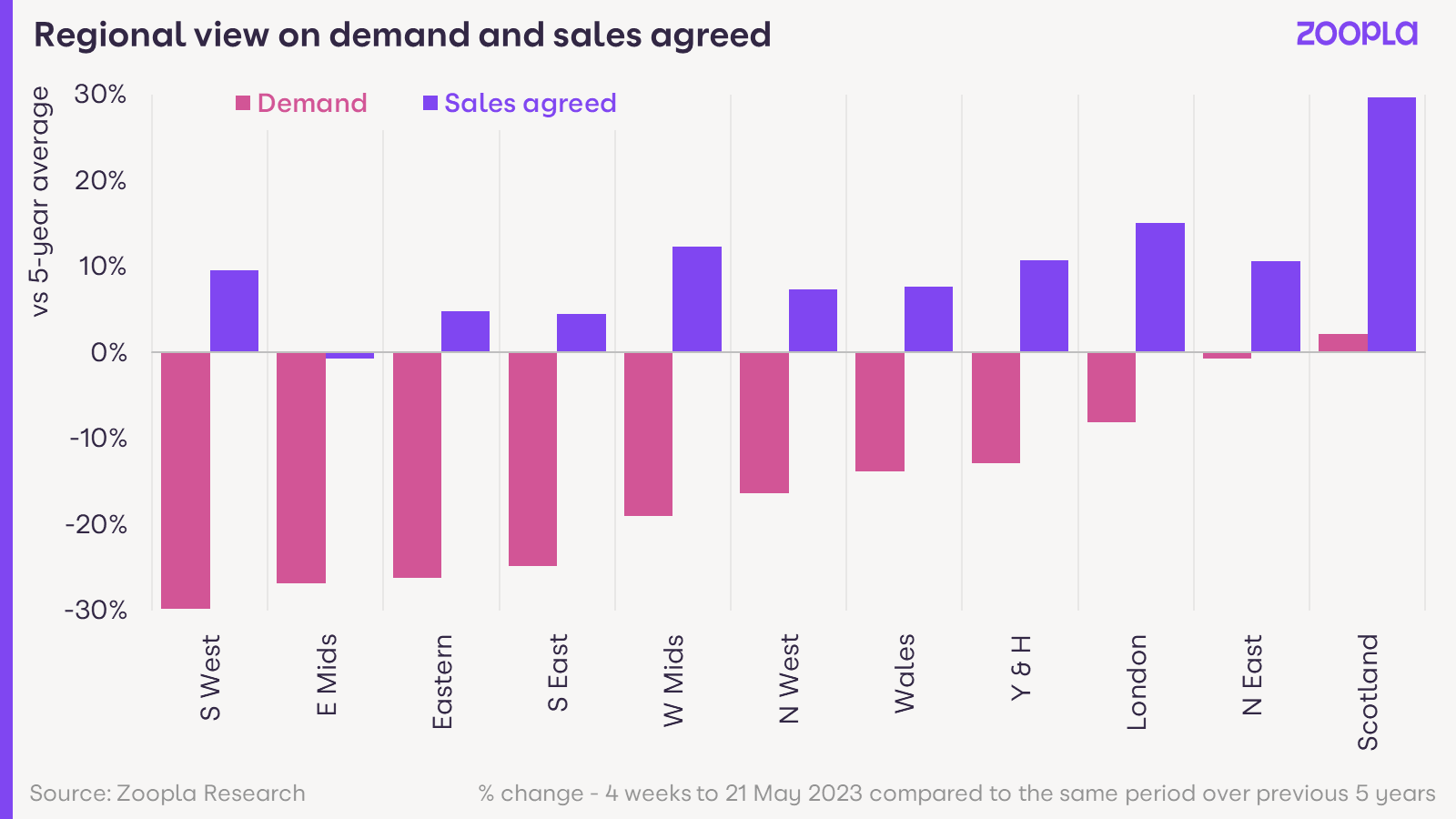

- There are distinct regional differences in the strength of market activity – Scotland, the North East and London are currently the best performing regions

- Mortgage regulations have helped dampen the impact of higher mortgage rates on house prices so far – although the rebound in activity could be impacted if mortgage rates start to increase in H2 2023

Tuesday, 30th May 2023, London: Despite weaker demand than a year ago, sales agreed have reached their highest point this year and are up 11% on the five-year average according to Zoopla’s latest House Price Index.

Pace of house price falls slows as buyer confidence improves

Average house prices have fallen 1.3% over the last six months but the speed of falls has been slowing as buyer confidence improves and more sales are agreed.

However, there are distinct differences in the strength of demand and the number of sales across the country. Demand and sales agreed are running above the five-year average in Scotland, the North East and London, which have been the best-performing regions over the last four weeks.

In contrast, demand for housing in regions in southern England is lagging behind as these regions posted above-average house price growth in recent years, ahead of earnings. This has added to affordability challenges and the impact of higher mortgage rates.

Annual house price growth has slowed in key cities including Oxford (+0.1%), Cambridge (+0.3%), Reading (0.8%) and Brighton (+0.8%).

Despite more sales, sellers need to remain realistic with asking prices to attract sufficient buyer interest. 18% of homes currently listed for sale on Zoopla have had the asking price cut by more than 5%, down from 28% in February.

Landlord sell-off continues – boosting supply of cheaper homes

A proportion of landlords continue to sell homes in the face of higher mortgage rates and rising costs. Just over one in ten (11%) homes currently listed for sale on Zoopla were previously rented out – down from a pandemic-driven peak of 14% in 2020 when rents were falling in London and other major cities.

Historically, around half of these homes listed for sale return to the rental market having been unable to find a buyer – or are bought by another investor. This proportion has fallen to a third more recently as more landlords look to cash in on capital gains to pay down debt or fund retirement.

The average price of a previously rented home is £190,000, 25% below the average value of an owned home. These properties appeal to first-time buyers who often want to buy cheaper doer-upper homes. The increased supply of cheaper homes will be supporting sales activity from first-time buyers (an important group who accounted for over one in three sales last year) in the market.

Has a house price crash been avoided?

The decline in house prices since last autumn has been modest in comparison to some expectations. The biggest impact of higher mortgage rates and the cost of living is on sales volumes which, while starting to rebound, are on track to be 20% lower than last year.

The impact of mortgage rates on house prices has been tempered by mortgage regulations introduced in 2015. All new borrowers have had to prove to their bank that they can afford 6-7% mortgage rates even though they might have been paying 1% or 2%. This means that the market has been effectively operating at higher mortgage rates. Banks are currently testing whether borrowers can afford 8% mortgage rates which have squeezed more buyers out of the market.

The latest inflation figures have increased the likelihood of further interest rate rises which would result in mortgage rates increasing once again. This would impact demand and cut- short the current recovery in buyer confidence. The further interest rates edge above 5% the greater the impact will be on house prices.

Richard Donnell, Executive Director at Zoopla, comments:

“Falling mortgage rates in recent months together with the strength of the labour market has brought more buyers and sellers into the market.

“There are still fewer buyers in the market than a year ago, but sales are still being agreed with more homes to choose from.

“Sellers shouldn’t get carried away by more positive data on the housing market and need to price their homes realistically if they are serious about moving home in 2023.

“Home buyers remain price sensitive with one eye firmly on the outlook for the economy, the cost of living and the trajectory of mortgage rates which appear likely to edge higher in the coming weeks.”

Guy Gittins, CEO of Foxtons Estate Agents, comments:

“The market dynamic for sales rebounded much stronger than many had forecast at the start of the year, after a period of inactivity following the Government’s Mini Budget.

“This demand for London property is caused by the backlog of needs-based buyers who were looking to move following COVID-19, which was so great it has yet to be satisfied, despite the increased cost to buy.

“As well, given the extreme supply and demand imbalance in the lettings market, more renters who are in a position to buy have accelerated their search.

“New buyer activity has led to consistently higher viewing numbers than we have seen at any point in the last six years.

“In fact, our buyer numbers year to date are tracking very closely with the buyer numbers this time last year, which most people would refer to as the most buoyant market we’ve seen since 2016.

“Our growing pipeline of business gives us every expectation that the rest of this year will continue along this positive track.”

Kindly shared by Zoopla

Main article photo courtesy of Pixabay