Three years on: how the pandemic reshaped the UK housing market

After three years since the start of lockdowns for coronavirus, Halifax analyses how the pandemic has reshaped the UK housing market.

Key points from analysis:

-

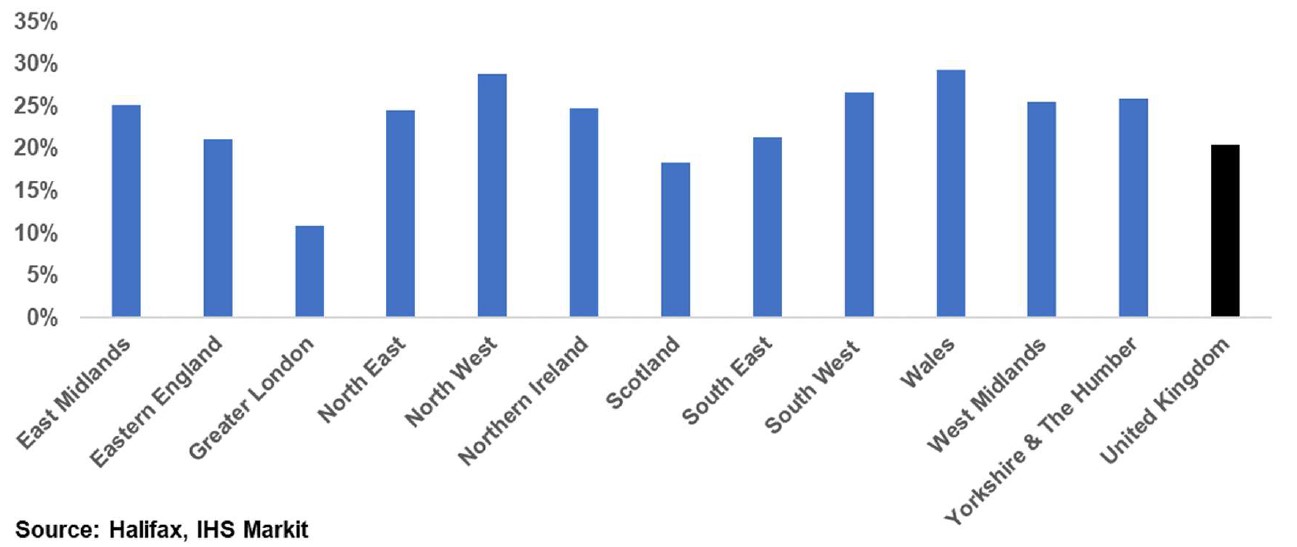

- UK house prices have risen by +20.4% (£48,620) over the last three years (compared to just +7.8% over the previous three years)

- Wales recorded the strongest house price growth (+29.3%) of any UK region or nation since the start of 2020

- The average price for bigger homes has grown at nearly twice the rate than for smaller properties

- Five UK regions have seen the average price of detached houses jump by more than £100,000 since the start of the pandemic

It’s now almost three years since the onset of the pandemic, when the UK was thrust into lockdown for the first time.

One of its many impacts was to transform the UK’s property market almost overnight – prompting a sudden drop in activity as the market largely shutdown, followed soon after by a surge in transactions as initial restrictions began to ease.

New research, based on data from the Halifax House Price Index, has examined how the rate of house price growth – driven by fundamental shift in buyer demand – has varied for different property types across the country since the start of 2020.

The big picture

At a national level, average UK house prices grew by +20.4% between January 2020 and December 2022, up by £48,620 (from £237,895 to £286,515).

For comparison, in the three years prior (January 2017 to December 2019), average house prices grew by just +7.8%, or £17,158.

Wales saw the strongest house price growth of any UK nation or region over the last three years, rising by +29.3% from £168,101 to £217,328 (+£49,227).

In cash terms, the South East of England saw the biggest jump, up by £69,224 (+21.3%) from £325,448 to £394,672.

Growth by property type Detached houses:

Growth by property type:

Detached houses

Drill down into different property types and it’s an interesting story. Take larger homes for example.

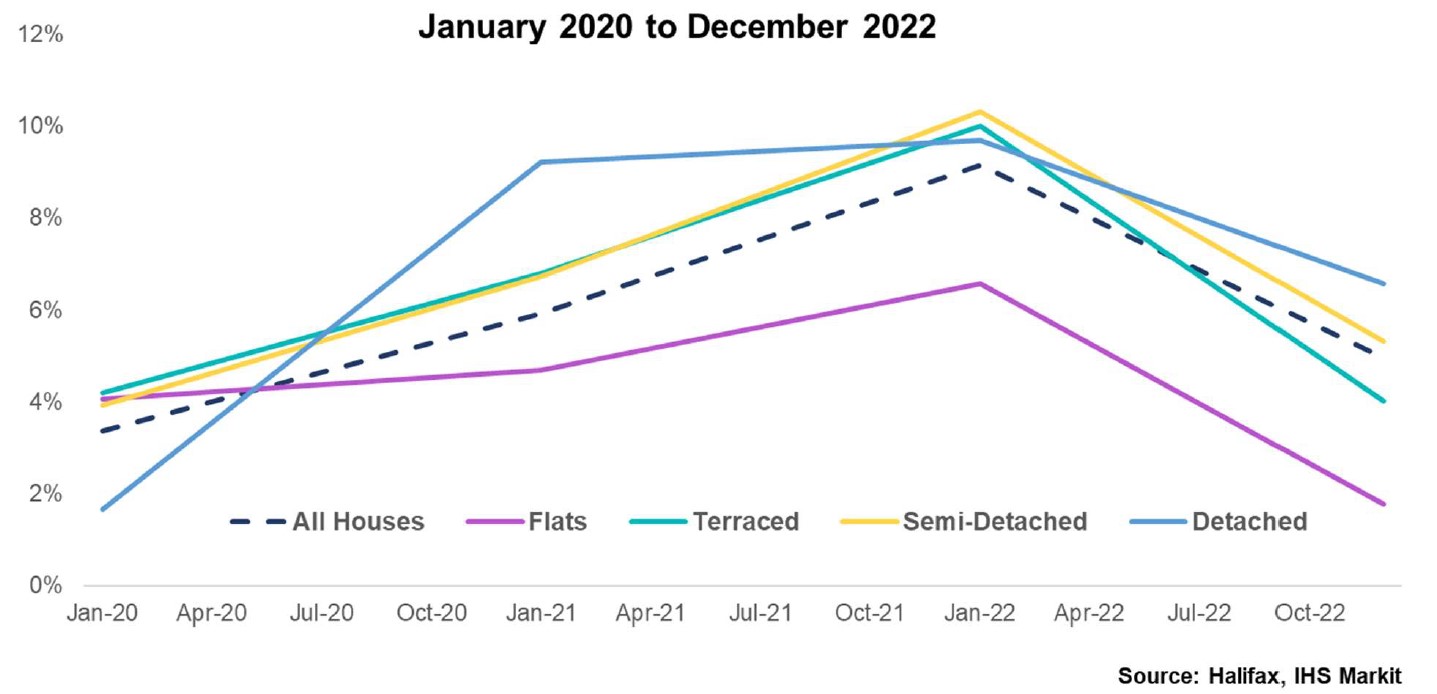

Heading into the pandemic, the rate of annual house price inflation for detached properties was relatively sluggish compared to other property types (at +1.7% in January 2020 versus +4.1% for flats), with buyers perhaps less willing to pay a premium.

Fast-forward just a few months and everything had changed. Suddenly there was surging demand for larger homes. This was driven by a number of factors, but foremost was the race for space, as prospective buyers sought bigger properties, often in more rural areas. This was in response to the radical changes to people’s lifestyles and working habits brought about by lockdown.

By the start of 2021, annual growth for detached homes had jumped to +9.2%. Fuelled further by cuts to Stamp Duty, across the UK, the average price of a detached home rose by +25.9% or £93,345 between the start of 2020 and the end of 2022. This compares to just +8.8% or £28,757 in the three years prior (January 2017 to December 2019).

Looking at the pace of growth, Wales saw the strongest house price inflation for detached houses over the last three years, up by around a third (+33.8%) or £86,675.

In cash terms, five UK regions – Eastern England, Greater London, South East, South West and West Midlands – saw the average price of a detached property rise by more than £100,000.

Flats

By contrast, demand for smaller properties in more urban areas fell during the pandemic – and nowhere was shift this more acute than in London.

At a UK level, the average price of a flat increased by +13.3% (£19,028) between the start of 2020 and the end of 2022.

However the capital saw the average price of its flats grow by just +3.8%. Even with an expensive starting point (£361,954 in January 2020), that translates to just a £9,996 increase – the weakest price rise of any property type across all regions and nations over the last three years.

Compare this with the North West of England, where prices for flats still managed to jump by £24,293 (+23.5%) over the same period.

Semi-detached and terraced houses

Semi-detached and terraced houses saw their average value increase by +23.1% (£55,361) and +21.1% (£38,743) respectively over the last three years.

In both cases Greater London saw the biggest increase in cash terms, up by £90,076 for semidetached and £69,094 for terraced homes. In percentage terms though these were among the smallest increases for these property types across the UK, at +15.8% and +14.4% respectively, such was the impact of the capital’s higher average starting point.

In terms of the strongest rate of growth since the start of 2020 for semi-detached houses this came in the South West (+30.8%) followed by Wales (+28.4%). For terraced homes it was the North East (+32.1%) and then the North West of England (+29.8%).

|

UK average house price by property type |

All |

Flat |

Terraced |

Semi-detached |

Detached |

|

Average price January 2020 |

£237,895 |

£142,792 |

£183,660 |

£239,605 |

£359,725 |

|

Average price December 2022 |

£286,515 |

£161,819 |

£222,403 |

£294,965 |

£453,070 |

|

Percentage growth |

20.4% |

13.3 % |

21.1 % |

23.1 % |

25.9% |

|

Price change |

£48,620 |

£19, 028 |

£38, 743 |

£55, 361 |

£93, 345 |

Charting house price growth: Demand for larger homes saw the average price of a detached house rise much more quickly than other property types at the start of the pandemic – a trend that continued for some time.

Kim Kinnaird, Mortgages Director, Halifax, said:

“The pandemic transformed the shape of the UK property market, and while some of those effects have faded over time, it’s important we don’t lose sight of the huge step change seen in average house prices.

“Heightened demand created a much higher entry point for bigger properties right across the country, and that impact is still being felt today by both buyers and sellers, despite the market starting to slow overall.

“Taking detached houses as an example, average prices remain some 25% higher than at the start of 2020.

“Even if those values were to fall by 10%, they would still be around £50,000 more expensive than before the pandemic.”

Kindly shared by Halifax

Main article photo courtesy of Pixabay