A third of commercial real estate loans in European CMBS face significant refinancing risk

A third of commercial real estate loans in European CMBS face significant refinancing risk, according to analysis by the Scope Group.

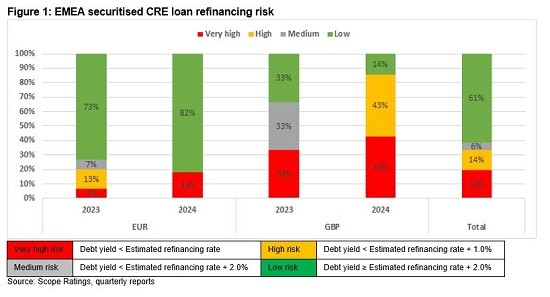

Almost 20% of the loans in European CMBS maturing this year and next face very high refinancing risk as their expected cash flows are too low to meet higher expected requirements from lenders. Another 14% face high risk if swap rates rise another 100bp.

A total of 20 of the securitised CRE loans in question mature in 2023 and 18 in 2024. Of those falling due this year, around 7% denominated in euros have debt yields less than our estimated refinancing rate hence have very high refi risk. The estimated refinancing rate is the relevant five-year swap rate plus the actual loan margins, topped up by 50bp to reflect ongoing debt repricing.

The situation is more severe in sterling because interest rates have risen faster: as many as one-third of GBP-denominated loans maturing in 2023 fall into the very high risk category. The data is worse for loans maturing in 2024: 18% of EUR loans and 43% of GBP loans are heavily exposed to refinancing failure.

Figure 1 shows the exposure to refinancing risk for securitised CRE loans maturing in 2023 and 2024, comparing the latest reported debt yields of loans securitised in euro and sterling-denominated European CMBS and the estimated refinancing rate.

In aggregate, as much as 33% of all loans in CMBS maturing in 2023 and 2024 are facing very high to high refinancing risk if interest rates rise by up to 100bp. This represents EUR 500m and GBP 1.1bn of senior real estate debt. In total, just over EUR 2bn of CMBS debt falls due this year and a little under EUR 2bn in 2024, accounting for around half of all outstanding euro CMBS debt of EUR 7.9bn. In sterling, GBP 978m matures this year and GBP 1.8bn in 2024, accounting for more than a third of the GBP 8bn outstanding.

CRE borrowers confronted by tripartite risks

CRE borrowers face three parallel risks: tightening credit standards, rising debt costs and pressure on property values. Banks are retrenching from new financings and alternative lenders are tightening financing conditions even if most property valuations are holding up so far, as. This is because of time lags in revaluation and anchor value bias.

We do expect valuations to gradually adjust with market evidence i.e. the anchor value bias weakens as more and more borrowers fail to refinance and are forced into fire sales, driven by a hesitant market with limited liquidity. Property yields are slowly starting to widen, especially for non-prime and non-green assets, reflecting deteriorating market conditions and rental growth outlook.

For now, borrowers are generally in wait-and-see mode or are seeking loan extensions, hoping in the meantime that the dust settles before they are forced into the less attractive alternatives of injecting fresh equity or considering asset sales into a weak market.

While the refinancing storm approaches for stranded assets and weak borrowers, bank lenders are in a dilemma around approving loan extensions without extra loan loss provisions or being exposed to loan defaults. Their hands are tied because financings with weak covenants still look healthy and are not yet triggering forced deleveraging. Borrowers are not yet in breach of loan-to-value or interest-coverage covenants based on the latest valuations and low interest-rate cap.

The origin of today’s difficulties lies in the last decade of extremely easy financing conditions. As an example, a 60% LTV loan with 2.0x interest coverage ratio (ICR) financing a prime Frankfurt office with a 2.0% coupon in 2020 looks very different against the backdrop of today’s financing conditions. A mere 30bp increase in the capitalisation rate combined with a 150bp increase in debt costs increases the LTV to 68% and reduces the ICR to a meagre 1.14x.

CRE debt investors also face challenges

On the flip side, tougher market conditions are affecting commercial real estate debt investors as well as borrowers. Like traditional bank lenders, debt fund investors are directly exposed to the under-performance of a single real estate debt line (on a look-through basis). Hence, the performance and net asset value of a debt fund equals the weighted average performance of all its positions.

A loan default directly exposes debt fund noteholders to losses arising from a fire sale of properties because debt funds typically lack loan extension periods and credit enhancements designed to prevent forced sales. Risks grow disproportionately when funds own mezzanine debt or invest in high-risk real estate projects such as construction loans. This can quickly expose investors to distressed situations, as in the case of Securo Pro Lux Compartment (Verius).

CMBS and CRE CLO noteholders tend to be better protected against liquidity and fire-sale risks thanks to mechanisms such as liquidity reserves, note protection tests, foreclosure periods and horizontal tranching, which help to limit imminent loss exposure and provide a buffer to navigate around troubled waters.

Natural asset and performance selection is now looming. Deep-pocketed sponsors owning green and well-suited asset portfolios will find market opportunities, while those with stranded assets will suffer to adapt to new market conditions and ongoing structural changes.

Related research

-

- Scope assigns preliminary unsolicited ratings to notes issued by CASSIA 2022-1 S.R.L. – Italian CMBS

- A primer on European CRE CLOs: same foundations as US CRE CLOs. Same success?

- European CMBS: stellar valuations but mixed operating performance; refinancing risks lurk

- Investors should assess debt yield alongside traditional financial covenants to capture CRE risk

- European real estate grapples with inflation, higher yields: assessing challenges for debt holders (webinar)

- European real estate grapples with inflation, higher yields: assessing challenges for debt holders (slides)

Kindly shared by Scope Group

Main article photo courtesy of Pixabay