Damp most likely issue to go undetected without home survey, reveal Legal & General surveyors

Monday 30th January 2023, London – Damp is the most common issue to go undetected prior to a home survey, according to a poll of Legal & General’s team of accredited surveyors.

Key points from poll:

-

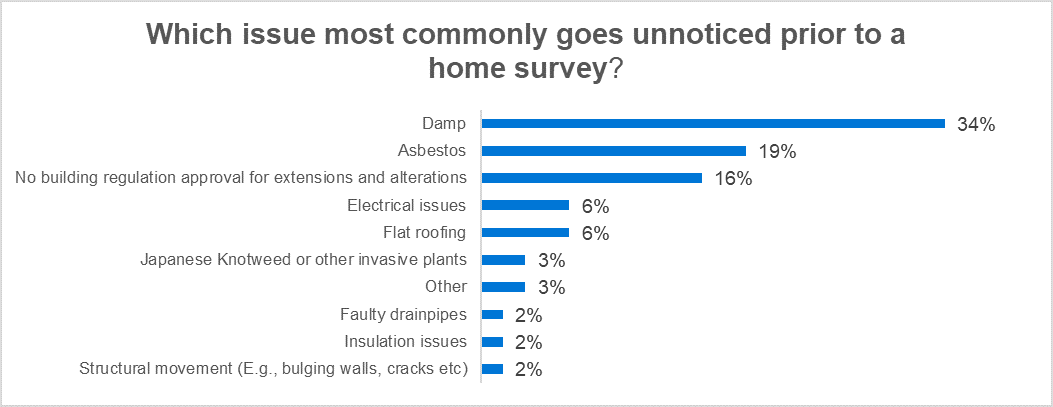

- In a poll of Legal & General surveyors, 34% of respondents said damp is the most likely issue to go unnoticed without a survey

- Almost 1 in 5 (19%) listed asbestos as the most common undetected problem

- The absence of building regulation approval was highlighted by 16% as the most common issue

Damp is the most common issue to go unnoticed prior to a home survey, according to a poll of Legal & General‘s team of accredited surveyors, which asked them about the issues they frequently find. 34% of respondents reported that damp is the most likely problem to go undetected without a home survey, while almost one in five (19%) said that asbestos is the most common problem that buyers fail to spot. The third most common issue was the absence of building regulation approval for extensions and alterations, which was highlighted by 16% of respondents.

The common issues highlighted by the research show why it’s so important for prospective homeowners to be vigilant when deciding to buy a home. Prolonged exposure to mould and dampness can present major health risks. And while living in damp housing can lead to poor health, it can also cost several thousands of pounds if buyers need to damp-proof their home or damp-proof areas of their home. Other issues highlighted by surveyors included problems with flat roofing, Japanese knotweed and asbestos.

Asbestos can present a particular threat to homeowners living in properties where textured wall coatings, such as Artex, were used to decorate walls and ceilings. Textured wall coatings, depending on their age and type, can contain asbestos fibres, and so if a DIY enthusiast homeowner uses a sander to flatten these surfaces, this activity can release harmful asbestos materials into the home. It is very important for prospective homeowners to learn about the materials used in the construction of their homes so they can avoid any potential issues with asbestos contamination.

Therefore, it’s imperative that prospective homeowners opt for a survey to provide peace of mind and, crucially, safeguard them from exposure to these risks.

Steve Rayers, Surveying Director, Legal & General Surveying Services, said:

“Having polled our own team of surveyors, these findings reinforce our long-held belief that buyers are vulnerable to a range of defects that may not be immediately obvious when viewing a property.

“The main issues that go undetected, such as damp and asbestos, pose a clear health hazard and only get worse – and more expensive to fix – over time.

“Buying a house without building regulation approval is equally risky. If buyers proceed with their purchase without approval the problem becomes theirs, meaning that they must pay to fix the work or return the house to its original state.

“The ongoing cost-of-living crisis is already forcing households to scale back expenses, and the last thing buyers need are unexpected repair costs after they’ve made one of the most expensive purchases of their life.

“Although people are increasingly looking for ways to reduce spending, it’s evident that planning ahead is now more important than ever, and home surveys can save buyers from making a very costly mistake further down the line.

“Many borrowers think they can get by just on the valuation that’s carried out on behalf of the lender, but this isn’t an alternative to a full home survey.

“Valuations are often carried out remotely and won’t necessarily pick up these important problems. Home surveys are not only here to mitigate costs and protect customers from potential health risks, they can even help buyers renegotiate the price of the property.

“If the survey report shows defects that require extensive repairs, buyers can point these out to the seller and negotiate on the asking price. In comparison, a valuation is very limited in its offering, and doesn’t offer the level of detail and a thorough assessment of the condition of a property that comes with a home survey.”

Kindly shared by Legal & General

Main photo courtesy of Pixabay